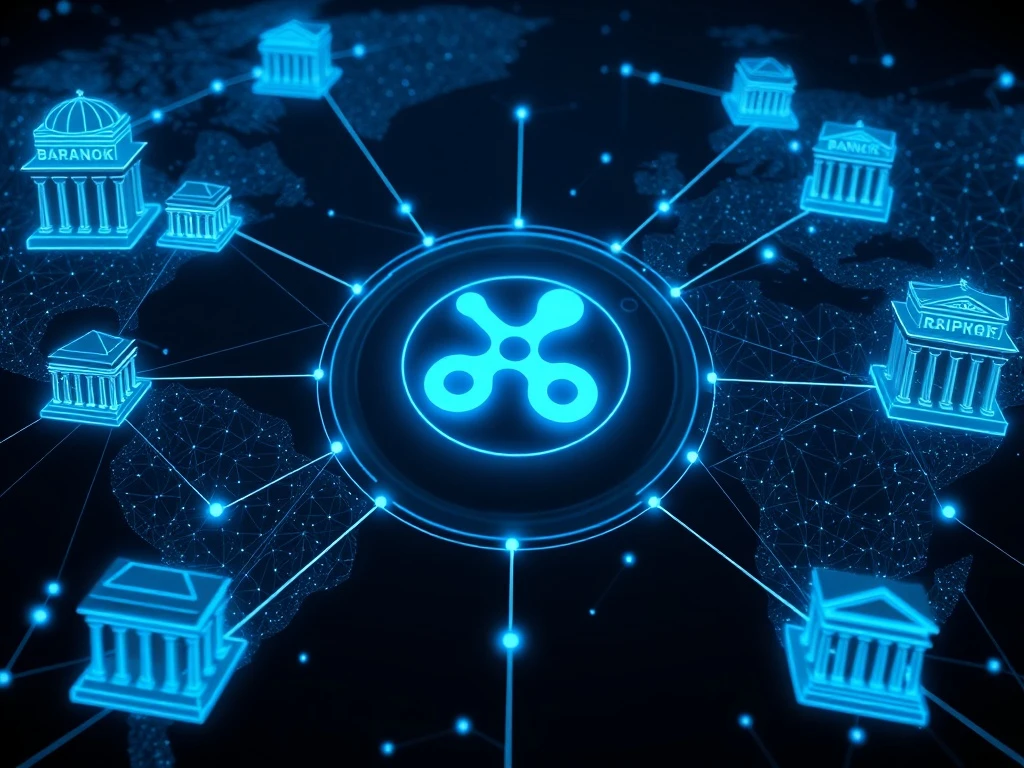

XRP News Today: Ripple’s XRP Revolutionizes Cross-Border Payments with 100+ Global Banks

Ripple’s XRP is making waves in the financial world as over 100 global banks test its blockchain technology for cross-border payments. This groundbreaking development signals a major shift toward institutional blockchain adoption, with giants like Santander and Bank of America leading the charge. Could this be the future of global finance?

Ripple XRP: The Backbone of Institutional Blockchain Adoption

Recent disclosures reveal that Ripple’s XRP is currently in “test mode” with major financial institutions worldwide. This testing phase focuses on leveraging XRP’s capabilities for:

- Low-liquidity asset transactions

- Accelerated settlement processes

- Multi-currency compatibility

How Global Banks Are Implementing Blockchain Technology

Santander’s One Pay FX stands as a prime example of successful blockchain integration. This fully operational platform demonstrates Ripple’s technology in action, offering:

| Feature | Benefit |

|---|---|

| Reduced costs | Lower transaction fees for customers |

| Faster processing | Near-instant cross-border payments |

| Enhanced transparency | Real-time tracking of transactions |

The Future of Cross-Border Payments with XRP

While live XRP settlements remain limited, the scale of testing suggests blockchain could become complementary infrastructure for financial institutions. This aligns with industry trends where traditional finance seeks distributed ledger solutions to address legacy system inefficiencies.

Frequently Asked Questions

Q: Which banks are currently testing Ripple’s XRP?

A: Major institutions including Santander, Bank of America, Axis Bank, and Standard Chartered are evaluating Ripple’s technology.

Q: How does XRP improve cross-border payments?

A: XRP facilitates low-liquidity asset transactions and accelerates settlement processes through blockchain technology.

Q: Is Santander’s One Pay FX fully operational?

A: Yes, Santander has implemented a mature, integrated product rather than just a pilot program.

Q: What does this mean for cryptocurrency adoption?

A: The involvement of over 100 banks signals growing institutional acceptance of blockchain solutions in traditional finance.