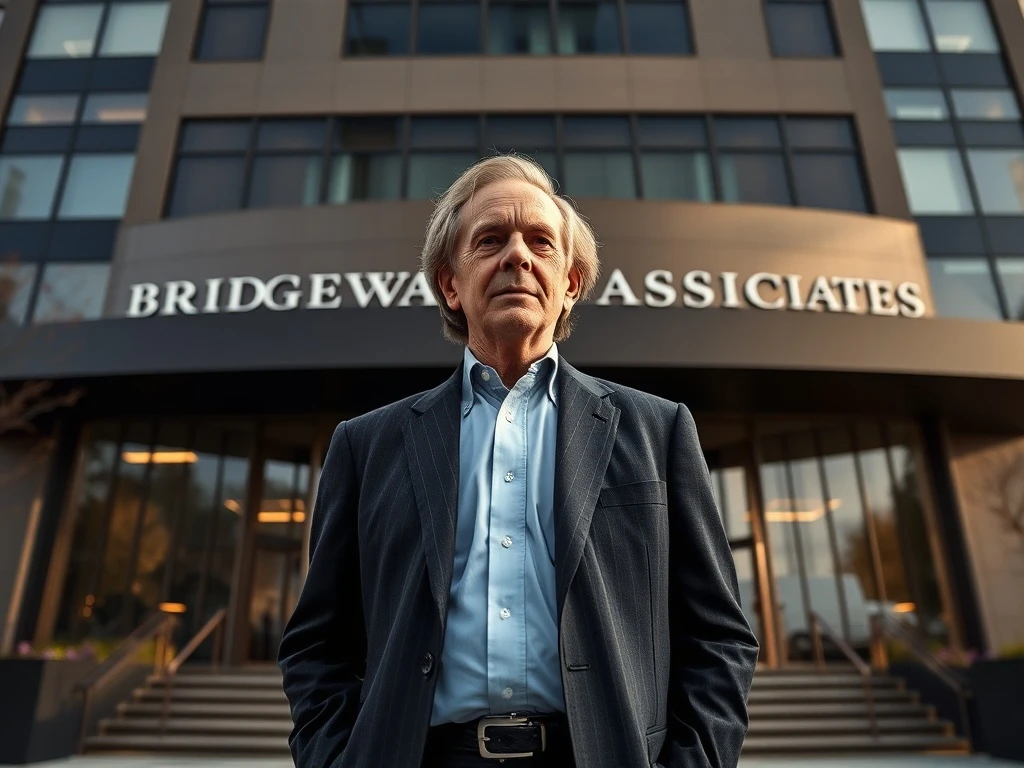

Ray Dalio’s Historic Bridgewater Exit: The End of an Era in Hedge Fund Leadership

Ray Dalio, the legendary founder of Bridgewater Associates, has officially completed his exit from the hedge fund after an incredible 50-year tenure. This monumental shift marks the end of an era for one of the most influential figures in the financial world. But what does this mean for Bridgewater and the broader hedge fund industry? Let’s dive in.

Ray Dalio’s Final Departure from Bridgewater

After decades at the helm, Ray Dalio has sold his remaining stake in Bridgewater Associates, finalizing a multi-year leadership transition. This move follows his earlier steps to reduce involvement, including stepping down as CEO in 2017 and introducing new leadership structures in 2022. The firm, which manages over $92 billion in assets, is now fully under new management.

Why This Hedge Fund Leadership Change Matters

Dalio’s exit is part of a broader trend in the financial industry, where long-standing leaders are stepping back to ensure institutional continuity. Key implications include:

- Decentralized Leadership: Bridgewater has been moving toward a more decentralized model, and Dalio’s departure accelerates this shift.

- Cultural Impact: The firm’s philosophy of “radical transparency” may evolve under new leadership.

- Industry-Wide Transformation: Hedge funds globally are adapting to economic shifts and investor expectations.

What’s Next for Bridgewater’s Investment Strategies?

Bridgewater is renowned for its macroeconomic investment strategies. With Dalio’s exit, analysts are watching closely to see how the firm maintains its edge. Key areas to monitor:

- Will the new leadership uphold Dalio’s principles?

- How will the firm navigate current market volatility?

- What innovations might emerge in its investment approach?

The Legacy of Ray Dalio in the Financial Industry

Dalio’s influence extends far beyond Bridgewater. His books, such as Principles, and his macroeconomic insights have shaped modern finance. His exit symbolizes a generational shift in the financial world.

Conclusion: A New Chapter for Bridgewater

Ray Dalio’s departure closes a historic chapter in finance, but it also opens a new era for Bridgewater. The firm’s ability to adapt will determine its future success in an ever-changing hedge fund landscape.

Frequently Asked Questions (FAQs)

1. Why did Ray Dalio leave Bridgewater?

Dalio’s exit was part of a planned leadership transition to ensure long-term continuity and decentralization at Bridgewater.

2. How much is Bridgewater worth after Dalio’s exit?

Bridgewater manages over $92 billion in assets, making it one of the world’s largest hedge funds.

3. What is Bridgewater’s investment strategy?

The firm is known for its macroeconomic approach, focusing on global economic trends and radical transparency.

4. Will Bridgewater’s culture change without Dalio?

While the core philosophy may remain, new leadership could bring subtle shifts in culture and strategy.

5. What is Ray Dalio’s next move?

Dalio has not announced specific plans but is expected to focus on writing, speaking, and philanthropy.