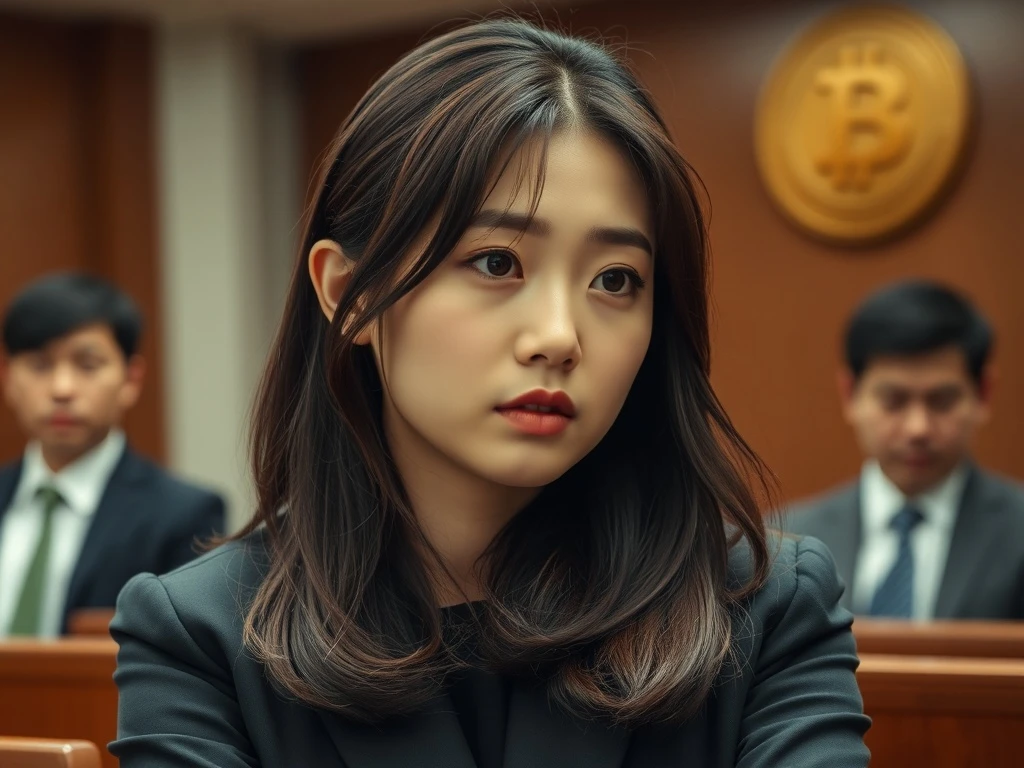

**Park Gyuri Crypto Fraud**: K-pop Star Faces **Damning** New Accusations in Pica Coin Scandal

The dazzling world of K-pop often collides with unexpected controversies, and now, former Kara member Park Gyuri finds herself at the center of a swirling storm of **Park Gyuri crypto fraud** accusations. As legal proceedings against her ex-boyfriend, Song Ja-ho, continue, the spotlight has intensified on her alleged involvement with Pica Coin, an art-themed altcoin project. This high-profile case serves as a stark reminder of the volatile nature of the crypto market and the significant risks, both financial and reputational, that celebrities face when venturing into this space.

Unraveling the Pica Coin Allegations Against Park Gyuri

The core of the legal battle revolves around Pica Coin, an altcoin project linked to Song Ja-ho, who stands accused of fraud and breach of trust. Park Gyuri, previously serving as Pica Coin’s Chief Communications Officer and Advisor, initially denied direct involvement in any illicit activities. However, recent court admissions have complicated her narrative.

- Park’s Admission: She stated in court that she sold her personal Bitcoin holdings in 2021 to purchase Pica Coin, believing it to be a legitimate art-technology startup. She claims to have lost her investment when the coin was delisted from Upbit in June 2021.

- CEO’s Counterclaim: Pica Coin CEO Seong Hae-joong disputed Park’s account, alleging she received 60 million won (approximately $43,566 at the time) in cash from Song as compensation. This alleged payment, occurring months after their reported breakup, adds a layer of complexity to her defense.

- Role as CCO/Advisor: Her official position within Pica Coin, even if advisory, makes her claims of being unaware of the project’s illicit nature harder to substantiate. The conflicting narratives highlight the challenges of proving intent in cases involving alleged crypto fraud.

The High Stakes of K-pop Celebrity Crypto Involvement

Park Gyuri’s case underscores the inherent dangers for public figures who associate with cryptocurrency ventures. The allure of quick profits and the desire to stay ahead of digital trends often draw celebrities in, but the consequences can be severe when projects falter or are revealed as fraudulent.

The **K-pop celebrity crypto** sphere is particularly susceptible to these risks:

- Reputational Damage: Celebrities are often seen as trusted figures. When their names are linked to failed or fraudulent projects, public trust erodes, impacting their careers and public image.

- Lack of Due Diligence: The case raises questions about the level of due diligence performed by celebrities before endorsing or investing in crypto projects. In volatile markets, where reputations and finances are tightly linked, thorough research is paramount.

- Blurred Lines: Personal relationships intersecting with business partnerships, as seen with Park and Song, can complicate legal and ethical boundaries, making it difficult to separate personal investments from professional endorsements.

Navigating Cryptocurrency Legal Risks: Lessons from the Pica Coin Trial

The ongoing trial against Song Ja-ho and the subsequent accusations against Park Gyuri offer crucial insights into the evolving landscape of **cryptocurrency legal risks**. Proving intent in complex crypto fraud cases is a significant hurdle for prosecutors.

Key legal challenges and implications include:

| Aspect | Challenge Highlighted by Case | Broader Implication |

|---|---|---|

| Proving Intent | Park’s defense: unaware of illicit nature. Prosecutors: Song manipulated price. | Difficult to establish malicious intent when individuals claim ignorance or genuine investment. |

| Compensation vs. Investment | Alleged cash transfer to Park from Song post-breakup. | Distinguishing legitimate investment losses from alleged compensation for participation in schemes. |

| Regulatory Scrutiny | Increased focus on celebrity involvement in low market cap tokens. | Heightened regulatory oversight on token projects, especially those leveraging celebrity influence. |

The case illustrates the difficulty of separating personal relationships from professional activities in legal contexts, a factor that could influence public perception of her credibility.

Beyond Park Gyuri Crypto Fraud: Broader Implications for Investors

For everyday investors, the **Park Gyuri crypto fraud** case serves as a critical cautionary tale. It emphasizes the importance of transparency, independent research, and skepticism, particularly when a project’s primary appeal is its celebrity endorsement.

Actionable insights for investors:

- Do Your Own Research (DYOR): Never rely solely on celebrity endorsements. Investigate the project’s whitepaper, team, technology, and market viability independently.

- Beware of Low Market Cap Altcoins: Projects with small market capitalizations are often more volatile and susceptible to price manipulation schemes.

- Question Opaque Deals: Any project lacking clear financial statements, team transparency, or a robust development roadmap should raise red flags.

- Understand Delisting Risks: Exchanges delist coins for various reasons, including low liquidity, lack of development, or regulatory concerns, leading to significant investor losses.

The Altcoin Fraud Trial: A Cautionary Tale for the Industry

The delisting of Pica Coin from Upbit and the subsequent legal fallout reflect the significant risks associated with unregulated or opaque **altcoin fraud trial** ventures. The outcome of Song’s trial and any potential further actions against Park will likely shape how similar cases are approached in the future, particularly in jurisdictions where celebrity influence and financial accountability intersect.

The broader implications for the crypto industry include:

- Heightened Scrutiny: Expect increased regulatory scrutiny of celebrity involvement in token projects, especially those with low market capitalizations and unclear utility.

- Liability of Non-Technical Stakeholders: The case may set precedents regarding the liability of individuals, like CCOs or advisors, who are not directly involved in the technical development but hold influential positions within a project.

- Demand for Transparency: The incident reinforces the crypto community’s call for greater transparency and accountability from all participants in token launches.

As the trial progresses, the distinction between Park’s stated intentions and the evidence against her will remain central to both legal and public discourse. The reformed Kara group, now touring Asia, has not publicly addressed the controversy, but Park’s legal entanglements may impact the group’s public image.

Conclusion

The unfolding drama surrounding Park Gyuri and the Pica Coin **altcoin fraud trial** is more than just a celebrity scandal; it’s a pivotal case that highlights the intricate web of personal relationships, business ventures, and regulatory challenges within the cryptocurrency space. As the legal proceedings continue, the outcome will undoubtedly send ripples through both the entertainment and crypto industries, shaping perceptions and setting precedents for accountability in a rapidly evolving digital economy. For investors and public figures alike, the message is clear: vigilance and due diligence are paramount in the wild west of crypto.

Frequently Asked Questions (FAQs)

Q1: Who is Park Gyuri, and what is her connection to this crypto case?

Park Gyuri is a former member of the popular K-pop girl group Kara. She is facing renewed accusations related to her alleged involvement with Pica Coin, an art-themed altcoin project, during her ex-boyfriend Song Ja-ho’s fraud trial. She served as the project’s Chief Communications Officer and Advisor.

Q2: What is Pica Coin, and what are the main allegations against it?

Pica Coin was an art-themed altcoin project. The main allegations center on its founder, Song Ja-ho, who is accused of manipulating the coin’s price and defrauding investors. Pica Coin was delisted from the Upbit exchange in June 2021.

Q3: What are the conflicting narratives in Park Gyuri’s case?

Park Gyuri claims she invested in Pica Coin legitimately and lost her investment when it was delisted. However, the Pica Coin CEO, Seong Hae-joong, alleges that Park received 60 million won (approx. $43,566) in cash from Song Ja-ho as compensation, suggesting a more active role than she admits.

Q4: Why is this case significant for cryptocurrency investors?

This case serves as a cautionary tale for investors about the risks associated with celebrity-endorsed crypto projects, especially those with low market capitalizations. It highlights the importance of independent research, transparency, and understanding the potential for fraud or price manipulation.

Q5: What are the broader implications of this case for celebrities involved in crypto?

The case underscores the significant reputational and legal risks for celebrities involved in cryptocurrency ventures. It emphasizes the need for thorough due diligence, as associations with fraudulent schemes can severely damage public image and lead to legal liabilities. It also points to increased regulatory scrutiny on celebrity endorsements in the crypto space.