Movement Labs Scandal: Co-Founder Suspended Amid MOVE Token Turmoil

The cryptocurrency world is watching closely as Movement Labs announced the suspension of its co-founder, Rushi Manche. This significant event follows a period of intense scrutiny and market volatility surrounding the project’s native asset, the MOVE token. The co-founder suspension comes amidst controversy over a market maker agreement Manche helped arrange, leading to a third-party investigation and, notably, Coinbase’s decision to suspend trading for MOVE.

Why the Movement Labs Co-Founder Suspension Occurred

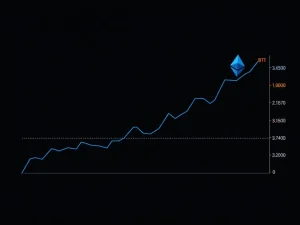

Movement Labs confirmed the co-founder suspension via an X post, stating the decision was made due to “ongoing events.” At the heart of these events is a deal brokered by Rushi Manche involving Rentech and a market maker called Web3Port. The Movement Network Foundation requested a third-party review, conducted by private intelligence firm Groom Lake, to look into this agreement. This investigation was prompted after Web3Port reportedly sold 66 million MOVE tokens acquired through the deal, representing about 5% of the total supply. This large sale reportedly caused significant downward price pressure, estimated at $38 million, in December 2024. Separately, Coinbase announced its decision to suspend trading of the Movement Network (MOVE) token, citing the token’s failure to meet its listing standards. The timing suggests a connection between the market events and Coinbase’s action.

Understanding the MOVE Token Market Turmoil

The reported sale of 66 million MOVE tokens by Web3Port had a direct and substantial impact on the token’s market performance. A sale of this size injects significant supply onto exchanges, which, if not met by commensurate demand, leads to price decline. The stated $38 million in downward price pressure highlights the severity of the event for the MOVE token price and its holders. This kind of volatility erodes investor confidence and stability for the project.

The Complex Role of a Crypto Market Maker

A crypto market maker plays a critical role in the digital asset ecosystem. Their primary function is to provide liquidity, ensuring that tokens can be easily bought and sold on exchanges without causing massive price swings. A good market maker can help a project get listed on major exchanges and create a healthy trading environment. However, the relationship can be problematic if incentives are misaligned. Reports suggest many new token listings face issues, sometimes linked to market maker activities. Choosing the right crypto market maker is crucial for a project’s early success.

Past Incidents of Crypto Market Manipulation

The controversy surrounding the MOVE token’s market activity brings to light broader concerns about market manipulation in the crypto space. Several high-profile cases have alleged various forms of manipulation:

- Creditors of Celsius Network alleged that market maker Wintermute was involved in wash trading the Celsius token, creating false trading volume.

- Fracture Labs sued Jump Crypto, alleging a pump-and-dump scheme involving their in-game currency, DIO.

- A report claimed DWF Labs engaged in market manipulation and inflated trading volumes through deals, an accusation DWF Labs and Binance denied.

- A Massachusetts court fined CLS Global for fraudulent manipulation of trading volumes.

- The founder of Gotbit faces charges in the US related to market manipulation and wire fraud conspiracy.

These examples underscore the risks associated with market activities and the challenges in preventing market manipulation.

Implications of Token Delisting

Coinbase’s decision to suspend trading of the MOVE token is a significant setback for Movement Labs. Delisting from a major exchange like Coinbase reduces a token’s accessibility to a large pool of investors and traders, impacting its liquidity and perceived legitimacy. While the specific reasons cited were failure to meet listing standards, the context of the market maker controversy and investigation likely played a role in this assessment. For Movement Labs, regaining trust and exchange listings will be a challenge.

Conclusion

The suspension of a co-founder at Movement Labs is a serious development, highlighting the potential pitfalls in navigating market maker relationships and the critical need for transparency in the crypto industry. The ongoing investigation into the market maker deal and the resulting MOVE token turmoil serve as a stark reminder of the risks projects face. This situation underscores the importance of robust governance, clear agreements with third parties, and vigilance against potential market manipulation to protect both the project and its community.