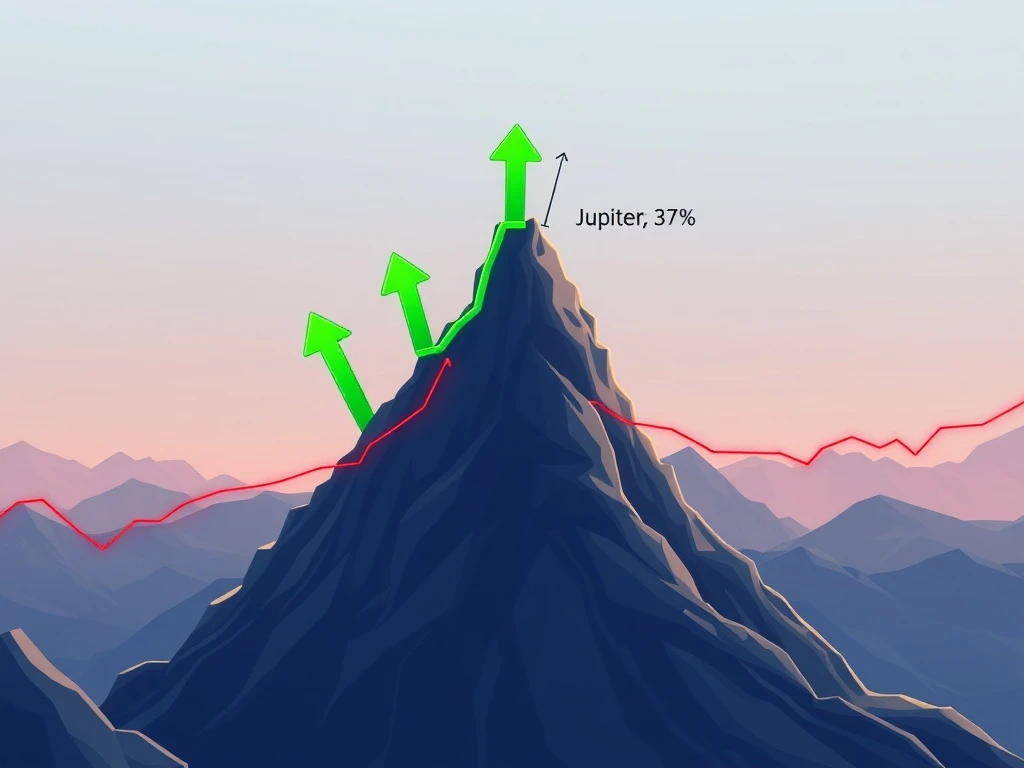

Jupiter (JUP): Unlocking Crucial 37% Upside Potential Amidst Crypto Corrections

The crypto market often presents a rollercoaster of emotions, and for holders of Jupiter (JUP), the recent 11% single-day dip might feel like a plunge. While broader crypto market correction weighs heavily on altcoins, a fascinating technical signal has emerged, hinting at a significant rebound. Could this be the turning point for Jupiter JUP?

Decoding the Bullish Fractal: A Glimmer of Hope for Jupiter JUP

Despite the recent pullback, technical analysts are pointing to a compelling bullish fractal pattern appearing on JUP’s chart. This pattern isn’t just a random occurrence; it echoes the remarkable breakout seen in another token, HYPE, earlier this year. HYPE experienced a massive 175% rally after breaking through a key descending trendline [1].

What does this mean for Jupiter JUP? The fractal suggests JUP might be approaching a pivotal moment. Key levels to watch include the 200-day moving average at $0.5880 and a long-term descending trendline at $0.74 [1]. If JUP successfully closes above $0.5880, it could trigger a test of $0.74, representing a substantial 37% potential upside from current levels.

Let’s break down the pattern’s structure:

- Historical Precedent: HYPE previously traded within a descending channel, then formed higher lows, reclaimed its 50-day MA, and finally broke above resistance.

- JUP’s Trajectory: JUP is mirroring this path, having recently stabilized above its 200-day MA and consolidating within a correction zone.

Navigating the Current Crypto Market Correction: Is JUP Different?

The broader market correction has undoubtedly impacted JUP, trimming its monthly gains. However, the emerging bullish fractal suggests that JUP might be carving out a different narrative. While the overall market sentiment is cautious, specific catalysts could support JUP’s recovery.

Confirmation is key for this fractal. Analysts emphasize that sustained trading volume and a firm retest of the 200-day MA are essential to validate its bullish implications. Without these, the pattern remains a potential scenario rather than a confirmed trend.

Broader market dynamics are also playing a role:

- Dovish Fed Stance: The U.S. Federal Reserve’s softer monetary policy has eased capital outflows from high-risk assets, indirectly providing support for altcoins like JUP.

- Increased Liquidity: HashKey Global’s upcoming listings of Pepe (PEPE) and Notcoin (NOT) on August 22, 2024, could enhance overall market liquidity, creating a more favorable environment for an altcoin recovery, including JUP [2].

Understanding JUP Price Prediction: What the Fractal Tells Us

The fractal offers a compelling framework for JUP price prediction, suggesting a path towards significant gains if certain conditions are met. On-chain data also provides interesting insights, revealing a 15% increase in JUP wallet inflows over the past 30 days. This indicates growing interest from retail or institutional players [2]. However, skeptics rightly caution that volume must align with price action to confirm true strength.

The fractal’s potential goes beyond just technical lines on a chart. It reflects evolving market psychology, where retail-driven tokens are increasingly influencing institutional sentiment. JUP’s community-centric governance model has attracted speculative capital, which can amplify its price volatility. While major exchanges haven’t yet listed JUP, its price behavior often mirrors that of established peers like Solana (SOL), suggesting broader market narratives could enhance the fractal’s predictive power.

Actionable Insights for Traders and Investors

For short-term traders, monitoring the Relative Strength Index (RSI) is crucial. Overbought conditions or divergences could invalidate the fractal’s signal, advising caution. The 12% decline from JUP’s May peak highlights its susceptibility to bearish cycles, so risk management remains paramount.

Long-term holders, however, may view the current dip and the emerging pattern as a significant buying opportunity, especially if the price stabilizes above $1.50 by mid-2025 [1]. The fractal’s relevance underscores the importance of technical indicators in crypto markets, where retail and institutional flows frequently converge.

As with all crypto assets, unexpected macro events—such as sudden regulatory shifts or central bank policy changes—could disrupt the fractal’s trajectory. Traders are encouraged to treat this pattern as a guiding light rather than an absolute certainty. Diligence and continuous market monitoring are vital.

Conclusion: A Crucial Juncture for Jupiter JUP

The recent 11% fall in Jupiter JUP might seem daunting, but the emergence of a bullish fractal pattern offers a compelling counter-narrative. This technical signal, reminiscent of past explosive rallies, suggests a potential 37% upside if key resistance levels are breached with confirming volume. While the broader crypto market correction presents challenges, positive external factors and growing on-chain interest could provide the necessary tailwinds for an altcoin recovery. As always, thorough research and a balanced perspective are essential in navigating the dynamic world of cryptocurrency.

Frequently Asked Questions (FAQs)

Q1: What is a bullish fractal pattern in crypto trading?

A bullish fractal pattern is a technical analysis formation on a price chart that suggests a potential reversal from a downtrend to an uptrend. It typically involves a specific sequence of candlesticks (often five bars where the middle bar has the highest high, flanked by two lower highs on each side) or a larger repeating price structure that mirrors a previous successful breakout, indicating a likely upward movement.

Q2: What key price levels should Jupiter (JUP) investors watch?

Investors should closely monitor the 200-day moving average, currently around $0.5880, as a crucial support and potential breakout level. Additionally, the long-term descending trendline at $0.74 is identified as a significant resistance point. A decisive close above these levels, especially with increased volume, could confirm the bullish fractal’s implications for JUP.

Q3: How do broader market dynamics affect JUP’s potential recovery?

Broader market dynamics, such as the U.S. Federal Reserve’s monetary policy and overall crypto market liquidity, significantly influence JUP. A dovish Fed stance can encourage capital flow into riskier assets like altcoins. Furthermore, upcoming major exchange listings, like HashKey Global’s plans for PEPE and NOT, can boost overall market liquidity and investor confidence, creating a more favorable environment for JUP’s price to recover.

Q4: What are the risks associated with this bullish JUP price prediction?

While the bullish fractal is promising, risks remain. JUP has shown susceptibility to bearish cycles, as evidenced by its 12% decline from its May peak. Technical signals like the Relative Strength Index (RSI) should be monitored for overbought conditions or divergences, which could invalidate the fractal. Additionally, unexpected macro events, regulatory changes, or central bank policy shifts could disrupt any predicted trajectory.

Q5: Is the Jupiter (JUP) bullish fractal a guaranteed outcome?

No, technical analysis patterns like the bullish fractal are guides, not guarantees. They indicate probabilities based on historical price action. Confirmation through sustained volume and successful retests of key support/resistance levels is crucial. External factors, market sentiment, and unforeseen events can always influence the actual price movement of Jupiter JUP.