Fed holds interest rate steady at 23-year high, possible rate cut coming September

Key Takeaways

Fed’s rate hold aligns with expectations, Bitcoin price shows minimal immediate reaction.

Market anticipates September rate cut, potentially boosting crypto investment sentiment.

Share this article

The Federal Reserve announced today that it will keep its benchmark interest rate unchanged, maintaining the federal funds rate at 5.25% to 5.5%. This decision, aligns with widespread market expectations and signals the Fed’s continued cautious approach to monetary policy amid shifting economic conditions.

“Recent indicators suggest that economic activity has continued to expand at a solid pace. Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated. In recent months, there has been some further progress toward the Committee’s 2 percent inflation objective,” the Federal Reserve said in a statement.

Implications for crypto markets

This decision arrives against a backdrop of moderate inflation, with the US consumer price index (CPI) showing a 3.3% year-on-year increase in June. This economic indicator has already positively influenced crypto markets, suggesting a potential correlation between inflation trends and digital asset performance.

For the crypto market, particularly Bitcoin, the Fed’s decision carries significant weight. While the immediate impact of a rate hold may be limited, the longer-term implications of the Fed’s monetary policy direction could be substantial. Historically, periods of lower interest rates have been favorable for risk assets, a category that includes crypto, given how such assets reduce borrowing costs and by implication encourage investment in non-traditional assets.

The crypto market’s reaction to the Fed’s decision will be closely watched, especially in light of recent events. The movement of $2 billion worth of Bitcoin from a DOJ entity just days before the FOMC meeting has introduced an element of uncertainty. This government action, coupled with the Fed’s decision, shows the complex interplay between regulatory actions, monetary policy, and crypto market dynamics.

Post-FOMC market movements

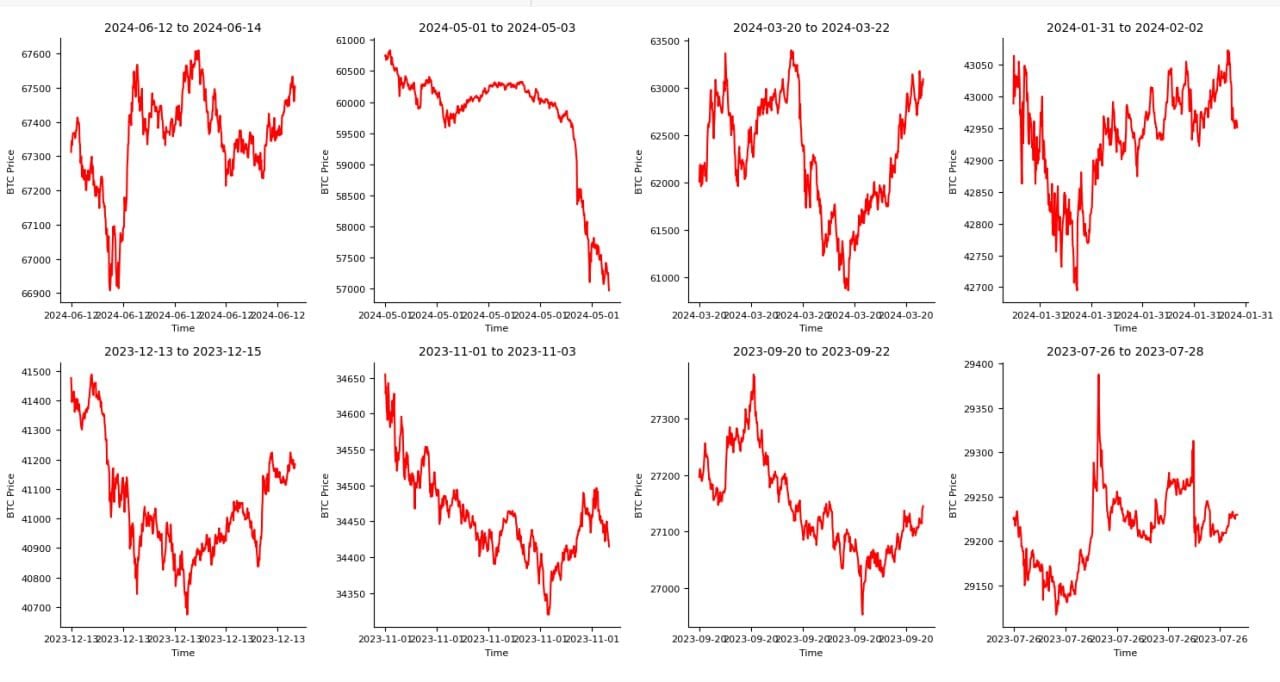

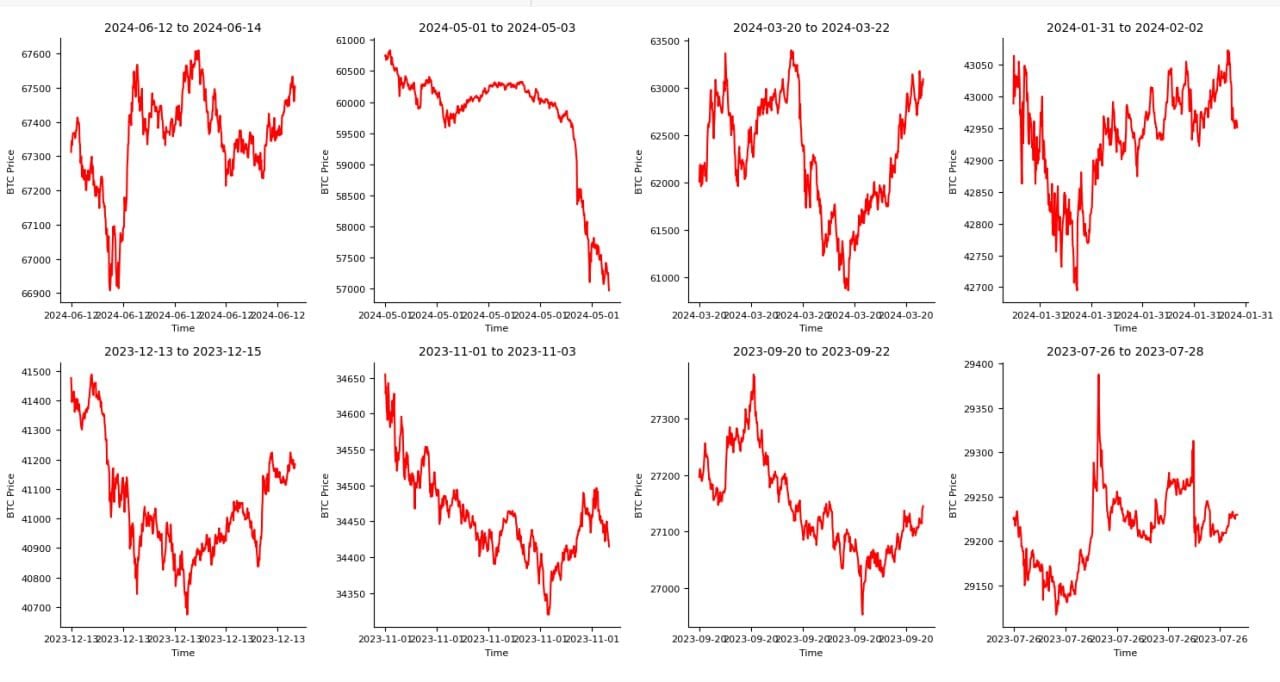

The following chart shows the price activity of Bitcoin in 48 hours after the last eight FOMC decisions.

Each chart depicts the price fluctuations of Bitcoin (BTC) over distinct three-day intervals between July 2023 and June 2024. The charts highlight significant price volatility within short periods, showcasing peaks and troughs that suggest rapid market dynamics. For instance, from July 26 to July 28, 2023, there is a notable spike followed by a quick decline, reflecting a high level of trading activity or external influences affecting the market.

The price trends vary across the different intervals, with some periods like January 31 to February 2, 2024, showing multiple sharp fluctuations, while others, such as November 1 to November 3, 2023, exhibit a steady downward trend. These variations indicate the sensitivity of Bitcoin prices to market conditions and possibly to news events or economic factors impacting investor sentiment.

Macro-level economic shifts influencing crypto markets

Looking ahead, several macroeconomic factors will continue to influence both traditional and crypto markets. These include ongoing inflation trends, global economic recovery patterns, and potential shifts in monetary policies of other major central banks. The divergent approaches of the Bank of Japan and the Bank of England, both set to announce their own decisions this week, highlight the global nature of these economic considerations.

The relationship between inflation and crypto markets remains a topic of keen interest. While Bitcoin has often been touted as a hedge against inflation, its performance in various inflationary environments has been mixed.

The Fed’s approach to managing inflation through interest rate policies could significantly impact this narrative, potentially influencing investor sentiment towards crypto either as a store of value or as a hedge against inflation.

Share this article