Ethereum Price: Explosive Surge Past Four-Year Resistance Signals Momentous ETH Rally

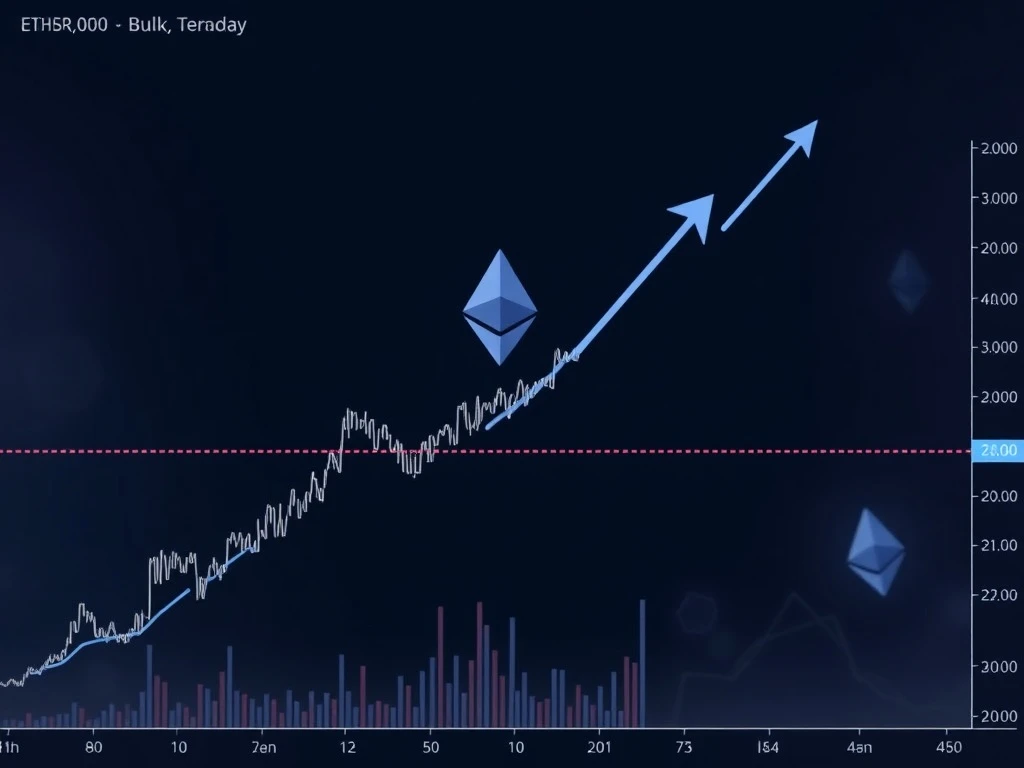

The crypto world is buzzing with anticipation as **Ethereum price** (ETH) makes a historic move, breaching a critical four-year diagonal resistance on its weekly chart. This isn’t just another price pump; it’s a significant technical event that signals the completion of a multi-year bullish pennant pattern, potentially setting the stage for an explosive **ETH rally**.

Ethereum Price: A Historic Breakthrough

For years, a formidable diagonal resistance line on Ethereum’s weekly chart acted as a ceiling, constraining its upward movements. Originating in 2021, this level had become a psychological and structural barrier for traders and investors alike. The recent surge has seen **Ethereum price** decisively breach this long-standing resistance, marking a pivotal moment in its market trajectory.

This breakthrough is not isolated; it coincides with the completion of a prominent bullish pennant pattern that has been forming since 2021. A bullish pennant is a continuation pattern characterized by converging trendlines that follow a strong upward move. It signifies a period of consolidation before a likely resumption of the prior uptrend. Ethereum’s price has repeatedly tested the $3,800 resistance level, each attempt showing increased buying strength, culminating in this powerful breakout.

Unpacking the Bullish Pennant: Why This ETH Rally Matters

The successful completion of the **bullish pennant** pattern is a rare and highly anticipated technical event. It suggests that after a prolonged phase of range-bound trading, Ethereum is now primed for a sustained upward movement. This pattern typically indicates that the market has absorbed selling pressure and is ready for the next leg up.

What makes this particular breakout compelling is the confluence of factors supporting it:

- Four-Year Resistance Breach: The psychological and technical significance of breaking a long-term barrier cannot be overstated.

- Volume Confirmation: A sustained move above the pennant’s upper boundary, ideally accompanied by strong trading volume, validates the breakout.

- Pattern Measured Move: Technical analysis often projects a target based on the initial flagpole of the pennant. This pattern completion now positions Ethereum for a potential rally, with some analysts eyeing targets that could translate to an 18.4% increase from recent levels, aligning with the typical measured move of such breakouts.

This alignment of technical indicators provides a robust bullish case for the anticipated **ETH rally**.

Institutional Tides: Fueling the Ethereum Resistance Break

The recent surge in **Ethereum price** and its successful breach of the long-standing **Ethereum resistance** is not solely a technical phenomenon. Institutional activity has played a crucial role in amplifying Ethereum’s momentum. The crypto market has witnessed significant inflows into Ethereum-based Exchange Traded Funds (ETFs), with cumulative inflows reaching an impressive $8.8 billion. Major players like BlackRock’s ETHA and Fidelity’s FETH have been key drivers of this demand.

This institutional interest underscores a broader confidence in Ethereum’s fundamental strengths and its evolving ecosystem. Institutions are increasingly recognizing Ethereum’s foundational role in the decentralized economy, driven by:

- Ecosystem Advancements: Continuous development in Layer 2 (L2) solutions like Arbitrum and Optimism significantly reduce gas fees and enhance network scalability, making Ethereum more accessible and efficient.

- Tokenization and DeFi: Ethereum remains the backbone for the vast majority of tokenization efforts and Decentralized Finance (DeFi) protocols, solidifying its position as critical Web3 infrastructure.

- Future Potential: Analysts draw parallels between Ethereum’s dominance in tokenization and Google’s early dominance in internet search, highlighting its potential for long-term influence and growth.

These fundamental strengths, combined with increasing institutional adoption, provide a strong underpinning for the current bullish sentiment.

Beyond the Charts: A Deeper Crypto Market Analysis

While Ethereum’s technical and institutional drivers are strong, a comprehensive **crypto market analysis** requires considering broader macroeconomic factors and Bitcoin’s performance. Historically, Bitcoin has often dictated the direction of the broader crypto market. However, recent trends suggest a potential decoupling.

Despite Bitcoin’s inability to break past the $120,000 mark, which has introduced some uncertainty across the market, Ethereum appears to be charting its own course. Several indicators point towards a quiet rotation of capital into Ethereum:

- Weekly MACD: The Moving Average Convergence Divergence (MACD) on Ethereum’s weekly chart has turned green, a bullish signal indicating increasing upward momentum.

- ETH/BTC Inflow Ratio: This ratio has hit multi-year lows, suggesting that capital is flowing more heavily into Ethereum relative to Bitcoin.

This potential decoupling could mean that even if Bitcoin faces headwinds, Ethereum’s unique strengths and growing utility might allow it to maintain its upward trajectory, especially if institutional flows persist.

What’s Next for the ETH Rally? Navigating Key Levels

With the **bullish pennant** complete and significant **Ethereum resistance** levels breached, the focus now shifts to sustaining this momentum. The next critical test for Ethereum will be its ability to hold and consolidate above the newly established support levels, particularly the psychological $4,500 mark. Historically, $4,500 has acted as a significant ceiling, and a confirmed breakout and sustained trading above this level would validate the current bullish pattern.

If Ethereum successfully navigates this threshold, the stage could be set for a retest of its all-time highs and potentially even an ambitious target of $8,000. However, market participants remain cautiously optimistic, acknowledging inherent risks:

- Volatility: The crypto market is known for its rapid price swings, and false breakouts are always a possibility.

- Macroeconomic Conditions: Broader economic factors, such as inflation data, interest rate decisions, and geopolitical events, can significantly impact investor sentiment.

- Bitcoin’s Influence: While a decoupling narrative is emerging, a sharp downturn in Bitcoin could still exert downward pressure on the entire market.

For investors, monitoring trading volume, observing price action around key support and resistance levels, and staying informed about institutional inflows will be crucial in assessing the strength and longevity of this potential **ETH rally**.

Conclusion

Ethereum stands at a pivotal juncture, having successfully breached a four-year diagonal resistance and completed a significant bullish pennant pattern. This technical triumph, bolstered by robust institutional inflows and ongoing ecosystem advancements, paints a compelling picture for a continued **ETH rally**. While macroeconomic factors and market volatility remain variables, the confluence of technical indicators, strong fundamentals, and growing institutional confidence suggests that Ethereum’s upward trajectory is gaining substantial strength. The coming weeks will be crucial in confirming these signals and potentially setting new milestones for the second-largest cryptocurrency.

Frequently Asked Questions (FAQs)

Q1: What is a bullish pennant pattern, and why is it important for Ethereum?

A: A bullish pennant is a continuation chart pattern formed during a strong uptrend. It looks like a small symmetrical triangle (the pennant) following a sharp price rise (the flagpole). It signifies a period of consolidation where buyers and sellers are in equilibrium before the price typically breaks out to continue its upward trend. For Ethereum, the completion of a multi-year bullish pennant suggests that after a long consolidation, ETH is poised for another significant price increase.

Q2: Why is the breach of a four-year resistance level significant for Ethereum’s price?

A: A four-year resistance level represents a major historical barrier that Ethereum’s price has struggled to overcome for an extended period. Breaching such a long-standing resistance indicates strong buying pressure and a shift in market sentiment. It removes a significant psychological and technical hurdle, often leading to accelerated price movements as previous sellers are exhausted and new buyers enter the market, paving the way for a potential **ETH rally**.

Q3: How are institutional inflows impacting Ethereum’s market performance?

A: Institutional inflows, particularly into Ethereum-based ETFs, inject substantial capital into the market, increasing demand for ETH. This demand helps to drive up the **Ethereum price** and provides a solid foundation for its growth. The participation of major financial institutions like BlackRock and Fidelity also lends credibility to Ethereum as an asset class, attracting more mainstream investors and signaling long-term confidence in its utility and potential.

Q4: What are the next key price targets for Ethereum after this breakout?

A: Following the breakout, technical analysts are closely watching the $4,500 level as the next critical test for **Ethereum price**. If ETH can sustain momentum above this historical ceiling, the next potential target could be a retest of its all-time highs and potentially even an ambitious $8,000, depending on continued market conditions and institutional demand. These targets are based on technical patterns and historical price action.

Q5: Is Ethereum truly decoupling from Bitcoin’s price action?

A: While Bitcoin often leads the broader crypto market, recent indicators suggest a potential decoupling for Ethereum. The weekly MACD turning green for ETH and the ETH/BTC inflow ratio hitting multi-year lows indicate that capital might be rotating from Bitcoin into Ethereum. This suggests that Ethereum’s strong fundamentals, ecosystem growth, and institutional interest are allowing it to forge its own path, even if Bitcoin faces broader market uncertainties.