Ethereum Price: Historic Pattern Hints at Massive 450% Potential Gains Against Bitcoin

Crypto investors are closely watching the Ethereum price against Bitcoin (BTC). A striking historical pattern suggests Ether (ETH) could be on the cusp of a significant rally, potentially mirroring the massive gains seen back in 2019. What does this mean for the second-largest cryptocurrency?

Understanding the ETH BTC Historical Fractal

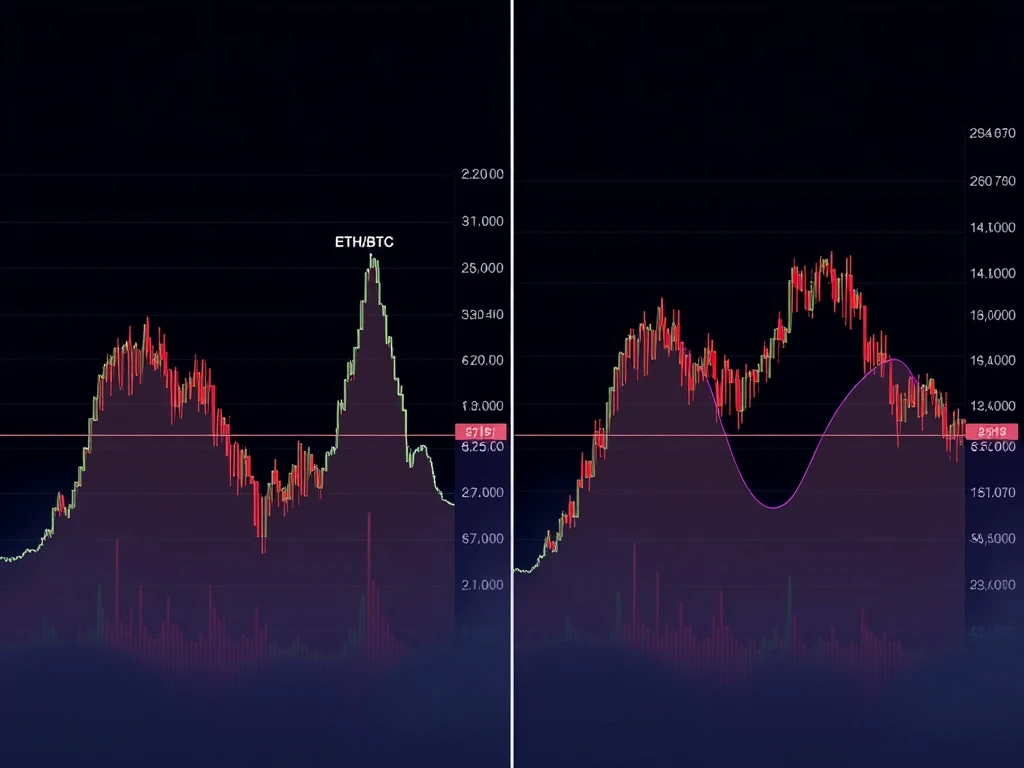

The current behavior of the ETH BTC pair is showing remarkable similarities to its performance leading up to September 2019. At that time, the pair hit a low around 0.016 BTC before embarking on a rally that saw its value increase by nearly 450% over the following year.

Comparing the two periods reveals key parallels:

- Oversold Conditions: Both periods show an oversold Relative Strength Index (RSI), indicating potential for a price rebound.

- Below Key Averages: The price spent extended periods trading below important moving averages.

- Significant Decline: The pair experienced substantial multiyear declines. In 2019, it was a 90%+ drop driven by the ICO market collapse. Today, it’s an 80%+ drop from the 2021 peak.

This fractal pattern is a major point of interest for those performing crypto market analysis.

Nearing the Critical 0.016 BTC Level

Currently trading near 0.019 BTC, the ETH BTC pair is approaching the critical 0.016 BTC level that acted as a bottom in 2019. This level is seen by some analysts as a potential turning point once again.

Adding to the technical picture, the pair has been trading below a multi-year “bearish parabola” resistance curve since December 2021. This curve has limited upside attempts, but recent price action shows signs of this resistance weakening. Chartists suggest that if this curve finally breaks, it could pave the way for significant upside. However, if it holds, a retest or even a brief dip to the 0.016 BTC level remains a possibility before a potential bounce.

Ethereum vs Bitcoin: Underlying Factors and Skepticism

While the technical chart offers a bullish perspective based on history, fundamental factors and skepticism around Ethereum vs Bitcoin dynamics also play a role.

Ethereum’s performance against Bitcoin has been weighed down by several factors since its 2021 peak:

- Skepticism regarding the transition to proof-of-stake (PoS).

- Increasing competition from other layer-1 blockchains.

- Bitcoin’s growing narrative as a primary institutional asset.

In response, Ethereum co-founder Vitalik Buterin has proposed architectural changes aimed at making Ethereum simpler, faster, and more maintainable over the next five years. This proposal has been hailed by some as extremely bullish for ETH.

However, not everyone is convinced. Bitcoin proponent Adam Back is a vocal skeptic, arguing that Buterin’s proposals overlook fundamental design flaws in Ethereum’s account-based system compared to Bitcoin’s UTXO model. He contends that Ethereum’s complexity increases technical risks and challenges its scalability and security. Back also criticizes PoS for concentrating power, starkly contrasting it with Bitcoin’s proof-of-work distribution. His strong stance leads him to advise selling ETH and buying Bitcoin, suggesting that no upgrade can fix what he views as a flawed foundation.

What This Means for Your ETH Price Prediction

The confluence of a compelling historical price fractal and ongoing fundamental debates creates a complex picture for any ETH price prediction. The technical setup strongly suggests that the 0.016 BTC level is a critical support zone where a significant rebound is historically likely.

The potential for a repeat of the 2019 rally is exciting for Ethereum holders. However, it is crucial to consider the valid points raised by skeptics regarding Ethereum’s design and the competitive landscape. Market analysis requires looking at both technical patterns and fundamental realities.

Conclusion: A Pivotal Moment for ETH/BTC

The ETH/BTC pair stands at a pivotal juncture, nearing a price level that previously marked the start of a massive uptrend. While the historical fractal offers a compelling bullish case for substantial gains, the path forward is not without challenges or differing opinions on Ethereum’s long-term viability relative to Bitcoin. Investors should conduct thorough research, weighing the technical signals against the fundamental arguments before making investment decisions.