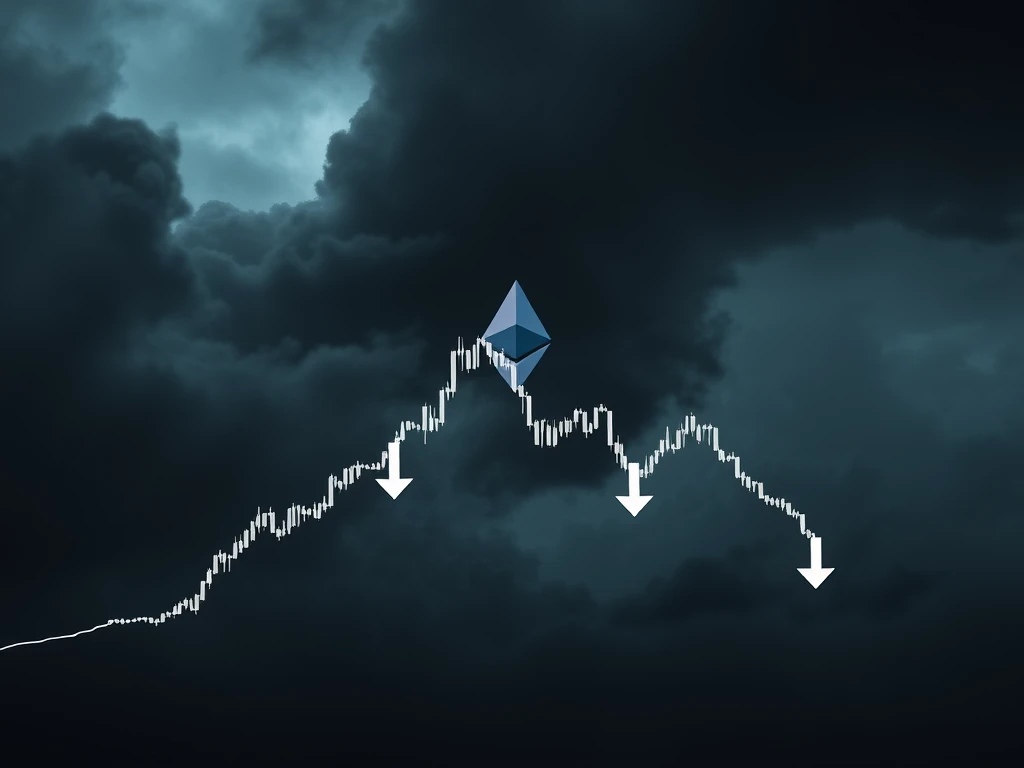

Urgent Ethereum Price Warning: ‘Double Top’ Pattern Signals Terrifying 42% Drop!

Hold onto your hats, crypto enthusiasts! The Ethereum market is flashing some serious warning signs. After a significant run, a chilling chart pattern has emerged – the dreaded ‘double top’. Could this spell the end of the recent ETH bull run and trigger a sharp 42% plunge in the Ethereum price? Let’s dive into the analysis and see what’s brewing in the world of ETH.

Is the Ethereum Bull Run Really Over? Decoding the 357-Day Downtrend

For over 357 days, ETH price action has painted a concerning picture. This prolonged downtrend suggests that the bullish momentum that once propelled Ethereum to dizzying heights may have faded. Many are now questioning if the bull market has indeed ‘forgotten’ about ETH. But what does this extended period of bearish sentiment truly mean for the future of Ethereum? Is a turnaround on the horizon, or are we bracing for a deeper correction?

To understand the current situation, let’s break down the key elements:

- Prolonged Downtrend: A 357-day downtrend is not a minor blip. It indicates sustained selling pressure and a lack of strong buying interest.

- Fading Bullish Sentiment: The initial excitement and optimism surrounding Ethereum might be waning as investors grapple with market uncertainties and potentially better opportunities elsewhere.

- Market Correction: After periods of rapid growth, markets often undergo corrections. This downtrend could be a necessary phase to rebalance and consolidate before any potential resurgence.

The Ominous ‘Double Top’: What Does It Mean for ETH?

The ‘double top’ pattern is a classic technical analysis indicator that often spells trouble for asset prices. It forms when the price of an asset attempts to break through a resistance level twice, fails both times, and then starts to decline. In the case of Ethereum price, this pattern suggests that buyers are struggling to push the price higher, and sellers are gaining control.

Understanding the Double Top Pattern:

- First Top: The price rises to a peak and then retreats.

- Second Top: The price attempts to rally again to the same peak level but fails to break through.

- Neckline Break: Once the price falls below the ‘neckline’ (the support level between the two tops), it often signals the start of a significant downtrend.

If the ‘double top’ pattern plays out as anticipated, the projected 42% drop is calculated based on the height of the pattern itself, measured from the neckline to the peak. This potential decline could bring significant pain to ETH holders and further dampen market sentiment.

Why a 42% Price Drop in the Crypto Market Could Be Terrifyingly Real

A 42% drop is not just a minor dip; it’s a substantial correction that can shake the confidence of even seasoned crypto investors. Several factors could contribute to this potential price plunge, making it a very real possibility for the crypto market and specifically for Ethereum:

| Factor | Impact on ETH Price |

|---|---|

| Broader Market Sentiment: | Negative sentiment across the entire crypto market, often influenced by macroeconomic factors like inflation, interest rate hikes, or regulatory concerns, can drag down even fundamentally strong assets like Ethereum. |

| Profit-Taking: | Investors who bought ETH at lower prices might be looking to take profits, especially if they perceive a market top forming. This selling pressure can exacerbate a downtrend. |

| Technical Breakdown: | The ‘double top’ pattern itself is a technical breakdown. If traders and algorithms recognize this pattern, it can trigger further selling as they anticipate a price decline and adjust their positions accordingly. |

| Lack of Catalysts: | Without strong positive catalysts to drive demand for Ethereum, such as major upgrades, increased adoption, or positive news flow, the price may struggle to find upward momentum and become more vulnerable to bearish patterns. |

Navigating the Storm: What Should Ethereum Holders Do Now?

The potential for a 42% drop in ETH price might sound alarming, but it’s crucial to approach this situation with a balanced perspective and a well-thought-out strategy. Panic selling is rarely the answer. Instead, consider these actionable insights:

- Stay Informed: Keep a close eye on market analysis, news, and technical indicators. Understanding the factors influencing the price of Ethereum is crucial for making informed decisions.

- Risk Management: Assess your risk tolerance and portfolio allocation. Consider strategies like setting stop-loss orders to limit potential losses if the price declines further.

- Long-Term Perspective: Remember that the cryptocurrency market is known for its volatility. If you have a long-term belief in the fundamentals of Ethereum and its technology, short-term price fluctuations might be less concerning.

- Diversification: Don’t put all your eggs in one basket. Diversifying your crypto portfolio can help mitigate risk.

- Seek Professional Advice: If you are unsure about how to navigate this market situation, consider consulting with a financial advisor who specializes in cryptocurrencies.

Is a Price Turnaround Possible for Ethereum? Hope Amidst the Fear

While the ‘double top’ pattern and the extended downtrend paint a bearish picture, the cryptocurrency market is inherently unpredictable. A price turnaround for Ethereum analysis is always possible. Positive developments, unexpected market catalysts, or a shift in investor sentiment could potentially invalidate the bearish scenario.

Factors that could trigger a potential Ethereum price turnaround:

- Positive News and Developments: Breakthroughs in Ethereum’s technology, increased adoption by institutions, or favorable regulatory news could inject renewed optimism into the market.

- Broader Market Recovery: If the overall crypto market sentiment improves and Bitcoin, the market leader, starts to rally, it could lift Ethereum along with it.

- Undervaluation: If the price of Ethereum drops significantly, it might become undervalued relative to its potential, attracting bargain hunters and long-term investors.

Final Thoughts: Navigating the Volatile Ethereum Market

The ‘double top’ pattern in the Ethereum price chart is indeed a warning sign that should not be ignored. The potential for a 42% drop is a stark reminder of the inherent risks in the cryptocurrency market. However, it’s also crucial to remember that technical patterns are not guarantees, and the market can change rapidly. By staying informed, managing risk, and maintaining a balanced perspective, ETH holders can navigate this potentially volatile period and position themselves for future opportunities. The crypto journey is often filled with ups and downs, and understanding market cycles is key to long-term success.