Ethereum Layer 2 Fees: Are Rollups Extractive or Essential?

Ethereum Layer 2 solutions have revolutionized how we interact with the blockchain, promising faster transactions and lower costs. They’ve been hailed as a major success story for Ethereum scaling. But recently, a debate has emerged: are these Layer 2s truly beneficial for the Ethereum mainnet, or are they becoming ‘extractive’ by drawing away valuable activity and revenue?

Understanding the Ethereum Layer 2 Debate and L2 Fees

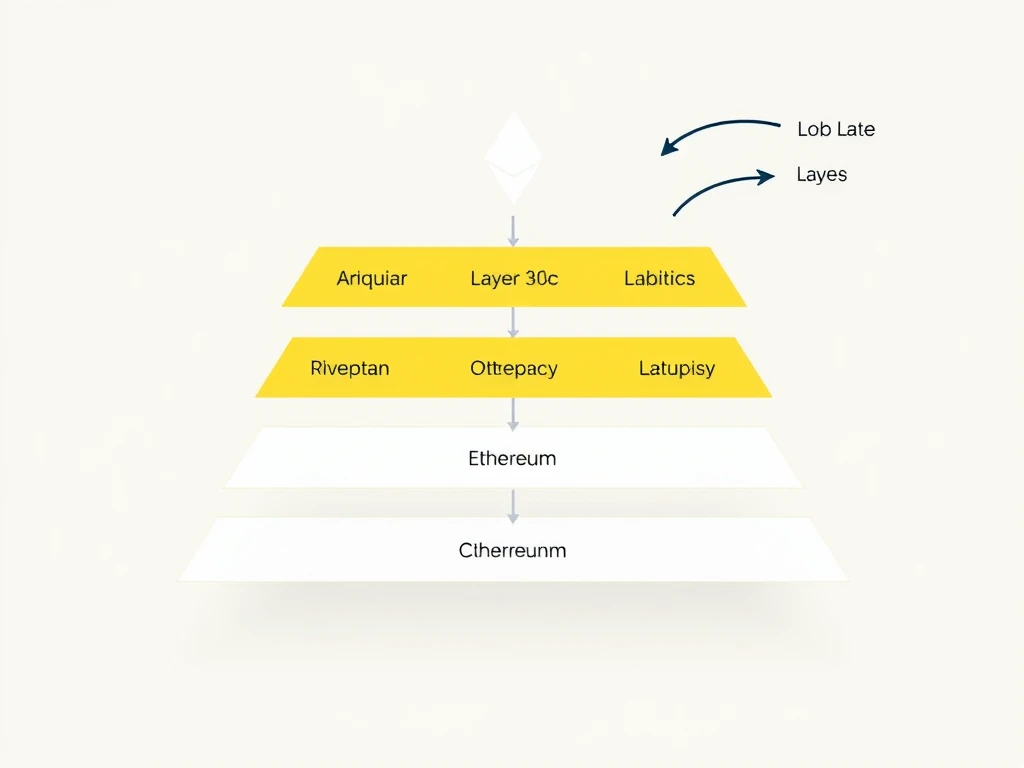

Layer 2 (L2) rollups were developed to address Ethereum’s congestion and high gas fees. By processing transactions off-chain and posting compressed data back to the mainnet, they significantly increased throughput while inheriting Ethereum’s security. This has led to a boom in L2 usage, making decentralized applications more accessible.

However, critics argue that while L2s rely on Ethereum for security and finality, they are capturing the most profitable part of the transaction lifecycle: sequencing fees. Sequencing involves ordering and bundling transactions before they are sent to the mainnet. Centralized L2s like Base, Optimism, and Arbitrum currently control this process and keep the associated fees. The argument is that the Ethereum mainnet, which provides the underlying security guarantees, isn’t being adequately compensated for its crucial role.

Did Dencun Shift the Balance of L2 Fees?

The fee dynamics became particularly pronounced after Ethereum’s Dencun upgrade in March 2024. Dencun introduced ‘blobs,’ a new transaction type that drastically reduced the cost for L2s to post data to Ethereum. This made L2 operations significantly more profitable. CoinMetrics analyst Tanay Ved highlighted how this impacted profitability.

A key example cited is the Base Network, launched by Coinbase. According to CoinMetrics data following Dencun, Base generated substantial revenue from user fees but paid a much smaller amount back to the Ethereum base layer for settlement. This disparity has fueled the ‘extractive’ narrative.

Base Network Responds to Fee Concerns

A spokesperson for the Base Network acknowledged that Base pays fees to Ethereum for every transaction settled on the mainnet. They stated that Base has paid over $20 million in settlement fees since its launch and pointed to public financial data showing these costs. They also emphasized Base’s role in growing the overall Ethereum ecosystem by onboarding new users, builders, and assets, all of whom transact in ETH.

While Base does pay settlement fees, an examination of their financial statements often shows that the fees collected from users are significantly higher than the amount paid to Ethereum. For instance, in a recent month, user fees on Base were roughly 10 times the settlement fees paid to the mainnet.

Can Ethereum Scaling Improvements Rebalance Fees?

Some believe the current fee imbalance may not last. Future Ethereum hard forks are planned to increase blob throughput further. As L2 activity continues to grow, the increased capacity for blobs could potentially lead to higher total blob fees flowing back to the mainnet. Proposals like EIP-7762, which adjusts minimum blob fees, could also contribute to increased fee capture for Ethereum.

The Risk of Centralized Sequencing and the Promise of Decentralized Rollups

Beyond fees, another critical discussion point is the centralization of L2 sequencers. Critics argue that centralized sequencers represent a single point of failure, potentially impacting the rollup’s liveness and security. The $2.6 million hack on Linea last year is sometimes cited as an example highlighting the risks associated with centralized components.

This concern has led to increased interest in Decentralized Rollups, specifically ‘based rollups.’ In this model, transaction ordering is performed by Ethereum mainnet validators rather than a dedicated, centralized sequencer. This approach aims to inherit Ethereum’s decentralization and security properties more fully.

Several based rollups have emerged, with Taiko being a notable example. While currently smaller in terms of total value secured compared to giants like Base or Arbitrum One, based rollups offer a different architectural choice that proponents believe aligns better with Ethereum’s core ethos.

Other Ideas and the Path Forward

Other potential solutions discussed within the community include imposing a direct ‘tax’ on L2s, although this faces philosophical opposition as potentially contradicting Ethereum’s decentralized, market-driven principles. It could also risk driving activity to competing Layer 1 chains outside the ecosystem.

Another perspective is that social pressure and collaborative efforts within the decentralized Ethereum ecosystem could encourage leading L2s to adopt more decentralized sequencing models over time. Workshops involving various ecosystem teams are seen as steps towards addressing shared challenges like interoperability and decentralization.

Despite the debates around L2 fees and centralization, there remains significant optimism about Ethereum’s future. Its strong position in DeFi, stablecoins, and growing institutional interest highlight its continued importance as foundational infrastructure. The ability of the decentralized ecosystem to adapt and evolve, as seen with past upgrades and ongoing research into solutions like based rollups, suggests that Ethereum can navigate these challenges and continue to grow its Layer 2 ecosystem in a way that benefits both the mainnet and its users.

Summary: Balancing Innovation and Value Capture

The rise of Ethereum Layer 2 solutions has been essential for scaling the network and making it more usable. However, the success has sparked a necessary debate about the distribution of value, particularly L2 fees and the risks of centralized sequencing. While some argue current dynamics are ‘extractive,’ others point to the overall growth L2s bring to the ecosystem and potential future fee rebalancing through upgrades and the adoption of Decentralized Rollups. The conversation highlights the ongoing challenge for a decentralized network like Ethereum to balance rapid innovation with ensuring the health and value capture of its core layer.