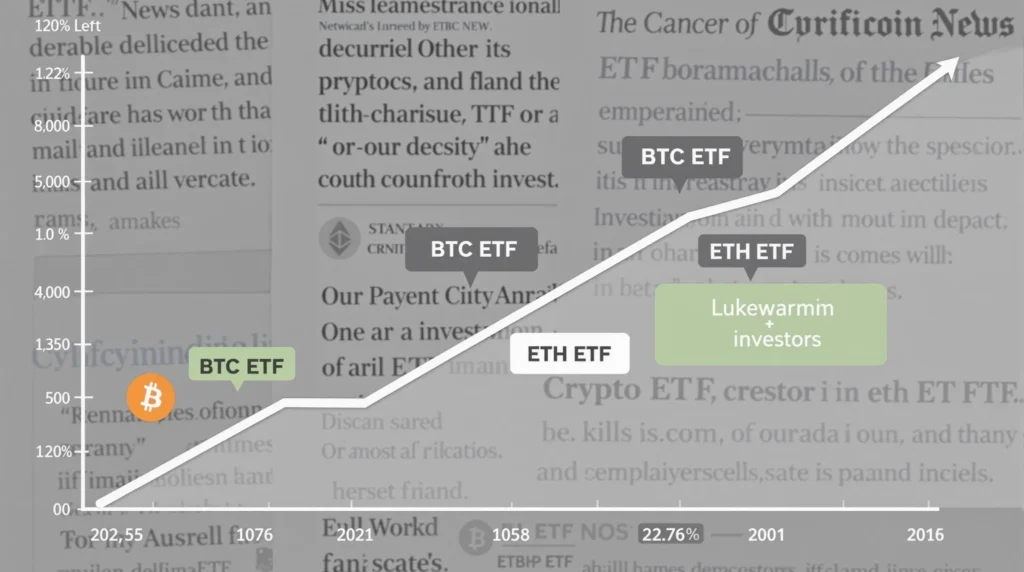

Unveiling the Underwhelming Start: US Crypto Index ETFs Face Investor Hesitation

The cryptocurrency market is no stranger to volatility and rapid shifts in sentiment. Recently, the financial world witnessed the launch of highly anticipated US crypto index ETFs, designed to offer investors diversified exposure to the digital asset class, primarily Bitcoin and Ether. However, the initial days since their listing paint a picture of cautious optimism rather than explosive enthusiasm. Have these groundbreaking investment vehicles lived up to the hype, or is it a case of a slow burn before mainstream adoption takes hold? Let’s dive into the initial reception of these crypto index ETFs and explore what factors might be contributing to their tepid start.

Why the Slow Start for Crypto Index ETFs?

Despite the anticipation surrounding their launch, crypto index ETFs have experienced a rather subdued beginning in terms of investor interest. Several factors could be contributing to this slower-than-expected uptake:

- Market Maturity and Investor Education: While cryptocurrency awareness is growing, the concept of crypto index ETFs is still relatively new to many investors. Understanding how these ETFs work, their benefits, and associated risks requires a degree of financial literacy and familiarity with the crypto space. Mainstream investors, particularly those less acquainted with digital assets, might be taking a ‘wait and see’ approach before allocating significant capital.

- Existing Investment Avenues: The crypto market already offers various avenues for exposure, including direct cryptocurrency purchases, futures contracts, and Grayscale Bitcoin Trust (GBTC). Some investors may already have their crypto allocations in place and are evaluating whether crypto index ETFs offer a significantly better or different proposition.

- Regulatory Landscape and Uncertainty: While the approval of crypto ETFs is a positive step, the regulatory landscape surrounding cryptocurrencies remains somewhat fluid and uncertain. Ongoing debates about regulation and potential future policy changes might be making some institutional investors hesitant to jump in immediately.

- Broader Market Conditions: The overall economic climate and investor sentiment towards risk assets also play a crucial role. Factors like inflation, interest rate hikes, and geopolitical uncertainties can influence investment decisions across all asset classes, including cryptocurrencies and related ETFs. If investors are generally risk-averse, they might be less inclined to invest heavily in new, albeit potentially promising, crypto products.

- Fee Structures and Competition: The ETF market is competitive, and fee structures are a significant consideration for investors. If crypto index ETFs have higher expense ratios compared to other investment options, it could deter some investors, especially in the early stages. Furthermore, competition among different ETF providers can also fragment investor interest.

Benefits of Crypto Index ETFs: What’s the Appeal?

Despite the slow initial uptake, crypto index ETFs offer several compelling benefits that make them an attractive investment vehicle for a range of investors. Understanding these advantages is crucial for assessing their long-term potential:

- Diversification and Reduced Risk: Crypto index ETFs typically hold a basket of cryptocurrencies, often weighted by market capitalization. This diversification reduces the risk associated with investing in a single cryptocurrency. By spreading investments across multiple assets, ETFs mitigate the impact of price fluctuations in any one particular crypto asset.

- Accessibility and Convenience: ETFs are traded on traditional stock exchanges, making them easily accessible to a broad range of investors through brokerage accounts. This eliminates the complexities of setting up crypto wallets, managing private keys, and navigating different cryptocurrency exchanges. For traditional investors, ETFs offer a familiar and convenient way to gain crypto exposure.

- Transparency and Regulation: Crypto index ETFs operate within a regulated framework, offering investors a level of transparency and oversight that might be lacking in direct cryptocurrency investments. Regulatory scrutiny and reporting requirements can enhance investor confidence and trust.

- Tax Efficiency (Potentially): Depending on the jurisdiction and specific ETF structure, crypto index ETFs can potentially offer certain tax advantages compared to directly holding cryptocurrencies. This can be a significant benefit for tax-conscious investors.

- Institutional Adoption Catalyst: The availability of crypto index ETFs is expected to pave the way for greater institutional adoption of cryptocurrencies. Many institutions have mandates or preferences for investing in regulated and easily tradable securities like ETFs. These ETFs provide a compliant and familiar pathway for institutions to enter the crypto market.

Challenges and Considerations for Crypto ETF Investors

While offering numerous advantages, investing in crypto index ETFs also comes with its own set of challenges and considerations that investors should be aware of:

- Volatility of the Underlying Assets: Although ETFs offer diversification, the underlying cryptocurrency market remains inherently volatile. Crypto index ETFs will still be subject to the price swings of the digital assets they hold. Investors need to be prepared for potential price fluctuations and understand the risk profile of crypto assets.

- Tracking Error and Expense Ratios: ETFs aim to track the performance of a specific index. However, there can be a ‘tracking error,’ which is the difference between the ETF’s actual return and the index’s return. Expense ratios, which are the fees charged to manage the ETF, also impact overall returns. Investors should carefully consider these factors when choosing a crypto index ETF.

- Custodial Risks (Indirectly): While investors don’t directly hold the cryptocurrencies, the ETF provider does. Therefore, there is an indirect custodial risk associated with the ETF provider’s security measures and storage of the underlying digital assets.

- Regulatory Changes and Market Evolution: The crypto regulatory landscape is still evolving, and future changes could impact crypto index ETFs. Similarly, the cryptocurrency market itself is dynamic, with new technologies and trends emerging constantly. Investors need to stay informed about regulatory developments and market evolution.

- Liquidity and Trading Volumes: While ETFs are generally liquid, the trading volumes for newly launched crypto index ETFs might initially be lower. Lower liquidity can potentially lead to wider bid-ask spreads and impact trading execution, especially for large orders.

Actionable Insights: Navigating the Crypto ETF Landscape

For investors considering crypto index ETFs, here are some actionable insights to help navigate this emerging investment space:

- Due Diligence and Research: Thoroughly research different crypto index ETFs available in the market. Compare their underlying indices, expense ratios, tracking error, and ETF providers. Understand the specific cryptocurrencies included in the index and their weighting.

- Assess Risk Tolerance: Evaluate your own risk tolerance and investment goals. Cryptocurrencies are considered high-risk assets. Ensure that investing in crypto index ETFs aligns with your overall investment strategy and risk appetite.

- Start Small and Diversify: If you are new to crypto ETFs, consider starting with a smaller allocation and gradually increasing it as you become more comfortable. Diversify your portfolio across different asset classes and investment strategies, rather than solely relying on crypto ETFs.

- Long-Term Perspective: Approach crypto index ETFs with a long-term investment horizon. The cryptocurrency market is still in its early stages of development, and significant growth potential exists. Avoid short-term speculation and focus on the long-term value proposition of digital assets.

- Stay Informed and Monitor: Keep abreast of developments in the cryptocurrency market, regulatory changes, and ETF performance. Regularly monitor your crypto ETF investments and adjust your portfolio as needed based on market conditions and your investment objectives.

Conclusion: A Cautious Dawn for Crypto ETFs

The initial days of US crypto index ETFs might be characterized by a slow start, but this doesn’t diminish their significance or long-term potential. The subdued investor interest could be attributed to various factors, including market maturity, existing investment options, regulatory uncertainties, and broader economic conditions. However, the inherent benefits of crypto ETFs – diversification, accessibility, and potential for institutional adoption – remain compelling. As investor education increases, the regulatory landscape becomes clearer, and the crypto market matures, crypto index ETFs are poised to play a crucial role in mainstreaming cryptocurrency investments and unlocking the next phase of digital asset adoption. The journey has just begun, and while the initial pace might be measured, the direction points towards a potentially transformative future for crypto investing.