CleanSpark Achieves Explosive 145% Hashrate Growth in June

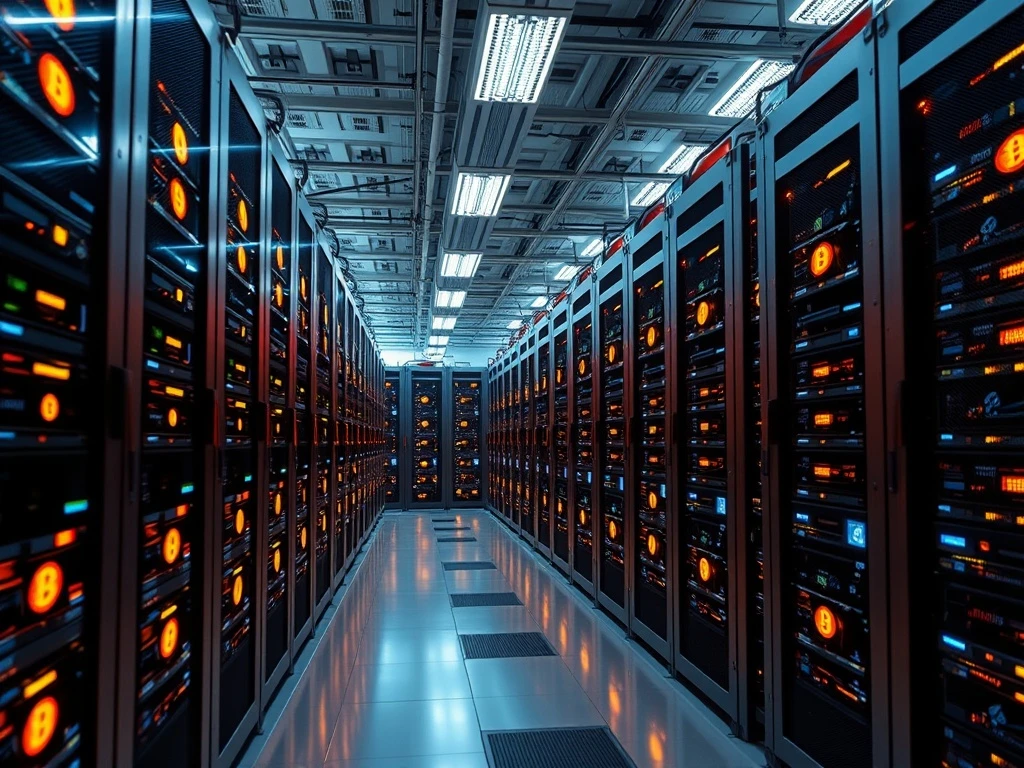

CleanSpark, a prominent player in the digital asset sector, recently released its operational results for June, showcasing significant growth in its Bitcoin mining activities. Despite navigating the complexities of the post-halving environment, the company demonstrated a substantial increase in its mining capacity and Bitcoin production.

CleanSpark’s Impressive Bitcoin Mining Performance

In June, CleanSpark successfully mined 685 BTC. This figure represents a notable increase compared to the 445 BTC mined in June of the previous year. This surge in production highlights the company’s expanding operational capabilities.

Key figures for June 2024:

- BTC Mined: 685

- Estimated Value of June BTC Production: Approximately $74.2 million (at current prices mentioned in the source)

- BTC Sold in June: 578

- Current BTC Holdings: 12,608 BTC

These results demonstrate CleanSpark’s ongoing efforts to maximize its Bitcoin output.

Scaling Hashrate: A Key Driver for This Crypto Miner

A major factor behind CleanSpark’s increased production is the significant expansion of its operational hashrate. The company reached 50 EH/s in June, a substantial leap from 20.4 EH/s recorded in June 2023. This represents a 145.1% year-over-year increase in mining capacity.

Zach Bradford, CEO and president of CleanSpark, commented on this achievement, stating, “The tireless efforts of our operations and technology teams resulted in the addition of over 10 EH/s of capacity across four states to achieve the ambitious target. This represents a 9.6% month-over-month increase.”

The company has been actively expanding its footprint, adding facilities in Georgia, Mississippi, Wyoming, and Tennessee since February 2024. This geographic diversification and infrastructure build-out are crucial for scaling their hashrate.

CleanSpark’s BTC Holdings and Market Position

Even with significant monthly sales, CleanSpark’s total Bitcoin holdings increased slightly from 12,502 BTC in May to 12,608 BTC in June. This positions CleanSpark as a significant holder of BTC among publicly traded companies.

According to data from BitcoinTreasuries.net cited in the source, CleanSpark ranks seventh among publicly traded companies by Bitcoin holdings. Within the Bitcoin mining sector, only MARA Holdings (50,000 BTC) and Riot Platforms (19,225 BTC) hold more BTC than CleanSpark.

CEO Zach Bradford also highlighted a broader trend: “Corporations around the globe are embracing the value of a Bitcoin-enhanced balance sheet. In fact, corporate Bitcoin acquisitions have outpaced ETF net inflows for the third consecutive quarter.” This suggests a growing corporate interest in holding BTC as a treasury asset.

Navigating the Post-Halving Bitcoin Environment

The current environment for Bitcoin miners is marked by challenges, particularly following the recent halving event. The halving reduced the block reward for miners, directly impacting their revenue per block found.

Adding to the pressure, Bitcoin mining difficulty has reached all-time highs this year, hitting 126.9 trillion on May 31st. Increased difficulty means miners require more computational power to earn the same amount of BTC, driving up operational and energy costs.

CleanSpark’s strategy has included selling a portion of its mined Bitcoin to fund operations and expansion, a pivot towards a ‘self-funding’ model mentioned previously. In June, the company sold 578 BTC, which accounted for the majority of its monthly production.

Market Reaction and Challenges Facing Bitcoin Miners

Despite the positive operational report, CleanSpark’s stock (CLSK) experienced a dip on the Nasdaq following the announcement, dropping around 8% at the time the source article was written. This stock movement was noted as following a broader market trend, with the Nasdaq index also seeing declines.

The challenges facing the Bitcoin mining industry are real: reduced block rewards, rising network difficulty, and fluctuating energy prices all impact profitability. Miners must constantly upgrade equipment and optimize operations to remain competitive.

CleanSpark’s significant investment in newer, more efficient mining rigs, such as the 26,000 Bitmain immersion mining rigs purchased in August 2024, is a direct response to the need for increased efficiency and hashrate in this competitive landscape.

Conclusion

CleanSpark’s June report demonstrates robust operational growth, particularly in scaling its hashrate and increasing Bitcoin production year-over-year. While the company continues to build its BTC reserves, it is also actively selling mined coins to support its expansion strategy. The performance highlights CleanSpark’s position as a leading crypto miner, successfully navigating the challenging post-halving environment through strategic growth and operational efficiency, even as market conditions present headwinds for the sector.