Curious Trend: Bitcoin Retail Investors Lagging as Price Nears Highs

As the Bitcoin price pushes closer to setting new records, a curious trend is emerging in the crypto market: the apparent absence of the typical retail investor frenzy. While institutions have been active buyers, data suggests individual investors are staying on the sidelines, a pattern that deviates from what might be expected as BTC approaches previous peaks.

Bitcoin Price Nears Highs, But Where Are Retail Investors?

Bitcoin has recently been trading near the $104,000 mark, setting its sights on the previous Bitcoin all-time high around $109,350. Historically, such significant price movements, especially nearing record territory, trigger widespread excitement among retail traders. However, current indicators paint a different picture, suggesting a notable lag in engagement from this crucial market segment.

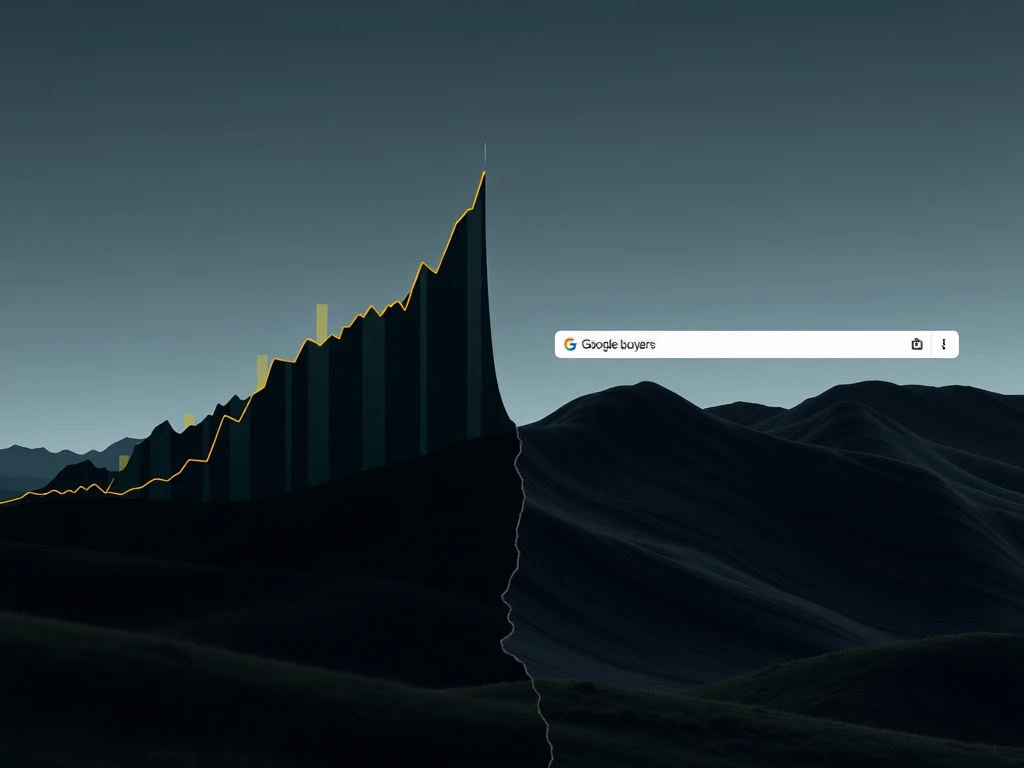

Lagging Google Search Volume and App Rankings

One key indicator for public interest is Google search volume. Searches for the term “Bitcoin” are currently hovering at levels last seen in June 2024, a period when Bitcoin was trading significantly lower, around $66,000. This flat search trend suggests that the general public isn’t rushing to look up Bitcoin despite its recent price appreciation.

Similarly, tracking the popularity of cryptocurrency trading apps offers insight into retail activity. The Coinbase app, a popular platform for individual investors, currently ranks around 15th in the US App Store’s finance category. This ranking is comparable to its position in June 2024 and significantly lower than peaks observed during past price surges. These metrics serve as proxies, indicating that the surge in curiosity and potential new money inflow from retail investors that often accompanies major price moves is currently subdued.

Why Retail Investors Were Net Sellers in 2025

Data from firms like River highlights a significant dynamic observed throughout 2025. According to their estimates, retail investors were actually net sellers of Bitcoin during this period, offloading approximately 247,000 BTC, valued at roughly $23 billion based on the average price. In stark contrast, institutional players were the primary accumulators. For instance, MicroStrategy’s strategic purchases accounted for a substantial 77% of the 157,000 BTC acquired by businesses that year. This data reinforces the idea that while institutions have been driving demand, individual investors have largely been exiting their positions or remaining inactive.

Historical Pattern: Retail Interest Peaks After Bitcoin All-Time Highs

Analyzing past market cycles reveals a consistent pattern regarding retail investors. Their interest often spikes *after* a major price milestone, particularly after Bitcoin breaks a previous Bitcoin all-time high. For example:

- In November 2024, the Coinbase app ranking and Google search interest peaked about a week after Bitcoin surpassed its prior ATH of $73,757.

- In March 2024, a similar surge in retail interest occurred roughly six days after Bitcoin closed above its November 2021 record high of $68,000.

These instances suggest that rather than anticipating the move, many retail participants react to the news of a new record, often entering the market after a significant portion of the price appreciation has already occurred. This reactive behavior means they often buy closer to the peak of the initial rally.

Navigating the Crypto Market: Lessons for Retail Investors

The tendency for retail investors to enter the market *after* a Bitcoin all-time high has been surpassed highlights a common challenge in the crypto market. Buying near the peak of euphoria can be a sub-optimal strategy, as it increases the risk of buying just before a price correction or period of consolidation. The current low levels of retail interest, despite the proximity to a new record, align with the historical pattern of retail demand lagging the initial price move. This underscores the importance of understanding market cycles and avoiding the urge to succumb to fear of missing out (FOMO) by entering only after significant gains have been made public.

Conclusion

The current disconnect between Bitcoin’s rising price and the subdued interest from retail investors, as indicated by Google search volume and app rankings, presents a fascinating market dynamic. While institutions have been accumulating, retail appears to be waiting for the confirmation of a new Bitcoin all-time high before potentially re-engaging. Historical data suggests this lag is typical, with retail interest peaking about a week after a record is broken. For those participating in the crypto market, observing these trends provides valuable context, reminding us that market cycles involve different participants acting on different signals and timelines.