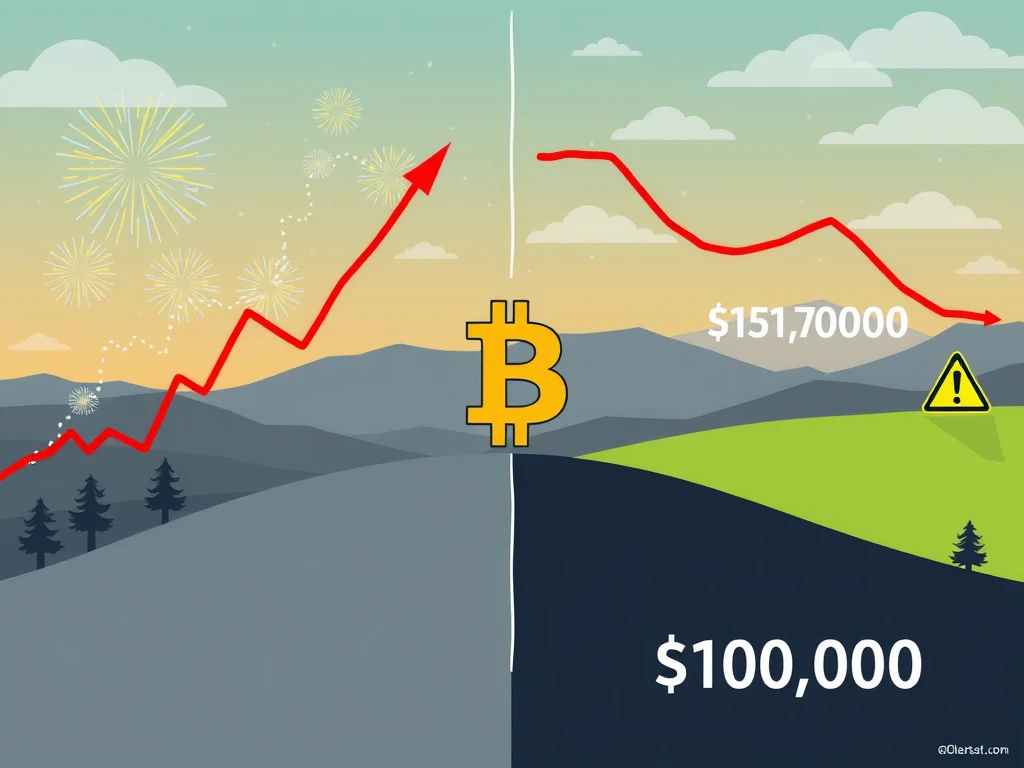

Urgent Bitcoin Price Analysis: $100K Retest vs. Record High Close

The `Bitcoin market` is currently presenting a complex picture. While Bitcoin (BTC) just achieved its highest monthly close in history, raising hopes for continued upside, key indicators and market behavior suggest the possibility of a retest of lower support levels, potentially around $100,000. This conflict has investors and traders closely watching price action and external factors. What should you know about the current state of Bitcoin?

Analyzing the Latest `Bitcoin Price` Action

Bitcoin managed a weekly candle close above a critical level from December 2024, providing a thin margin of support after a week that saw an 8% retracement from highs. Data indicates the close came in around $105,700, holding a level analysts deemed necessary to preserve bullish momentum.

However, this positive close is shadowed by a bearish divergence noted on the Relative Strength Index (RSI). The RSI, a tool to measure price trend strength, shows a lower high while the price itself reached new highs before pulling back. This divergence often signals weakening momentum and potential trend shifts.

Despite the late-month pullback, May concluded with Bitcoin posting 11% gains, securing the highest monthly close ever for BTC/USD. The market now looks for clear direction.

What Liquidity Tells Us About the `BTC Price` Outlook

Order book data provides insight into potential future price movements by showing where buy and sell orders are concentrated. Currently, monitoring resources indicate that a significant portion of order book liquidity sits above the current `BTC price`, rather than below it. This suggests that there might be less immediate buying pressure at lower levels and more resistance or targets at higher prices.

Some analysts interpret this liquidity distribution as a sign that while a dip towards $100,000 is possible, an eventual move higher, potentially towards $113,000, remains a plausible trajectory based on where large orders are placed.

External Factors Influencing the `Price Forecast`

Beyond chart patterns, macroeconomic factors play a significant role in the `Price forecast` for Bitcoin and other risk assets. This week, attention is focused on US labor market data and statements from the Federal Reserve (Fed).

Recent data hinting at potential weakness in the labor market challenges the Fed’s stance on keeping interest rates elevated for an extended period. Simultaneously, the Personal Consumption Expenditures (PCE) index, a key inflation gauge, aligned with or fell below expectations, confirming slowing inflationary pressure. This divergence between slowing inflation and high interest rates creates a unique economic backdrop.

While there’s pressure on the Fed to consider rate cuts, data suggests markets aren’t anticipating a move before September. Comments from Fed officials, including Chair Jerome Powell, will be closely watched for any shifts in this outlook. Additionally, declining strength in the US dollar index (DXY) could act as a potential tailwind for Bitcoin, as a weaker dollar often makes alternative assets more attractive.

Who’s Buying? `Crypto Analysis` of Hodler Behavior

Internal `Crypto analysis` of investor behavior provides another layer of understanding regarding market sentiment and potential direction. Recent price volatility has triggered shifts across different types of Bitcoin holders.

Key observations from onchain data include:

- **Stablecoin Outflows:** Significant amounts of stablecoins are moving off exchanges, potentially indicating traders are converting exchange-held funds into stablecoins as a hedge against price drops or preparing to deploy capital elsewhere.

- **Long-Term Holder (LTH) Activity:** Entities holding BTC for six months or more have shown a decrease in their realized cap, suggesting some long-term holders have been taking profits as prices climbed.

- **Whale Distribution:** Large holders (whales) have been gradually reducing their exposure as Bitcoin’s price increased from around $81,000 to $110,000, distributing holdings systematically.

- **Retail Accumulation:** In contrast to whales, retail investors appear to be accumulating Bitcoin at higher price levels, potentially waking up to the rally later in the cycle.

This combination of stablecoin withdrawals, reduced LTH accumulation, and differing behavior between whales and retail suggests the market is in a period of transition. Profit-taking by larger entities can sometimes signal potential local tops.

Potential Targets: Where Could the `Bitcoin Price` Go Next?

Looking ahead, technical indicators and onchain metrics offer potential price targets and support levels. The market value to realized value (MVRV) ratio, which compares market price to the average investor cost basis, is a useful tool for gauging unrealized profits and identifying potential turning points.

Current analysis using MVRV deviation bands places the `Bitcoin price` between the +0.5σ and +1σ bands, a zone that has historically preceded local market tops. While Bitcoin is approaching what could be considered overheated territory based on this metric, it has not yet crossed the +1σ band, a level often associated with mass profit-taking events.

This suggests that while a retest of $100,000 as support remains a possibility, the market might still have room for further upside before investor gains become compelling enough to trigger widespread selling. A move towards the $120,000 area is identified by the +1σ MVRV band as a potential target for a local top.

The current `Bitcoin market` is characterized by conflicting signals. A strong monthly close provides a bullish backdrop, but technical divergences, whale distribution, and macroeconomic uncertainty point to potential downside risks or at least a period of consolidation. Investors should conduct their own research and consider these factors carefully when making decisions in this dynamic environment.