Bitcoin Price Soars: BTC Funding Rates Signal Next Leg Up

Crypto markets are buzzing with potential as key indicators point towards a significant move for the Bitcoin price. Recent data on BTC funding rates suggests conditions are aligning for another substantial Bitcoin rally, reminiscent of past upward price movements.

Understanding BTC Funding Rates and Historical Bitcoin Rally

The perpetual futures funding rate for Bitcoin recently dipped into negative territory. This rate represents payments between traders holding long and short positions. A negative rate means short position holders are paying long position holders, typically indicating prevailing bearish sentiment in the derivatives market.

Historically, negative funding rates during or preceding an uptrend have been strong precursors to a Bitcoin rally. For instance, similar flips in September 2023 and July 2023 were followed by rallies of 80% and 150%, respectively. While past performance doesn’t guarantee future results, this pattern draws attention.

The recent recovery of BTC funding rates back into positive territory mirrors these prior setups, suggesting a potential ‘bearish reset’ may have occurred, paving the way for a fresh leg higher in the Bitcoin price.

Potential for a BTC Short Squeeze

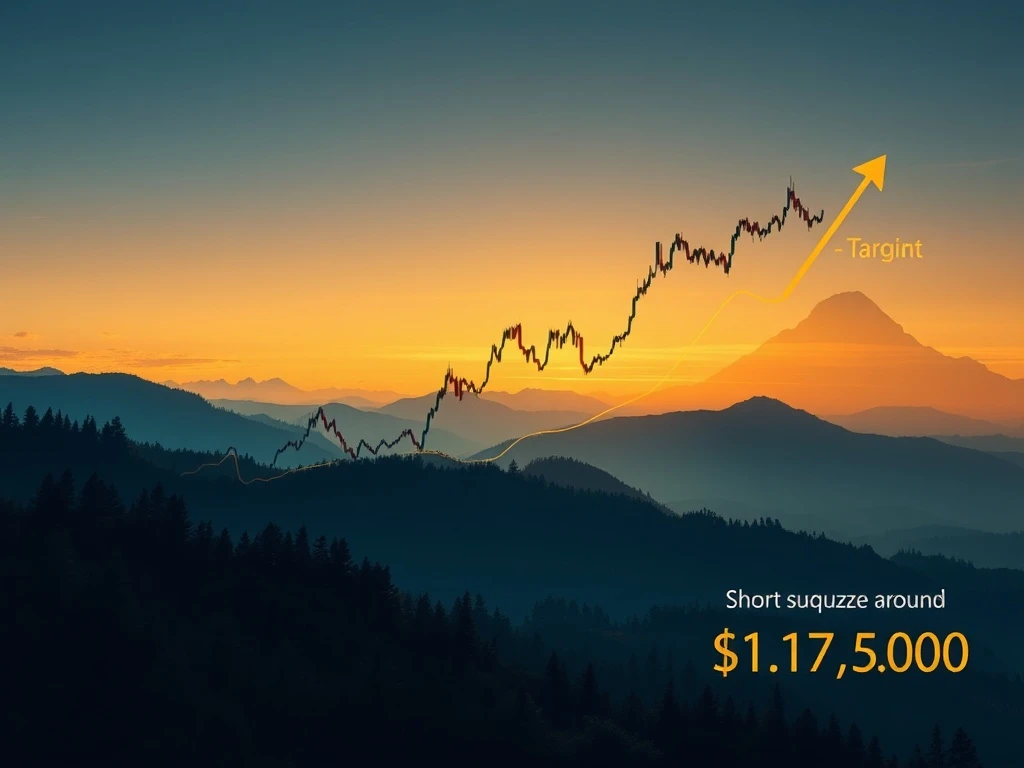

A negative funding rate often leads to an overcrowded short trade. When the price starts moving up against these positions, it can trigger a short squeeze. This happens when short sellers are forced to buy the asset to cover their positions, driving the price up further.

Data reveals a significant cluster of potential short liquidations near the $111,320 level for the BTC/USDT pair. CoinGlass data indicates approximately $520 million in leveraged short positions are at risk around this price point. Tapping into this liquidity could initiate a powerful BTC short squeeze, accelerating upward price momentum.

Analyzing the BTC Price Target

Beyond funding rates, technical analysis also supports a bullish outlook. Bitcoin has reportedly broken out above the upper trendline of a bull flag pattern on the daily chart. This pattern is generally considered bullish, suggesting continuation of the prior trend.

The measured move derived from this bull flag pattern points to a potential BTC price target near $117,500. This technical target aligns closely with forecasts from market analysts, such as 10x Research’s head, Markus Thielen, who predicted $116,000 by the end of July.

Summary: Signals Pointing to a Bitcoin Rally

Multiple indicators suggest favorable conditions for the next phase of the Bitcoin rally. The historical correlation between negative BTC funding rates and subsequent price surges, combined with the significant short liquidation risk near $111,320, creates a compelling case for upward movement. Furthermore, the technical breakout from a bull flag pattern provides a clear BTC price target around $117,500. While markets involve risk, these factors highlight potential catalysts for Bitcoin’s next leg higher.