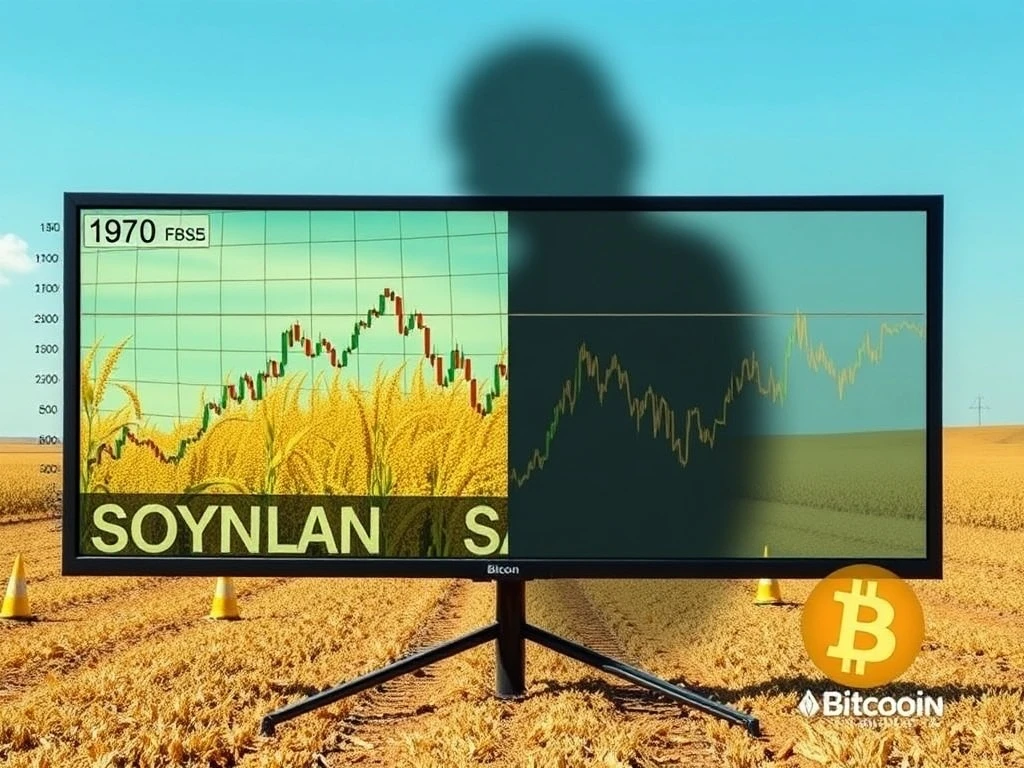

Bitcoin Price: Peter Brandt Issues Urgent Warning as Chart Echoes 1970s Soybean Bubble

Is the Bitcoin price headed for a dramatic fall? Veteran trader Peter Brandt recently issued a stark warning. He suggests the current Bitcoin price chart mirrors the infamous 1970s soybean bubble. This comparison has sparked significant debate among crypto analysts. Brandt’s perspective challenges the prevailing bullish sentiment. Many investors wonder if a significant correction is imminent. Understanding these conflicting viewpoints is crucial for navigating the volatile crypto landscape.

Peter Brandt Bitcoin Analysis: Echoes of the 1970s Soybean Bubble

Veteran trader Peter Brandt, known for his accurate market calls, has sounded an alarm. He observes a “broadening top” pattern forming on Bitcoin’s charts. This specific pattern, he explains, often signals major market tops. Brandt told Crypto News Insights, “Bitcoin is forming a rare broadening top on the charts. This pattern is famous for tops.” He cites a historical parallel: “In the 1970s, Soybeans formed such a top, then declined 50% in value.” Therefore, Brandt warns that a similar fate could await Bitcoin. This could mean a substantial 50% drop from its current levels. The 1970s were indeed a period of extreme commodity market volatility.

Furthermore, Brandt cautions about broader market implications. If history repeats, he states, it would significantly impact Michael Saylor’s company, MicroStrategy. MicroStrategy (MSTR) holds substantial Bitcoin reserves. A sharp decline in the Bitcoin price would leave these corporate treasuries “underwater.” MicroStrategy’s stock price has already seen a 10.13% drop over the past 30 days. This reflects mounting pressure on corporate Bitcoin holdings. Brandt suggests the anticipated “final thrust” for Bitcoin might never materialize. Instead, Bitcoin could potentially head towards bear market levels, possibly as low as $60,000. This is a sobering Bitcoin price prediction for many in the community.

Contrasting Views: Optimistic Bitcoin Price Prediction

Despite Brandt’s bearish outlook, many other analysts hold a far more optimistic Bitcoin price prediction. They firmly believe Bitcoin still has one major rally left in this current cycle. This potential surge could propel Bitcoin’s price significantly higher. For instance, BitMEX co-founder Arthur Hayes suggests Bitcoin could reach as high as $250,000. This represents a substantial upside from current levels. These bullish forecasts often lean on historical market trends. They also consider current macroeconomic factors.

Moreover, historical data supports a positive outlook for the final quarter of the year. The fourth quarter is traditionally Bitcoin’s strongest performing period. According to CoinGlass, Bitcoin averages a remarkable 78.49% return during Q4. October also consistently appears as a strong month for Bitcoin. This seasonal strength often fuels investor confidence. Such historical performance provides a counter-narrative to Brandt’s warnings. It suggests that a significant upward movement remains plausible for the Bitcoin price. This positive seasonality is a key component of many bullish arguments.

Navigating Current Crypto Market Sentiment and External Pressures

However, recent global events have introduced caution into the market. The overall crypto market sentiment has shifted downwards. This follows US President Donald Trump’s recent tariff scare. Such news triggered a broader market downturn. It occurred after a period of record highs. Consequently, analysts have adopted a more cautious stance. This sentiment is clearly reflected in key market indicators. The Crypto Fear & Greed Index, for example, registered an “Extreme Fear” score of 25. This reading came in its recent Wednesday update. This score indicates significant investor apprehension. It marks a notable shift during what is typically a bullish month for crypto.

Market analysts are closely watching Bitcoin’s immediate price action. Trading account AlphaBTC commented on X, saying Bitcoin “really needs to hold here, keeping the recent higher lows in tack and have another attempt at the monthly open where it was rejected yesterday.” This highlights critical support levels. Yet, not all experts share this level of bearishness. David Hernandez, a crypto investment specialist at 21Shares, sees a potential “opportunity window.” He suggests this window could open quickly for upward price movement. This would occur if the US Consumer Price Index (CPI) shows any signs of relief. He also mentions the “continuation of the immaculate disinflation narrative.” Hernandez optimistically states, “Bitcoin is coiled and ready to spring upward.” This suggests underlying strength despite current fear.

Comprehensive Bitcoin Market Analysis: Weighing Risks and Opportunities

Adding another layer to the complex Bitcoin market analysis, MN Trading Capital founder Michael van de Poppe offers a different perspective. He points to gold’s recent 5.5% drop from its highs. Van de Poppe suggests this could signal “the rotation” into Bitcoin and altcoins. This indicates a potential shift in investor capital. Such a rotation would naturally benefit the crypto market. Therefore, investors face a fascinating divergence of expert opinions. On one hand, Peter Brandt’s historical comparison offers a stark warning. It presents a cautious Bitcoin price prediction. On the other hand, several prominent analysts foresee substantial upside. They point to historical patterns and potential economic shifts.

Ultimately, the current landscape demands careful consideration. The market presents both significant risks and compelling opportunities. Investors must weigh the potential for a historical repeat against strong bullish indicators. Understanding these diverse perspectives is vital. It allows for informed decision-making in a rapidly evolving market. The ongoing debate underscores the dynamic nature of Bitcoin price movements. It also highlights the varied approaches to forecasting its future trajectory. Staying informed about both technical analysis and broader economic trends remains paramount for any crypto participant.