Bitcoin Price Prediction: Navigating the Crucial Tug-of-War at $115K and $122K

The cryptocurrency market is buzzing, and all eyes are on the Bitcoin price. Right now, Bitcoin is caught in a fascinating technical tug-of-war, presenting both opportunities and risks for traders and investors. Conflicting signals from short-term bullish patterns and longer-term bearish formations are creating a pivotal moment for the world’s leading cryptocurrency. Will buyers push for new highs, or are sellers preparing for a significant correction? Let’s dive into the intricate details of this battle.

Decoding the Technical Analysis Tug-of-War

At the heart of Bitcoin’s current dilemma are two distinct patterns identified through technical analysis: a bullish 4-hour (4H) pennant and a bearish daily rising wedge. These patterns tell different stories, reflecting short-term optimism clashing with longer-term caution. Understanding both is crucial for anyone trying to anticipate Bitcoin’s next move.

Crypto analyst Captain Faibik has highlighted the daily chart’s rising wedge. This is typically a bearish reversal pattern, characterized by price consolidating within a tightening range, but with both support and resistance lines sloping upwards. For Bitcoin, this pattern has formed between the critical levels of $115,000 and $125,000 over the past 30 days. The risk with a rising wedge is a breakdown below its lower boundary, which could trigger a significant price drop. If this bearish scenario plays out, targets of $95,000–$98,000 are on the table, indicating a substantial correction.

Conversely, the 4H chart paints a more optimistic picture, showcasing a bullish pennant. This is a continuation pattern that typically forms after a strong price rally, indicating a pause before the uptrend resumes. Bitcoin’s recent rally from $110,000 to $120,000 has set the stage for this pattern. A confirmed breakout above the pennant’s resistance, particularly past $122,000, could propel Bitcoin towards a projected target of $130,000, reigniting bullish momentum.

The Bearish Wedge: A Warning Signal for Bitcoin?

The daily rising wedge carries significant bearish implications that cannot be overlooked. One of the key concerns is the waning bullish volume supporting the recent price action. Typically, a healthy uptrend is accompanied by strong buying volume. The current decline in volume suggests that the buying pressure is fading, making the price susceptible to a reversal. Furthermore, a bearish PO3 (Price Over Price Over Price) setup has been noted, which often precedes a liquidity sweep designed to trap late buyers at current high levels. This means that if Bitcoin fails to sustain its current levels, a sharp drop could liquidate those who entered positions near the peak.

The upper boundary of this daily wedge has been tested repeatedly without a decisive breakout. Each failed attempt to push past resistance weakens the pattern and raises concerns about its structural integrity. Traders are keenly watching the $115,000 level. A sustained break below this point would confirm the bearish breakdown, signaling potential extended losses for the Bitcoin price.

The Bullish Pennant: A Glimmer of Hope for Bitcoin’s Price?

While the daily chart warns of caution, the 4H bullish pennant offers a compelling counter-narrative. This pattern suggests that despite the recent consolidation, buyers are still in control and preparing for the next leg up. The converging trendlines of the pennant indicate tightening consolidation, with Bitcoin coiling for a potential explosive move. As of writing, Bitcoin is trading near $117,739, right within this consolidation phase.

However, even within this bullish setup, analysts advise caution. Volume declines are also noted on the 4H chart, suggesting a momentum divergence despite the bullish pattern. This means that while the shape of the chart looks promising, the underlying strength (volume) isn’t fully confirming it. For the bullish pennant to truly validate its continuation thesis, a decisive increase in buying volume will be necessary to push Bitcoin beyond the $122,000 resistance.

Key Levels and Potential Bitcoin Price Scenarios

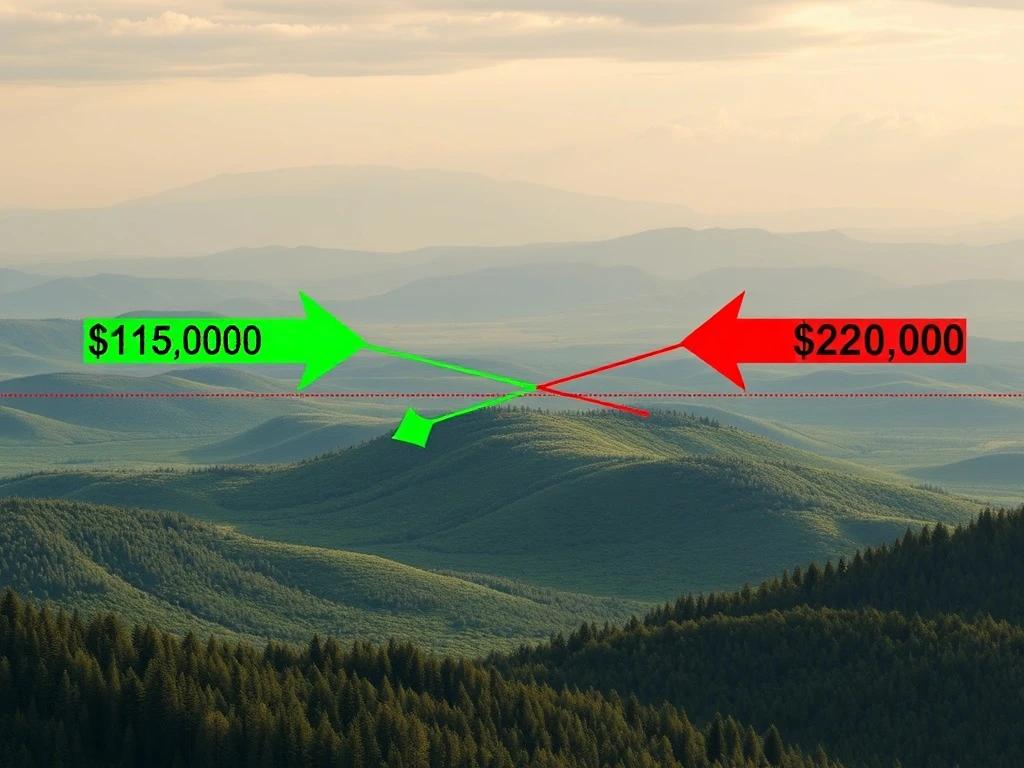

The current market hinges on two critical price levels: $115,000 and $122,000. These levels represent the battlegrounds where bulls and bears are making their stand. Let’s break down the potential scenarios:

- Breakout Above $122,000: A confirmed breakout above this level would validate the 4H pennant’s continuation thesis. This would signal strong buying momentum, potentially reigniting the uptrend and setting sights on $130,000 and beyond. This scenario would likely invalidate the immediate bearish implications of the daily wedge, at least for the short term.

- Breakdown Below $115,000: Conversely, a breakdown below $115,000 would confirm the bearish daily wedge. This would indicate that sellers have gained control, potentially extending losses towards $100,000, and even as low as $95,000-$98,000 as per Captain Faibik’s analysis. Such a move would liquidate many long positions and shift market sentiment to extreme caution.

Traders are advised to pay close attention to volume patterns and EMA (Exponential Moving Average) crossovers. These metrics often provide early signals of trend sustainability. A strong surge in volume accompanying a breakout or breakdown adds credibility to the move, while weak volume might indicate a false signal.

Beyond the Charts: What Do Indicators and On-Chain Data Say?

While chart patterns provide a visual roadmap, technical analysis also relies on various indicators to provide additional insights. Here’s what some of them are telling us about the Bitcoin price:

- RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence): These momentum oscillators are showing diverging signals. The RSI is trending lower despite relatively stable price action, hinting at fading buying pressure. This divergence often precedes a price correction. The MACD, on the other hand, might be showing signs of consolidation, awaiting a decisive move.

- EMAs and Bollinger Bands: The 20-period Exponential Moving Average (EMA) and Bollinger Bands generally support the bullish pennant case. Bitcoin remains above critical EMAs, and the narrowing volatility range indicated by the Bollinger Bands suggests a big move is imminent. If Bitcoin holds above these key moving averages, the bullish outlook remains intact.

- Parabolic SAR: The flattening dots of the Parabolic SAR indicator signal a pause in upward momentum. While not an outright reversal, it suggests that the strong bullish trend has temporarily lost steam, aligning with the current consolidation phase.

- On-Balance Volume (OBV): On-chain metrics like On-Balance Volume (OBV) remain elevated at $5.2 billion, reflecting sustained accumulation. This suggests that despite the short-term uncertainties, larger players might still be accumulating Bitcoin. However, this could quickly shift if the daily bearish wedge breaks to the downside, potentially leading to significant selling pressure.

Navigating the Volatility: Actionable Insights for Traders

Given the conflicting signals, how should traders and investors approach the current Bitcoin market? Here are some actionable insights:

- Patience is Key: Avoid making impulsive decisions. Wait for a clear confirmation of either a breakout or a breakdown from the key levels of $115,000 or $122,000.

- Monitor Volume: A decisive move accompanied by strong volume is more reliable. Look for a significant increase in buying volume on a breakout above $122,000, or a surge in selling volume on a breakdown below $115,000.

- Set Stop-Loss Orders: To manage risk, always use stop-loss orders. If you are taking a long position based on the bullish pennant, set a stop-loss below the pennant’s support or below $115,000. If you are bearish, consider stop-losses above $122,000.

- Consider Both Scenarios: Have a trading plan for both bullish and bearish outcomes. Don’t get emotionally attached to one direction. The market will do what it wants, regardless of your bias.

- Diversify and Manage Risk: While Bitcoin dominates the news, remember to diversify your portfolio and only risk capital you can afford to lose. The current volatility highlights the inherent risks in crypto markets.

Captain Faibik emphasized the uncertainty but noted that the 4H pattern offers a clear bullish roadmap, provided buyers hold the wedge’s lower boundary. This means the immediate support around $115,000 is paramount for the bullish case to remain viable.

The Broader Landscape: Macro Factors Influencing Bitcoin

Beyond the charts, external factors also play a significant role in influencing the Bitcoin price. Market sentiment remains fragmented, with short-term traders eyeing rapid gains from the 4H pennant, while longer-term investors remain wary of macro risks. These include:

- Regulatory Scrutiny: Increased regulatory attention globally can introduce uncertainty and affect investor confidence.

- Broader Market Corrections: A downturn in traditional financial markets (e.g., stock market corrections) can often spill over into cryptocurrencies.

- Federal Reserve Rate Hikes: Aggressive interest rate hikes by central banks can reduce liquidity in the market, making riskier assets like cryptocurrencies less attractive.

- Geopolitical Tensions: Global political instability can drive investors towards or away from perceived safe havens, including Bitcoin.

The recent delay in Bitcoin ETF approvals has also exacerbated volatility, affecting not just Bitcoin but also altcoins like XRP, which are facing similar consolidation patterns. Bitcoin’s dominance metric remains steady at 45%, suggesting institutional demand persists despite near-term uncertainties, which is a positive sign for long-term holders.

Liquidity levels around $120,000 will be crucial in determining whether the bullish pennant can sustain its momentum or if it collapses under bearish pressure. Analysts caution that while the 4H pattern offers a compelling bullish case, the daily wedge’s bearish implications cannot be ignored, particularly if Bitcoin fails to reclaim $125,000.

In conclusion, Bitcoin stands at a critical juncture. The battle between the short-term bullish pennant and the longer-term bearish wedge creates a fascinating dynamic, offering both significant upside potential and considerable downside risk. Traders and investors must remain vigilant, closely monitoring the key levels of $115,000 and $122,000, along with volume and indicator confirmations. Until a decisive move is made, Bitcoin’s price is likely to remain range-bound, presenting opportunities for nimble traders but also demanding careful risk management for all participants. The next few days will be telling for the future direction of the Bitcoin price.

Frequently Asked Questions (FAQs)

Q1: What is a 4H Pennant in Bitcoin analysis?

A 4H (4-hour) pennant is a bullish continuation pattern seen on a four-hour price chart. It forms after a strong price move, followed by a period of consolidation where price forms a small, symmetrical triangle (the pennant). It typically signals that the previous trend will resume after the consolidation, suggesting a potential upward move for Bitcoin.

Q2: What does a Bearish Daily Wedge signify for Bitcoin’s price?

A bearish daily wedge is a reversal pattern observed on the daily chart. It’s characterized by price moving upwards within converging trendlines, but with declining volume and momentum. It often signals that the uptrend is losing strength and a significant downward correction is likely once the price breaks below the lower trendline of the wedge.

Q3: Why are the $115,000 and $122,000 levels so important for Bitcoin?

$115,000 is a critical support level representing the lower boundary of the daily bearish wedge. A breakdown below this level would confirm the bearish pattern. $122,000 is a key resistance level for the 4H bullish pennant. A breakout above this level would confirm the bullish continuation pattern, potentially leading to higher prices.

Q4: How do technical indicators like RSI and MACD help in Bitcoin analysis?

RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) are momentum indicators. RSI measures the speed and change of price movements, indicating overbought or oversold conditions. MACD shows the relationship between two moving averages of a security’s price, identifying trend changes and momentum. Divergences between these indicators and price can signal potential reversals, adding depth to Bitcoin analysis.

Q5: What are the key risks influencing Bitcoin’s price beyond technical patterns?

Beyond technical patterns, key risks include broader market corrections, regulatory scrutiny (like delays in Bitcoin ETF approvals), Federal Reserve interest rate hikes, and geopolitical tensions. These macro factors can significantly influence investor sentiment and liquidity in the crypto market, amplifying Bitcoin’s price volatility.