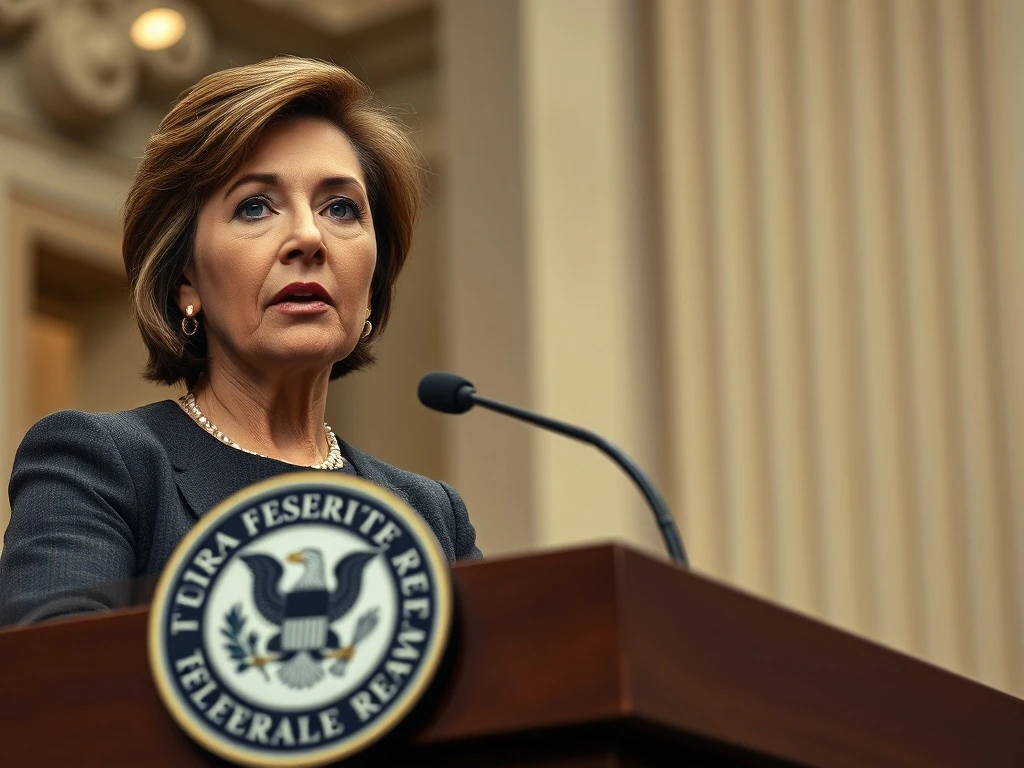

Federal Reserve Independence: Governor Lisa Cook’s Crucial Vow to Protect Central Bank Autonomy

WASHINGTON, D.C. — Federal Reserve Governor Lisa Cook delivered a significant commitment this week, pledging to vigorously defend the central bank’s independence throughout her tenure, a declaration that comes amid mounting political scrutiny of monetary policy decisions affecting inflation, employment, and financial stability in 2025.

Federal Reserve Independence Faces Contemporary Challenges

Governor Cook’s statement arrives during a particularly sensitive period for central banking institutions globally. Consequently, political pressures on monetary authorities have intensified recently. Many economists argue that central bank autonomy remains crucial for maintaining price stability. Historically, the Federal Reserve has operated with considerable independence since its 1913 establishment. However, recent legislative proposals and executive branch comments have questioned this traditional arrangement.

Specifically, the Federal Reserve’s dual mandate requires balancing maximum employment with stable prices. Therefore, political interference could compromise these objectives. For instance, short-term political cycles often conflict with long-term economic stability needs. Moreover, global financial markets closely monitor central bank independence signals. As a result, Governor Cook’s pledge carries substantial weight beyond domestic policy circles.

Historical Context of Central Bank Autonomy

The debate surrounding Federal Reserve independence isn’t new. In fact, it has surfaced periodically throughout U.S. economic history. President Franklin Roosevelt challenged Fed autonomy during the 1930s. Similarly, President Richard Nixon pressured Chairman Arthur Burns in the 1970s. More recently, the 2008 financial crisis and 2020 pandemic response tested institutional boundaries.

Currently, several factors make this defense particularly timely:

- Elevated inflation concerns persist despite recent moderation

- Political election cycles increase pressure on interest rate decisions

- Digital currency developments raise new governance questions

- Global coordination needs require consistent policy frameworks

Furthermore, research consistently shows that independent central banks achieve better inflation outcomes. A 2023 International Monetary Fund study confirmed this correlation across 50 countries. Specifically, nations with autonomous central banks averaged 2.1% inflation versus 4.7% in less independent systems.

Governor Cook’s Professional Background and Perspective

Lisa Cook brings unique qualifications to this defense. Previously, she served as a Michigan State University economics professor. Additionally, she worked on the White House Council of Economic Advisers. Her academic research focused on economic growth and innovation. Consequently, she understands both theoretical and practical policy dimensions.

Governor Cook assumed her Federal Reserve Board position in May 2022. Since then, she has participated in numerous critical policy decisions. These include the aggressive interest rate hikes to combat post-pandemic inflation. Also, she helped navigate regional banking sector stresses in 2023. Therefore, her institutional experience informs her independence commitment.

Monetary Policy Implications for 2025

Governor Cook’s pledge directly impacts upcoming monetary policy decisions. The Federal Open Market Committee faces several complex challenges this year. First, balancing inflation control with economic growth remains delicate. Second, managing quantitative tightening without disrupting markets requires careful execution. Third, communicating policy shifts clearly demands consistent messaging.

Several key policy areas will test Federal Reserve independence:

| Policy Area | Independence Challenge | Potential Impact |

|---|---|---|

| Interest Rate Decisions | Political pressure to cut rates before elections | Could reignite inflation if premature |

| Bank Regulation | Industry lobbying for lighter oversight | Might increase systemic risk |

| Digital Dollar Development | Congressional demands for specific features | Could compromise technical design |

| Climate Risk Analysis | Political opposition to certain assessments | Might limit financial stability tools |

Market participants generally welcome strong central bank independence. For example, bond yields typically stabilize when autonomy appears secure. Conversely, uncertainty about political influence often increases volatility. Recent Treasury market movements demonstrate this relationship clearly.

Comparative International Perspectives

The Federal Reserve isn’t alone in facing independence challenges. Actually, central banks worldwide confront similar pressures. The European Central Bank maintains strict independence protocols. However, member state governments occasionally test these boundaries. Similarly, the Bank of England regained operational independence in 1997. Yet political commentary still influences perception.

Emerging market central banks face even greater challenges. Often, their legal frameworks provide weaker protection. Consequently, inflation outcomes tend to be less stable. Governor Cook’s defense therefore resonates internationally. Many foreign central bankers monitor U.S. developments closely. Their independence often strengthens when major institutions like the Fed resist pressure.

Legal and Institutional Safeguards

The Federal Reserve’s independence derives from several structural features. Board members serve 14-year terms to insulate them from political cycles. Additionally, the Federal Reserve self-funds through portfolio earnings. This financial independence prevents congressional appropriation pressures. Also, the Federal Open Market Committee operates without executive branch approval.

However, these safeguards aren’t absolute. Congress created the Federal Reserve and could modify its structure. The President appoints Board members with Senate confirmation. Furthermore, the Government Accountability Office audits certain Fed functions. Therefore, independence exists within a system of democratic accountability.

Economic Theory and Practical Realities

Economic theory strongly supports central bank independence. The time inconsistency problem explains why politicians might prefer inflationary policies. Elected officials often prioritize short-term employment gains. Conversely, independent central bankers can focus on long-term price stability. This alignment produces better economic outcomes overall.

Practical experience confirms theoretical predictions. During the 1970s, political influence contributed to stagflation. Afterwards, increased Federal Reserve autonomy helped tame inflation. Similarly, the Volcker disinflation succeeded despite political opposition. More recently, the Fed’s pandemic response demonstrated effective independent action.

Nevertheless, independence doesn’t mean unaccountability. The Federal Reserve regularly testifies before Congress. It publishes detailed minutes and economic projections. Also, it maintains extensive public communication channels. This transparency balances autonomy with democratic oversight appropriately.

Conclusion

Federal Reserve Governor Lisa Cook’s pledge to defend central bank independence represents a significant commitment to institutional integrity. Her statement reinforces the importance of autonomous monetary policy for economic stability. As political pressures intensify during election years, such defenses become increasingly crucial. The Federal Reserve’s ability to maintain price stability and support maximum employment depends substantially on its operational independence. Therefore, Governor Cook’s vow carries implications far beyond her personal tenure, potentially influencing economic outcomes for years to come.

FAQs

Q1: What does Federal Reserve independence actually mean?

Federal Reserve independence means the central bank makes monetary policy decisions without direct political interference. However, it operates within a framework established by Congress and maintains accountability through regular reporting and testimony.

Q2: Why is central bank independence important for the economy?

Research shows independent central banks achieve lower, more stable inflation rates. They can make politically difficult but economically necessary decisions, like raising interest rates to combat inflation, without short-term electoral pressures.

Q3: How long has the Federal Reserve been independent?

The Federal Reserve has maintained varying degrees of independence since its 1913 creation. Its modern independence framework developed gradually, with significant strengthening occurring after the high inflation periods of the 1970s.

Q4: Can Congress or the President override Federal Reserve decisions?

While Congress could legislate changes to the Federal Reserve’s structure or mandate, they cannot directly override specific monetary policy decisions. The President appoints Board members but cannot remove them for policy disagreements.

Q5: How does Federal Reserve independence affect ordinary Americans?

Central bank independence helps maintain stable prices, which preserves purchasing power. It also supports sustainable economic growth and employment over the long term, contributing to overall financial stability and confidence.