Bitcoin Whales Defy Uncertainty with Massive $3.2 Billion Accumulation as Retail Sells

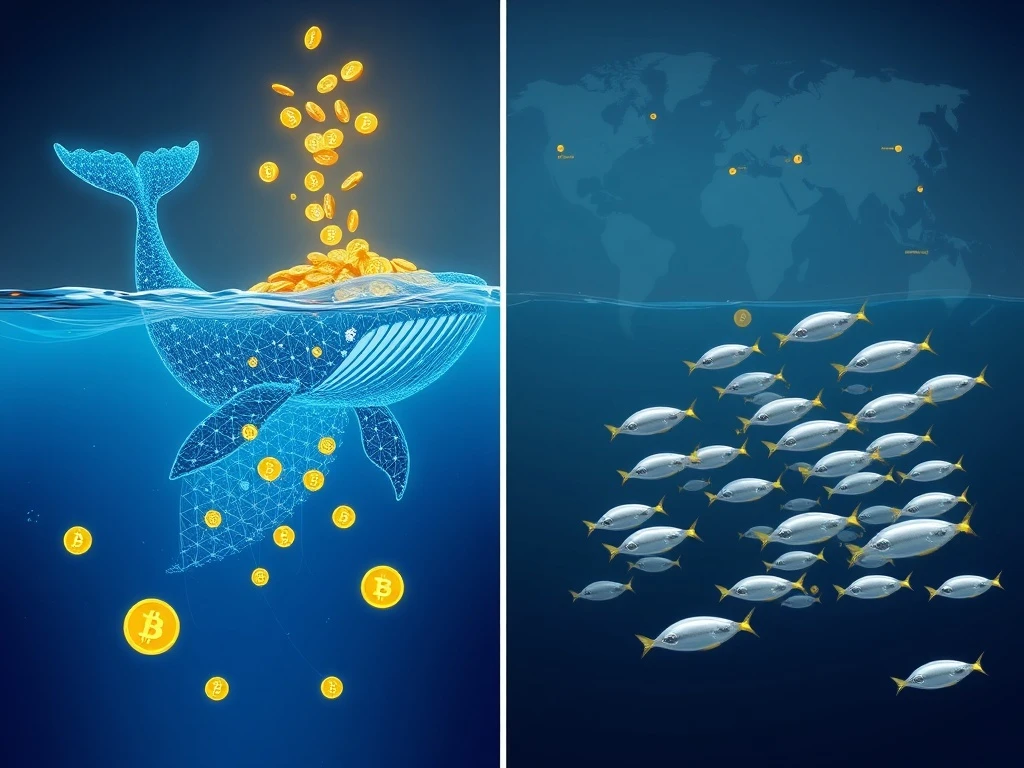

In a striking display of market divergence, Bitcoin’s largest holders executed a multi-billion dollar accumulation spree throughout mid-January 2025, directly countering selling pressure from smaller investors and presenting a complex picture for the flagship cryptocurrency’s future trajectory. This significant movement of capital, tracked by leading on-chain analytics firms, highlights a deepening divide in market participant sentiment during a period marked by notable geopolitical and economic crosscurrents. Consequently, analysts are scrutinizing this whale activity for clues about a potential trend reversal, even as broader market sentiment remains cautiously conservative.

Bitcoin Whales Execute a $3.2 Billion Accumulation Strategy

According to a detailed report from Crypto News Insights citing blockchain intelligence platform Santiment, entities classified as ‘whales’ demonstrated aggressive buying behavior between January 10 and January 19, 2025. Specifically, wallets holding between 10 and 10,000 BTC collectively purchased approximately 36,000 Bitcoin. At prevailing prices during that period, this acquisition represented a staggering capital inflow of roughly $3.2 billion. This cohort of investors, often comprising institutions, hedge funds, and ultra-high-net-worth individuals, controls a substantial portion of Bitcoin’s circulating supply. Their coordinated accumulation during a nine-day window signals a strong, deliberate conviction in the asset’s long-term value proposition, regardless of short-term price fluctuations or negative headlines.

Meanwhile, data from the same period reveals a contrasting narrative for retail participants. Wallets containing approximately 0.01 BTC or less, typically representative of individual, non-professional investors, were net sellers. This group offloaded an estimated 132 BTC during the identical timeframe. While the dollar value of this retail selling pales in comparison to whale buying, the behavioral pattern is critically important. It exemplifies a classic market dynamic where fear or impatience among smaller investors creates selling pressure, which larger, more strategic entities often absorb. This absorption can establish a stronger foundation for future price appreciation by consolidating supply into fewer, more resolute hands.

The Mechanics of Whale Watching and Market Sentiment

Analysts rely on on-chain data to track these movements. Every Bitcoin transaction is recorded on the public blockchain, allowing firms like Santiment, Glassnode, and CryptoQuant to cluster wallet addresses and analyze flow patterns. The ‘whale’ category is not monolithic; it is often subdivided. For instance, ‘sharks’ (100-1,000 BTC) and ‘humpbacks’ (1,000-10,000 BTC) may exhibit different behaviors. The recent buying was broad-based across this large-holder spectrum, suggesting a consensus among sophisticated capital. Santiment’s metrics, including the Supply Distribution chart and Exchange Netflow, clearly showed coins moving from known exchange wallets (often used for selling) into deep cold storage wallets (used for long-term holding). This movement from ‘weak hands’ to ‘strong hands’ is a fundamental bullish indicator tracked by seasoned crypto investors.

Decoding the Bullish Signal Amidst Conservative Sentiment

Santiment’s analysis explicitly framed this divergence as a long-term bullish signal that could foreshadow a trend reversal. Historically, periods where whales accumulate during retail sell-offs have often preceded significant market rallies. The logic is straightforward: when the most informed and capital-rich investors buy aggressively into fear or uncertainty, they are betting on a fundamental mispricing. Their actions provide a form of price support and reduce liquid supply, setting the stage for upward momentum once broader sentiment shifts. However, the report crucially noted that the overall market backdrop remains fraught with caution.

This conservative sentiment stems primarily from real-world geopolitical risks. Notably, remarks on tariffs and trade policy by former and current U.S. President Donald Trump have injected volatility into traditional financial markets. Cryptocurrency markets, while decentralized, are not immune to these macro shocks. Investors often treat assets like Bitcoin as risk-on investments, which can be sold during periods of global uncertainty to raise cash or cover losses elsewhere. This creates a tension: powerful on-chain metrics point to underlying strength, while macro headlines foster surface-level fear. Navigating this dichotomy requires separating signal from noise.

| Investor Cohort | BTC Range | Net Activity (Jan 10-19) | Approx. USD Value | Implied Sentiment |

|---|---|---|---|---|

| Whales | 10 – 10,000 BTC | +36,000 BTC | +$3.2 Billion | Strongly Accumulative |

| Retail | ≤ 0.01 BTC | -132 BTC | ~ -$11.8 Million | Net Distributive |

Historical Precedents and Market Psychology

This pattern is not without precedent. Similar whale accumulation phases were observed in late 2018 and early 2019 following a brutal bear market, and again in mid-2020 before Bitcoin’s historic run to all-time highs. The psychology at play involves differing time horizons and risk tolerance. Retail investors, often influenced by short-term price charts and media sentiment, are more prone to reactive selling during downturns or periods of stagnation. Institutional whales, conversely, operate with multi-year investment theses, deeper reserves, and a focus on asset allocation. They view volatility as an opportunity to build position size at favorable prices. The current data suggests whales are once again employing this strategy, viewing any price weakness induced by geopolitical news as a buying opportunity rather than an existential threat.

Broader Market Impacts and Future Trajectory

The $3.2 billion inflow from a single participant group has immediate and longer-term implications for the Bitcoin network and market structure. Firstly, it significantly reduces the liquid supply available on exchanges. A shrinking exchange reserve is a positive metric, indicating fewer coins are readily available for sale, which can reduce selling pressure. Secondly, such large-scale accumulation increases network security by further distributing holdings; it becomes more difficult for any single bad actor to manipulate the market. Finally, this activity often serves as a leading indicator for other institutional players and high-net-worth individuals, potentially triggering a wave of follow-on investment.

Key factors that experts will monitor in the coming weeks include:

- Continuation of Flow: Whether the whale accumulation trend sustains or pauses.

- Exchange Withdrawals: If the rate of BTC leaving major trading platforms remains elevated.

- Macro Developments: How evolving geopolitical and monetary policy narratives impact risk assets.

- Retail Sentiment Shift: If and when the fear among smaller investors subsides, potentially turning them into buyers.

The interplay between these factors will determine if the bullish signal identified by on-chain analysts translates into a sustained price recovery. The market now sits at an inflection point, balancing strong fundamental accumulation against a backdrop of cautious macro sentiment.

Conclusion

The January 2025 data presents a compelling narrative: Bitcoin whales are engaging in one of the most significant accumulation phases in recent history, deploying $3.2 billion to purchase BTC directly from selling retail investors. This classic divergence between ‘smart money’ and ‘the crowd’ has historically been a reliable long-term bullish indicator, suggesting a potential trend reversal is forming beneath the surface of conservative market sentiment. While geopolitical headlines continue to inject short-term uncertainty, the strategic buying by the largest holders underscores a profound confidence in Bitcoin’s fundamental value proposition. As the market digests this activity, the consolidation of supply into stronger hands may well be laying the groundwork for the next major chapter in Bitcoin’s evolution.

FAQs

Q1: What is a Bitcoin whale?

A Bitcoin whale is a term for an individual or entity that holds a very large amount of Bitcoin, typically defined as wallets containing between 1,000 to 10,000 BTC or more. Their transactions can significantly influence the market due to the size of their holdings.

Q2: Why is whale accumulation considered a bullish signal?

When whales accumulate, they are absorbing selling pressure and reducing the available supply of Bitcoin on exchanges. This indicates strong, long-term conviction from deep-pocketed investors and often precedes price rallies, as it shifts coins from short-term sellers to long-term holders.

Q3: How do analysts track whale activity?

Analysts use on-chain data from the public Bitcoin blockchain. Firms like Santiment cluster wallet addresses and monitor flows to and from exchanges, large wallets, and accumulation addresses to identify trends among different holder groups.

Q4: Did retail investors cause a price drop by selling 132 BTC?

No, the sale of 132 BTC by small retail wallets is minuscule compared to daily trading volume and whale buying. The importance is the behavioral pattern, not the dollar amount. It shows a sentiment divide where retail acts nervously while whales act confidently.

Q5: Can geopolitical events negate the bullish whale signal?

In the short term, yes. Severe macro shocks can cause market-wide sell-offs that impact all assets, including Bitcoin. However, long-term investors view such events as potential buying opportunities. The whale accumulation suggests they believe Bitcoin’s long-term trajectory will ultimately overcome short-term geopolitical volatility.