Crypto Fear & Greed Index Plummets: Market Plunges into ‘Extreme Fear’ Zone at 24

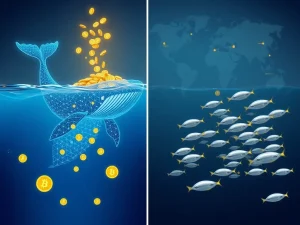

Global cryptocurrency markets entered a state of pronounced anxiety this week as the widely watched Crypto Fear & Greed Index plummeted eight points to a reading of 24, officially crossing into the “Extreme Fear” territory. This significant shift, recorded by data provider Alternative.me, provides a quantitative measure of the palpable nervousness currently gripping digital asset investors worldwide. The index’s sharp decline offers a crucial snapshot of collective market psychology, often serving as a contrarian indicator during periods of high volatility.

Decoding the Crypto Fear & Greed Index Plunge

The Crypto Fear & Greed Index functions as a daily sentiment thermometer for the cryptocurrency space. It operates on a scale from 0 to 100, where 0 represents “Extreme Fear” and 100 signifies “Extreme Greed.” A drop from 32 to 24 represents a substantial single-day deterioration in sentiment. The index does not rely on a single data point; instead, it synthesizes information from six key market dimensions to generate its composite score. This methodology aims to capture the emotional pulse of the market beyond simple price action.

Historically, readings in the “Extreme Fear” zone have sometimes preceded market bottoms, as capitulation sells off assets. Conversely, they can also indicate a period of sustained negative pressure. The current reading of 24 sits deep within the fear spectrum, suggesting a market dominated by risk-off behavior and negative outlooks. This environment often sees reduced speculative activity and increased focus on capital preservation among traders.

The Mechanics Behind the Market Sentiment Gauge

Understanding the index’s calculation is essential for interpreting its message. The score derives from a weighted blend of the following factors:

- Volatility (25%): This component measures the magnitude of recent price swings, particularly for Bitcoin. Increased volatility, especially to the downside, directly contributes to higher fear readings.

- Market Momentum/Volume (25%): Trading volume and recent price momentum are analyzed. Sustained high volume during price declines typically amplifies the fear signal.

- Social Media (15%): The index scans platforms like Twitter and Reddit for the volume and sentiment of cryptocurrency mentions. A surge in negative or fearful commentary pushes the score lower.

- Surveys (15%): Periodic market sentiment surveys provide a direct pulse check from the community of traders and investors.

- Dominance (10%): Bitcoin’s share of the total cryptocurrency market cap is considered. Rising dominance can sometimes indicate a “flight to safety” within crypto, away from altcoins.

- Trends (10%): Analysis of Google Trends data for search queries related to Bitcoin and cryptocurrency reveals public interest levels, which often spike during fear or greed extremes.

This multi-faceted approach helps mitigate the bias of any single metric, creating a more robust indicator of the market’s emotional state. The sharp drop to 24 suggests negative signals converged across most, if not all, of these data streams.

Contextualizing the Extreme Fear Reading

The descent into “Extreme Fear” did not occur in a vacuum. It coincides with a period of macroeconomic uncertainty, including persistent concerns about interest rate policies and traditional market correlations. Furthermore, the cryptocurrency market has recently experienced several notable events that contribute to risk aversion. These include regulatory announcements from major economies, volatility in related tech and growth stocks, and the typical post-halving cycle adjustments for Bitcoin.

Market analysts often compare current readings to historical precedents. For instance, during the market troughs following major bull runs, the index has frequently touched single-digit or low-teens fear levels. The current reading of 24, while severe, may not yet represent maximum historical pessimism. However, it clearly indicates a market where negative sentiment is the dominant force, influencing trading decisions and capital flows.

Potential Implications for Investors and the Market

For investors, the Extreme Fear reading serves as a critical data point for risk assessment. It signals a high-stress environment where emotional decision-making can lead to panic selling. Seasoned traders monitor these levels for potential buying opportunities, adhering to the contrarian philosophy of “being fearful when others are greedy, and greedy when others are fearful.” However, this strategy carries significant risk, as extreme fear can persist and lead to further declines.

The index also reflects broader market liquidity and stability conditions. Periods of extreme fear are often characterized by:

- Widening bid-ask spreads on exchanges.

- Increased selling pressure on leveraged positions.

- Reduced activity in decentralized finance (DeFi) and non-fungible token (NFT) markets.

- A heightened focus on Bitcoin and major stablecoins over smaller altcoins.

This environment tests the infrastructure of the cryptocurrency ecosystem, from exchanges to blockchain networks. It separates projects with strong fundamentals and community support from those reliant purely on speculative hype.

Conclusion

The Crypto Fear & Greed Index’s drop to 24 provides a clear, data-driven confirmation that the market has entered a phase of Extreme Fear. This sentiment gauge, built from volatility, volume, social data, and surveys, acts as a barometer for the psychological state of cryptocurrency participants. While historical patterns show that such depths of fear can mark transitional points, they also represent periods of heightened risk and volatility. Investors should prioritize rigorous fundamental analysis, sound risk management, and a long-term perspective over emotional reactions to this stark sentiment indicator. The index will be closely watched for any stabilization or reversal as the market digests current macroeconomic and sector-specific news.

FAQs

Q1: What does a Crypto Fear & Greed Index reading of 24 mean?

A reading of 24 means the index has entered the “Extreme Fear” zone. This indicates that current market data and sentiment across volatility, trading volume, social media, and surveys are overwhelmingly negative and fearful.

Q2: Is the Crypto Fear & Greed Index a good predictor of future Bitcoin price?

The index is a measure of current sentiment, not a direct price predictor. However, historically, prolonged periods in “Extreme Fear” have sometimes coincided with market bottoms, while “Extreme Greed” has aligned with tops. It is best used as a contrarian indicator within a broader analysis framework.

Q3: How often is the Crypto Fear & Greed Index updated?

The index is typically updated once per day, based on a 24-hour rolling analysis of its underlying data components. Real-time fluctuations are not reflected; it provides a daily snapshot.

Q4: Who creates the Crypto Fear & Greed Index?

The index is provided by Alternative.me, a data platform focused on cryptocurrency and alternative financial markets. They have been calculating and publishing the index for several years.

Q5: Should I buy or sell cryptocurrency when the index shows Extreme Fear?

There is no single correct action. Some investors see Extreme Fear as a potential long-term buying opportunity, following contrarian strategies. Others view it as a signal to reduce risk and wait for stability. Any decision should be based on your individual investment strategy, risk tolerance, and thorough research, not solely on this index.