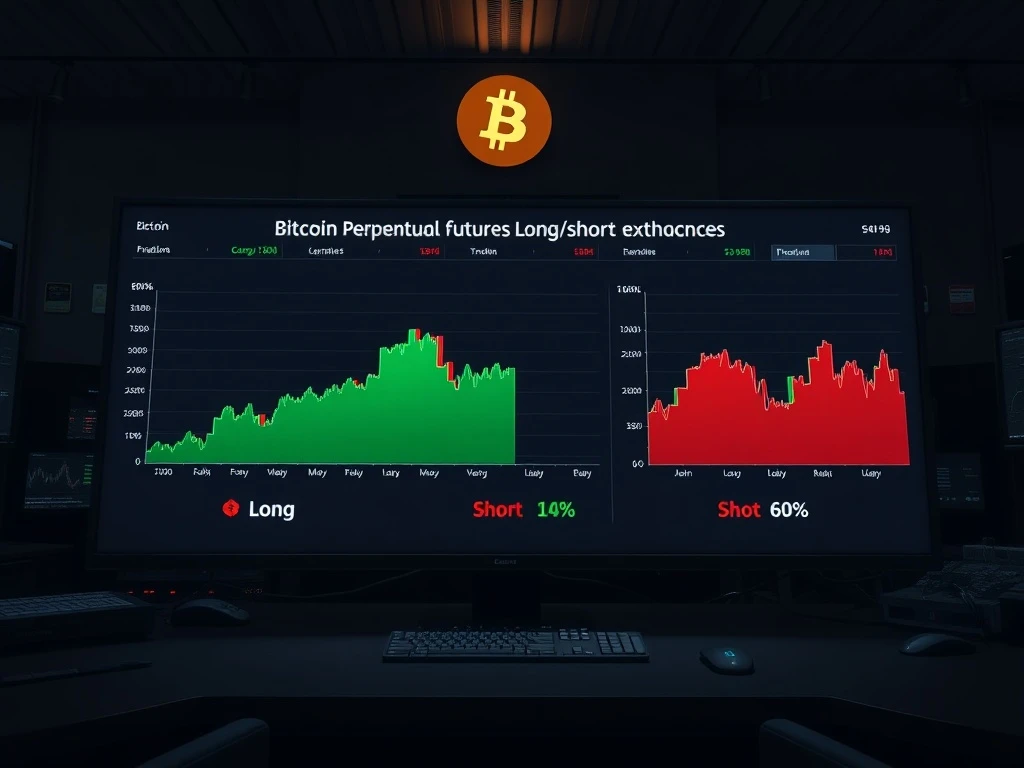

BTC Perpetual Futures Long/Short Ratio Reveals Cautious Market Sentiment

Global cryptocurrency markets displayed cautious positioning on Thursday, December 12, 2024, as Bitcoin perpetual futures long/short ratios across three leading exchanges revealed a subtle but meaningful tilt toward short positions. This aggregate data, compiled from platforms representing the majority of derivatives open interest, provides crucial insight into trader psychology and potential price direction for the world’s largest cryptocurrency. Market analysts closely monitor these ratios because they often serve as reliable contrarian indicators, with extreme positioning frequently preceding significant market reversals.

BTC Perpetual Futures Long/Short Ratio Analysis

Over the preceding 24-hour period, aggregate data from Binance, OKX, and Bybit showed traders maintaining 49.13% long positions against 50.87% short positions. This slight majority of short positions represents a noteworthy shift from previous weeks when long positions typically dominated. The perpetual futures market, which lacks expiration dates and uses funding rates to maintain price alignment with spot markets, has become the dominant venue for Bitcoin derivatives trading. Consequently, positioning data from these platforms offers unparalleled visibility into institutional and retail sentiment.

Exchange-specific breakdowns reveal subtle variations in trader behavior. Binance, the world’s largest cryptocurrency exchange by volume, recorded a ratio of 49.31% long to 50.69% short. OKX showed the most pronounced short bias at 48.38% long versus 51.62% short. Bybit displayed the most balanced ratio at 49.55% long to 50.45% short. These variations likely reflect differences in each platform’s user demographics, with OKX traditionally attracting more sophisticated derivatives traders who employ complex hedging strategies.

| Exchange | Long Percentage | Short Percentage | Net Bias |

|---|---|---|---|

| Binance | 49.31% | 50.69% | -1.38% (Short) |

| OKX | 48.38% | 51.62% | -3.24% (Short) |

| Bybit | 49.55% | 50.45% | -0.90% (Short) |

| Aggregate | 49.13% | 50.87% | -1.74% (Short) |

Several technical factors contribute to this positioning data. First, funding rates across major exchanges have remained slightly negative or neutral throughout the measurement period, reducing the cost of maintaining short positions. Second, open interest levels have remained relatively stable, suggesting this represents genuine sentiment rather than speculative positioning ahead of major news events. Third, the timing coincides with typical end-of-year portfolio rebalancing by institutional investors, who often reduce risk exposure during December.

Understanding Perpetual Futures Market Dynamics

Perpetual futures contracts, introduced by BitMEX in 2016 and now adopted by every major exchange, revolutionized cryptocurrency derivatives trading. Unlike traditional futures with fixed expiration dates, perpetual contracts use a funding rate mechanism to maintain price parity with underlying spot markets. This funding rate, typically exchanged every eight hours, pays longs when the rate is positive and pays shorts when negative. The current slightly negative funding rates across exchanges have made short positions marginally more economical to maintain.

The long/short ratio represents the percentage of open positions in each direction, not the total value. Therefore, a 50.87% short ratio means slightly more traders hold short positions, though the actual dollar value difference might be minimal. Market analysts consider several key thresholds when interpreting this data:

- Extreme Sentiment: Ratios exceeding 60% in either direction often signal potential reversals

- Neutral Zone: 45-55% range typically indicates balanced, healthy markets

- Historical Context: Current ratios must be compared against 30-day and 90-day averages

- Correlation with Price: Ratios often diverge from price action at market turning points

Recent market history provides context for the current positioning. Throughout most of 2024, long positions dominated perpetual futures markets, particularly during Bitcoin’s rally above previous all-time highs. The current shift toward more balanced or slightly short-biased ratios suggests traders are adopting more cautious stances amid macroeconomic uncertainty and regulatory developments. This sentiment aligns with reduced leverage levels across exchanges, as measured by estimated leverage ratios.

Expert Analysis of Market Implications

Seasoned derivatives traders interpret the current long/short ratios through multiple analytical frameworks. First, the absence of extreme positioning suggests markets are not currently at risk of a violent liquidation cascade in either direction. Second, the slight short bias could indicate sophisticated traders are implementing hedge strategies rather than outright bearish bets. Third, the consistency across three major exchanges lends credibility to the data, reducing concerns about platform-specific anomalies.

Historical patterns reveal important context. During the 2021 bull market peak, long ratios frequently exceeded 65%, creating conditions for the subsequent correction. Conversely, during the 2022 bear market trough, short ratios approached 60%, setting the stage for the recovery. The current ratios, while showing a slight short bias, remain within historically neutral ranges that typically accompany consolidation periods rather than trend reversals.

Several fundamental factors influence current positioning. Macroeconomic conditions, including interest rate expectations and inflation data, have created uncertainty across all risk assets. Regulatory developments, particularly regarding spot Bitcoin ETF flows and exchange compliance requirements, have introduced additional variables. Technical analysis shows Bitcoin trading within a defined range, with support at $60,000 and resistance at $68,000, encouraging range-bound strategies rather than directional bets.

Comparative Analysis with Traditional Markets

The cryptocurrency derivatives market has matured significantly since 2020, with perpetual futures now exhibiting characteristics similar to traditional financial instruments. The current long/short ratios parallel positioning in equity index futures, where institutional investors have also reduced net long exposure. This correlation suggests cryptocurrency markets are increasingly integrated with broader financial systems, responding to similar macroeconomic signals and risk assessments.

Data transparency represents a crucial advancement. Unlike early cryptocurrency derivatives markets where reliable data was scarce, current exchange reporting provides institutional-grade analytics. The consistency of reporting formats across Binance, OKX, and Bybit enables meaningful aggregation and analysis. This transparency has attracted traditional financial institutions to cryptocurrency derivatives, increasing market depth and reducing volatility during normal trading conditions.

Several key differences remain between cryptocurrency and traditional derivatives markets. Funding rate mechanisms have no direct equivalent in traditional finance, creating unique dynamics. Leverage availability, while reduced from historical extremes, remains higher than in regulated traditional markets. Settlement occurs entirely in cryptocurrency rather than fiat, creating additional considerations for risk management. These differences mean experienced cryptocurrency derivatives traders must develop specialized expertise beyond traditional finance knowledge.

Risk Management Considerations

The current long/short ratios carry important implications for risk management. Balanced positioning typically reduces the probability of cascading liquidations that can amplify price movements. However, even slight biases can become significant during periods of increased volatility. Traders monitoring these ratios should consider several risk factors:

- Leverage Levels: High leverage magnifies the impact of small price movements

- Funding Rate Trends: Sustained negative rates can pressure long positions

- Open Interest Changes: Increasing open interest alongside ratio shifts signals conviction

- Timeframe Alignment: Short-term ratios may conflict with longer-term trends

Exchange risk represents another consideration. While the three reported exchanges dominate perpetual futures trading, they operate under different regulatory frameworks with varying risk profiles. Binance’s global presence contrasts with OKX’s Asian focus and Bybit’s derivatives specialization. These differences can influence trader behavior and, consequently, positioning data. Sophisticated analysts weight exchange data based on reliability history and market share.

Methodological Considerations and Data Integrity

The methodology behind long/short ratio calculations warrants examination. Different exchanges employ slightly different calculation methods, though industry standardization has improved significantly. Some platforms count each position equally regardless of size, while others weight by position value. Most reputable exchanges now publish detailed methodology documentation, enabling proper interpretation.

Data collection timing creates another variable. The reported ratios represent snapshots rather than continuous measurements, though exchanges typically update data hourly. The 24-hour aggregation smooths intraday volatility but may miss shorter-term extremes. Independent analytics firms often supplement exchange data with proprietary collection methods, though the core findings generally align across sources.

Verification processes ensure data reliability. Cross-referencing long/short ratios with funding rate data, open interest trends, and liquidation histories creates a comprehensive picture. Discrepancies between these metrics can signal data quality issues or unusual market conditions. The current data shows internal consistency across all verification metrics, supporting its reliability for decision-making purposes.

Conclusion

The BTC perpetual futures long/short ratio analysis reveals a cryptocurrency derivatives market in cautious equilibrium. The slight short bias across Binance, OKX, and Bybit suggests traders are hedging against potential downside while avoiding extreme positioning that typically precedes sharp reversals. This balanced sentiment, occurring amid stable open interest and neutral funding rates, indicates healthy market conditions rather than bearish conviction. As cryptocurrency derivatives markets continue maturing, these positioning metrics will grow increasingly important for institutional and retail traders alike. Monitoring BTC perpetual futures long/short ratios provides valuable insight into market psychology, complementing fundamental and technical analysis for comprehensive trading strategies.

FAQs

Q1: What do Bitcoin perpetual futures long/short ratios measure?

These ratios measure the percentage of open long versus short positions in Bitcoin perpetual futures contracts across specific exchanges. They provide insight into market sentiment and positioning among derivatives traders.

Q2: Why are only three exchanges included in this analysis?

Binance, OKX, and Bybit represent the majority of Bitcoin perpetual futures open interest and trading volume. Their data provides reliable insight into overall market sentiment while maintaining methodological consistency.

Q3: How do long/short ratios differ from funding rates?

Long/short ratios measure position direction percentages, while funding rates represent payments between longs and shorts to maintain price alignment with spot markets. Both metrics provide complementary information about derivatives market conditions.

Q4: What constitutes extreme long or short ratios?

Historical analysis suggests ratios exceeding 60% in either direction often signal extreme sentiment that frequently precedes market reversals. Current ratios remain within neutral ranges of 45-55%.

Q5: How frequently should traders monitor these ratios?

Professional traders typically review long/short ratios daily alongside other derivatives metrics. Significant changes often warrant closer examination of underlying causes and potential market implications.