Polkadot’s **Historic** 2.1 Billion **DOT Supply Cap**: A **Transformative** Tokenomics Shift

The **Polkadot** ecosystem recently witnessed a pivotal moment. Its decentralized autonomous organization (DAO) has officially approved a hard cap on the network’s native token, DOT, for the very first time. This landmark decision sets the maximum supply at 2.1 billion Polkadot (DOT) tokens. It signifies a profound shift from the network’s previous inflationary model, which allowed for indefinite token issuance. This change holds significant implications for the future stability and value of DOT, particularly for investors keen on its long-term trajectory.

Understanding the New **DOT Tokenomics** Model

Previously, Polkadot operated under an inflationary model. This system minted approximately 120 million new DOT tokens annually without any upper limit on the total supply. Projections indicated that under this old framework, the total supply of DOT could have surged to over 3.4 billion tokens by 2040. Such a scenario raised concerns about potential dilution and price predictability.

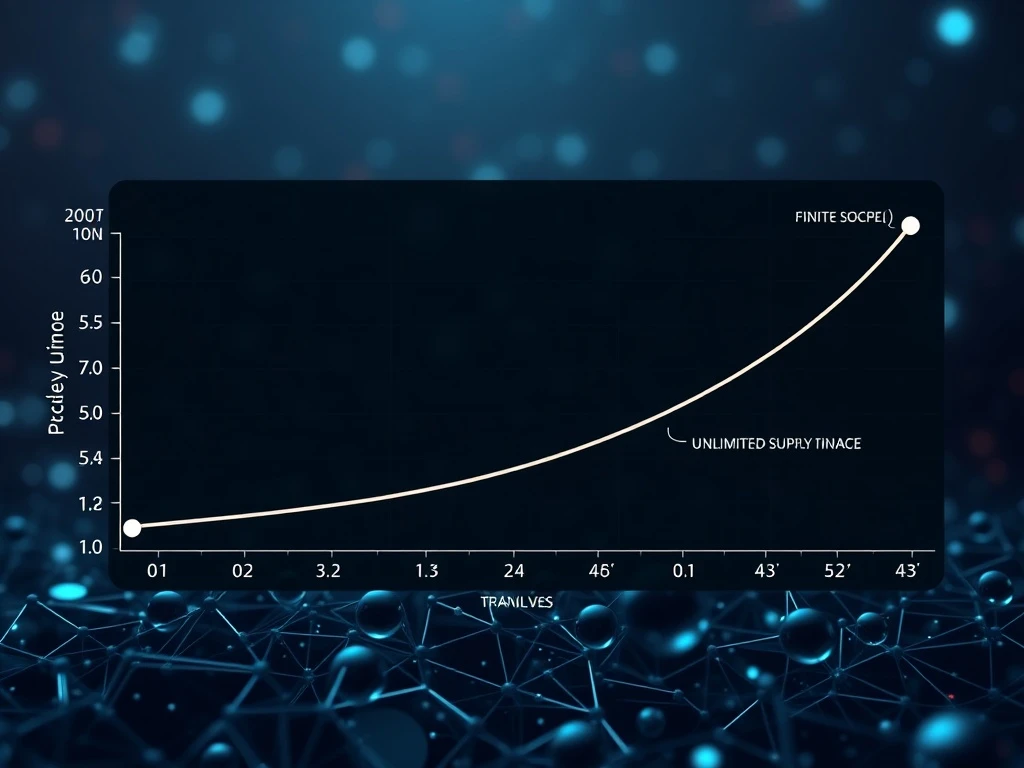

The newly approved tokenomics model introduces a critical change: a fixed maximum supply. The 2.1 billion **DOT supply cap** provides a clear ceiling. Furthermore, the new framework implements a gradual issuance reduction mechanism. This reduction will occur every two years, specifically on March 14, known as Pi Day. Currently, Polkadot’s total supply stands at approximately 1.5 billion tokens. The project has also released charts illustrating the stark difference in projected supply under the new, capped model compared to the old, uncapped one.

The shift to a fixed supply is a strategic move. It aims to foster greater predictability and scarcity for the DOT token. This move aligns Polkadot with other major cryptocurrencies that utilize supply caps to manage value over time. Ultimately, this decision reflects a maturing understanding of sustainable economic models within decentralized networks.

Combating **Cryptocurrency Inflation** Through Scarcity

One of the primary drivers behind this significant **Polkadot** tokenomics update is the desire to mitigate **cryptocurrency inflation**. In traditional financial markets, uncontrolled inflation erodes purchasing power. Similarly, an ever-increasing supply of a digital asset can put downward pressure on its value over time. By introducing a hard cap, Polkadot aims to create a deflationary or at least a non-inflationary environment for DOT.

The 2.1 billion **DOT supply cap** ensures that the token’s scarcity will increase as demand grows and the circulating supply approaches the maximum. This scarcity is a fundamental economic principle that often underpins long-term value appreciation. Investors typically favor assets with a predictable supply schedule, as it allows for better long-term financial planning and reduces uncertainty. This move could therefore make DOT a more attractive asset for those seeking stability in their crypto portfolios.

This decision also reflects a broader trend in the crypto space. Many leading digital assets, including Bitcoin, have implemented fixed supply limits. These limits are designed to protect against inflationary pressures and promote long-term value. Polkadot’s move signals its commitment to adopting best practices for token economics within its sophisticated blockchain ecosystem.

DAO Governance and Institutional Expansion

The approval of the **DOT supply cap** highlights the robust governance capabilities of the **Polkadot** DAO. This decentralized autonomous organization empowered its community to vote on and implement such a fundamental change to the network’s economic structure. It demonstrates the power of community-driven decision-making in the Web3 space, reinforcing Polkadot’s commitment to decentralization.

Interestingly, this tokenomics shift coincides with Polkadot’s strategic efforts to engage institutional investors. On August 19, Polkadot launched the Polkadot Capital Group. This new division specifically aims to bridge the gap between traditional Wall Street firms and Polkadot’s innovative blockchain infrastructure. The group seeks to connect finance players with opportunities in asset management, banking, venture capital, exchanges, and over-the-counter (OTC) trading. They also showcase crucial blockchain use cases like decentralized finance (DeFi), staking, and real-world asset (RWA) tokenization.

The introduction of a predictable and capped **DOT supply cap** could significantly enhance Polkadot’s appeal to institutional investors. Traditional financial entities often prefer assets with clear supply schedules and reduced inflationary risks. This enhanced clarity can simplify risk assessments and make DOT a more viable option for large-scale investment portfolios.

Initial Market Reaction and Long-Term Outlook

Despite the positive long-term implications, the immediate market reaction to the **DOT supply cap** announcement was not an immediate surge. Since the news broke, DOT’s price experienced a modest dip, falling from $4.35 to $4.15, representing a nearly 5% tumble. This short-term fluctuation is common in volatile cryptocurrency markets. It often reflects broader market sentiment or profit-taking, rather than a direct rejection of the underlying fundamental change.

Ultimately, capping the **Polkadot** token supply at 2.1 billion tokens is expected to introduce long-term scarcity. This move will significantly reduce inflationary pressure, thereby making DOT’s value more predictable for investors over time. Such a fundamental change to **DOT tokenomics** can often take time to be fully absorbed and reflected in market prices. Therefore, the long-term outlook for DOT, bolstered by this new economic model, remains a point of interest for many analysts and investors.

The Role of the **Web3 Foundation** and Future Implications

The **Web3 Foundation**, the team behind Polkadot, plays a crucial role in the network’s development and evolution. While the DAO made this specific decision, the Foundation provides essential research and development support. Crypto News Insights reached out to the **Web3 Foundation** for further details on this tokenomics shift. However, a response was not received by the time of publication. Their insights would undoubtedly shed more light on the technical implementation and strategic vision behind this momentous change.

The decision to implement a **DOT supply cap** signals a strong commitment to sustainable growth and investor confidence within the Polkadot ecosystem. It positions DOT more favorably against other major cryptocurrencies by addressing potential inflationary concerns. As Polkadot continues to expand its reach, particularly with its new Capital Group, a robust and predictable tokenomics model becomes increasingly vital. This move ensures the network’s economic foundations are as strong as its technological innovations.