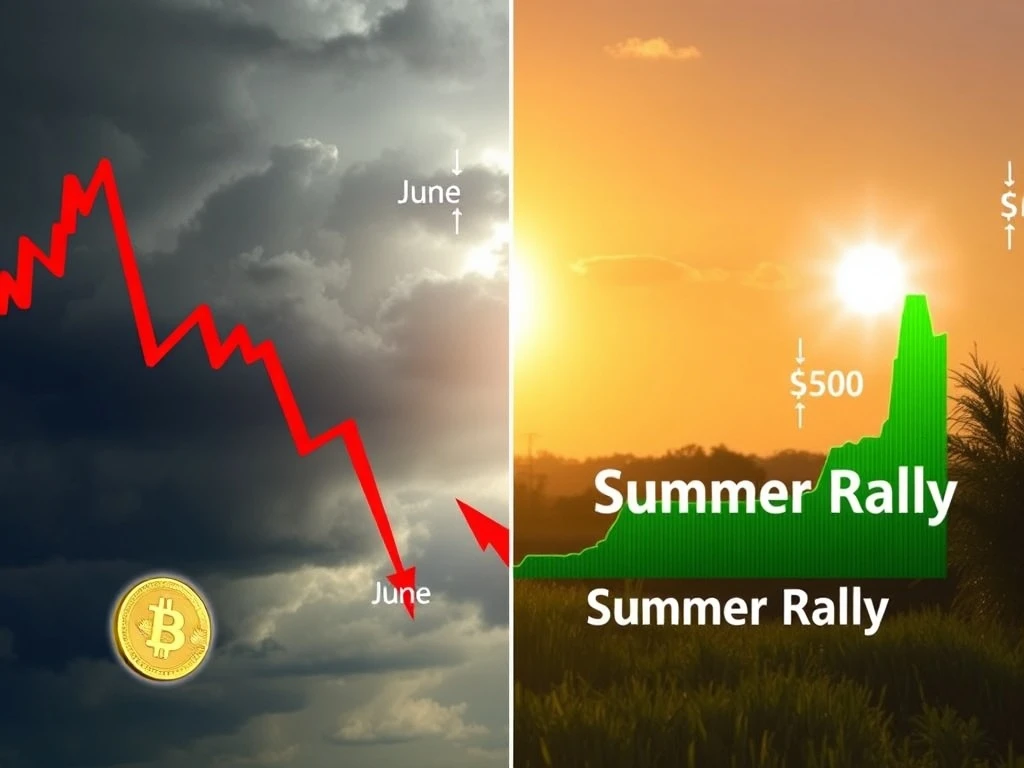

Bitcoin’s Crucial June: Unveiling the Summer Market Divide

Are you wondering why June often feels like a turbulent ride for Bitcoin investors, while traditional markets like the S&P 500 seem to glide towards a potential summer rally? For years, June has proven to be a challenging month for the premier cryptocurrency, hinting at a potential fourth consecutive summer in the red if current trends persist. Meanwhile, the S&P 500 is gearing up to extend its winning streak, potentially logging a third straight seasonal rally. This intriguing divergence between the world’s leading digital asset and the benchmark stock index offers a compelling look into the unique forces shaping both the Bitcoin and broader financial landscapes. Let’s dive into the historical patterns and underlying catalysts that explain this fascinating market behavior.

Bitcoin’s Perilous June and the S&P 500’s Resilience

The performance of Bitcoin and the S&P 500 during the summer months, particularly June, has shown a clear divergence in recent years. While their summer trends aren’t entirely decoupled, June stands out as a stark contrast. Since 2020, Bitcoin has managed only one positive June, often signaling a challenging start to the summer. In sharp contrast, the S&P 500 has experienced only two negative Junes over the same period, consistently demonstrating its resilience.

Looking at July and August from 2020 to 2024, the S&P 500 recorded eight positive performances, significantly outperforming Bitcoin, which saw six. This suggests that while both assets can benefit from broader market optimism, Bitcoin’s susceptibility to internal shocks makes its June performance particularly vulnerable. This seasonal weakness for Bitcoin, especially in June, makes it the second-worst month for the cryptocurrency, trailing only September.

Decoding the Crypto Market’s Summer Slumps

Bitcoin’s summer struggles often have less to do with typical seasonal patterns and more to do with unique, crypto-native shocks and prevailing economic trends. Let’s trace how the past five summers unfolded for the crypto market:

-

2020: The DeFi Summer Amidst Stimulus

June 2020 saw Bitcoin dip 3.18%, but this masked strong momentum from breaking $10,000 post-COVID crash and navigating the ‘sell the news’ halving event. By July, global stimulus and low interest rates fueled risk appetite. This period ignited ‘DeFi Summer,’ a boom in yield farming, significantly buoying the crypto market. The S&P 500 also saw positive performance from June to August, benefiting from the broader economic tailwinds. -

2021: China’s Crackdown and Institutional Interest

Entering summer 2021, Bitcoin faced intense regulatory uncertainty as China escalated its crackdown on mining and trading in May, causing a significant tumble through June. This crypto-specific shock deeply impacted the market. However, momentum returned in July, driven by rising institutional interest from figures like Elon Musk and Cathie Wood. This summer concluded with an 8.68% gain for Bitcoin, marking its last positive summer to date. -

2022: Contagion, Inflation, and Rate Hikes

The summer of 2022 was exceptionally harsh for both crypto and traditional markets. It began with the Terra collapse in May, triggering widespread contagion across the blockchain industry, leading to crises at Celsius and Three Arrows Capital by June. Adding to the woes, the SEC denied Grayscale’s spot Bitcoin ETF bid. Simultaneously, US inflation hit a 40-year high of 9.1%, prompting aggressive Federal Reserve rate hikes. While Big Tech earnings provided a brief July rebound for the S&P 500, optimism faded in August following Fed Chair Jerome Powell’s hawkish Jackson Hole speech. Bitcoin and the S&P 500 largely moved in tandem, reflecting the severe macro headwinds. -

2023: ETF Hopes and Hawkish Fed

June 2023 saw Bitcoin briefly defy its typical pattern, surging 12% due to a wave of spot ETF applications, notably from BlackRock. The S&P 500, however, lagged as the Fed paused rate hikes but maintained a hawkish tone, cooling the AI-driven tech rally. Despite strong Big Tech earnings aiding the S&P 500 in July, both Bitcoin and equities ended August in the red. Powell’s Jackson Hole speech again dampened rate cut hopes, compounded by China’s Evergrande bankruptcy. While a court sided with Grayscale on its ETF dispute, Bitcoin still closed the summer negatively. -

2024: Halving Pressures and AI Euphoria

June 2024 witnessed a sharp drop for Bitcoin, pressured by weak ETF inflows, miner selling post-halving, and a yen carry-trade unwind. In stark contrast, the S&P 500 climbed steadily, fueled by optimism around AI and mega-cap tech giants like Nvidia, alongside growing confidence in a Fed ‘soft landing’ for the economy. By August, Bitcoin slipped again amid renewed macro uncertainty, including China’s economic slowdown and rising global trade tensions. While traditional markets faced headwinds, the S&P 500 managed to close the month in the green, lifted by resilient tech performance and easing fears of further Fed tightening.

A Deep Dive into Market Analysis: What Drives the Divergence?

Understanding the unique drivers behind Bitcoin and the S&P 500’s performance is crucial for comprehensive market analysis. While both are influenced by broader economic currents, their internal mechanics and sensitivities differ significantly.

For Bitcoin, the recent downturns in June are often attributed to a combination of factors:

- Post-Halving Dynamics: The quadrennial Bitcoin halving events, while bullish long-term, often precede a period of miner capitulation and reduced selling pressure, as less efficient miners are squeezed out. This can lead to increased selling in the short term.

- ETF Inflow Volatility: While spot Bitcoin ETFs have brought institutional capital, their inflows can be volatile. Periods of low demand or outflows can exert significant downward pressure.

- Carry Trade Unwinds: Global macro factors, such as shifts in interest rate differentials (like the yen carry-trade), can lead to unwinding of leveraged positions, impacting risk assets like Bitcoin.

- Crypto-Native Events: Past summers show that major industry-specific events – regulatory crackdowns, project collapses, or significant protocol updates – can trigger disproportionate price movements unique to the crypto space.

The S&P 500, on the other hand, benefits from a different set of catalysts:

- Corporate Earnings: Q2 earnings reports in July are a pivotal driver. Strong performance from bellwether companies, especially in the tech sector, can significantly boost investor confidence.

- AI and Mega-Cap Tech: The ongoing enthusiasm around artificial intelligence and the robust performance of mega-cap technology stocks have been key drivers for the S&P 500, providing a concentrated source of growth.

- Fed Policy Expectations: Hopes for a ‘soft economic landing’ and eventual interest rate cuts from the Federal Reserve often fuel equity rallies, as lower rates typically make borrowing cheaper and boost corporate profits.

- Broader Economic Data: Indicators like employment figures, consumer sentiment, and inflation data provide a more stable, albeit sometimes volatile, backdrop for traditional markets, which tend to react to these in a more predictable manner.

Geopolitical tensions also play a role, albeit with varying impact. Events in the Middle East, such as potential oil supply disruptions from the Strait of Hormuz, can drive up inflation, impacting risk sentiment across all markets. However, the S&P 500’s diversified nature and established corporate structures often provide a buffer that Bitcoin, as a newer, more volatile asset, lacks.

Is a Summer Rally Possible for Bitcoin?

Historically, July has often delivered strong returns for Bitcoin, typically rebounding from a weak June. These recoveries have frequently followed crypto-specific downturns, such as post-halving sell-offs, the fallout from China’s mining ban, or ETF-related volatility. For equities, July is also a pivotal month, as companies report second-quarter earnings, which has often driven recent gains in the S&P 500.

However, August brings heightened attention to the Fed chair’s annual Jackson Hole speech, which often provides crucial hints into the Fed’s stance on rate policy. This year, investors are also closely watching oil prices and inflation data amid escalating tensions in the Middle East. Such developments could drive up inflation, impacting risk sentiment across all markets. While Bitcoin has become more intertwined with traditional markets through ETFs, corporate treasuries, and institutional flows, it remains uniquely vulnerable to crypto-native shocks. Unlike equities, which often move in sync with earnings, rate expectations, and broader macro trends, crypto still responds disproportionately to its own internal catalysts. That’s why strategies like ‘sell in May’ don’t always translate across asset classes.

In conclusion, while the S&P 500 appears poised for continued strength this summer, buoyed by robust tech earnings and easing inflation concerns, Bitcoin’s path remains more volatile. Its sensitivity to crypto-specific events and its relatively newer status mean that even as it integrates further into global finance, its most severe downturns often stem from within its own ecosystem. Investors navigating this summer’s markets will need to keep a close eye on both traditional economic indicators and the unique developments within the evolving crypto market to make informed decisions. The divergence between Bitcoin’s June struggles and the S&P 500’s potential summer rally highlights the distinct risk and reward profiles of these two powerful asset classes.