Stablecoin Regulation: Unpacking the Critical Gaps in EU and Swiss Crypto Rules

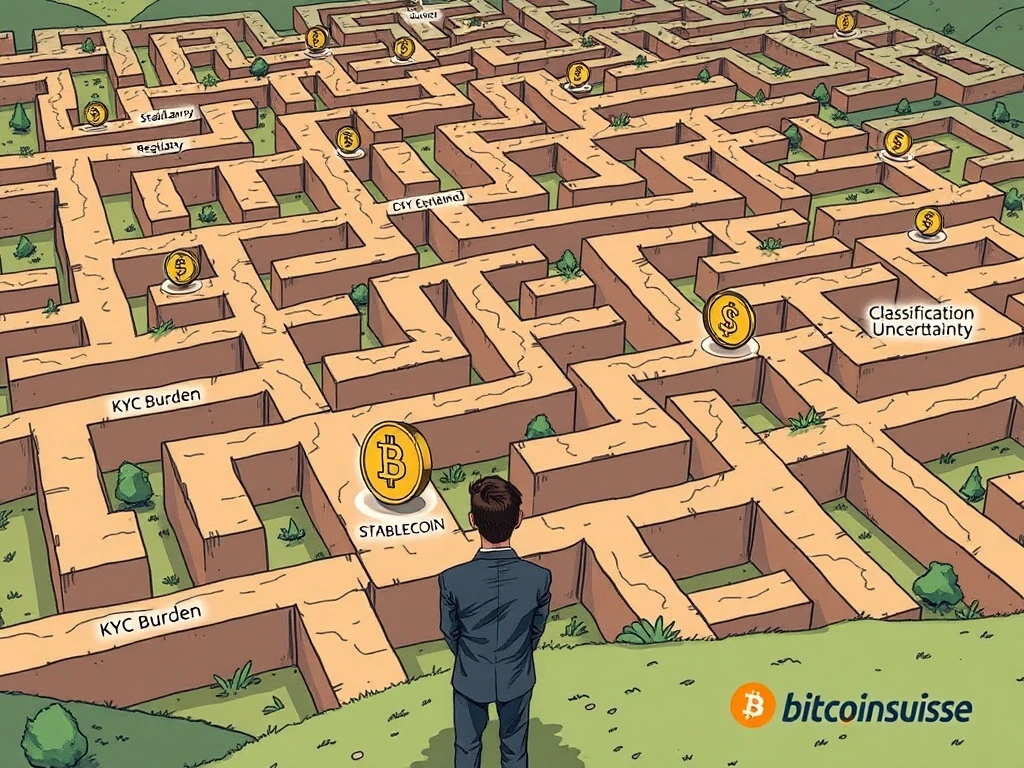

Stablecoins have emerged as a crucial bridge between traditional finance and the rapidly evolving world of cryptocurrencies, offering stability in a volatile market. Yet, their potential is often hampered by a complex and sometimes contradictory regulatory landscape. Recently, Peter Märkl, General Counsel at the prominent Swiss crypto exchange Bitcoin Suisse, voiced significant concerns regarding the current state of stablecoin regulation in both the European Union and Switzerland. His insights, shared at the German Blockchain Week, highlight pressing issues that could impede innovation and adoption, calling for urgent legislative clarity.

Navigating the MiCA Framework: Opportunities and Hurdles

The European Union’s Markets in Crypto-Assets Regulation (MiCA) has been hailed as a landmark achievement, aiming to provide a harmonized and comprehensive regulatory framework for crypto assets across all member states. Peter Märkl acknowledges MiCA’s ambition to standardize rules for stablecoin issuance, offering, and custody, a move many in the industry welcome for its potential to create a level playing field.

However, Märkl points to a critical challenge: the dynamic nature of crypto assets themselves. “Due to the rapidly evolving nature of crypto-assets and their use cases, classification remains dynamic and can, in certain cases, shift over time,” he explained. This fluidity means that what is classified one way today might be seen differently tomorrow, creating uncertainty for issuers and service providers. This constant re-evaluation poses a significant operational burden.

Furthermore, MiCA’s reach presents a unique disadvantage for entities operating outside the EU. Märkl warned that “Foreign stablecoin issuers need to seriously consider a license under MiCA as recent supervisory actions in Germany point to a strict enforcement of the rules.” This suggests that companies looking to serve the EU market, regardless of their primary jurisdiction, must navigate the intricacies of the MiCA framework, potentially requiring significant investment in compliance and licensing.

Swiss Crypto Rules: A Pioneer’s Persistent Puzzles

Switzerland has long been lauded as a trailblazer in crypto regulation, particularly with its Distributed Ledger Technology (DLT) Act introduced four years ago. Märkl recognized the DLT Act as “a great legislative platform.” Yet, even in this progressive environment, significant “holes in the local regulatory framework” persist, particularly concerning stablecoins.

A primary point of contention, according to Märkl, is the “unreasonable” burden of Know Your Customer (KYC) requirements placed directly on stablecoin issuers. Regulators in Switzerland, he noted, essentially expect stablecoin issuers to know the identity of individual holders. This approach contradicts the pseudonymous nature of blockchain transactions and presents an immense, perhaps impossible, operational challenge for issuers of widely distributed stablecoins. Imagine a stablecoin used by millions globally; requiring the issuer to KYC every single holder is a logistical nightmare that stifles widespread adoption and innovation. This aspect of the Swiss crypto rules creates a significant barrier to entry and operation for stablecoin projects.

Märkl stressed the need to “put a focus on the regulation of stablecoins” and provide “a set of rules that is comfortable for the players.” While a legislative process is ongoing, the industry eagerly awaits an outcome that balances regulatory oversight with practical operational realities, ensuring Switzerland remains competitive in the global crypto landscape.

Bitcoin Suisse’s Strategic Expansion and the Global Regulatory Maze

Despite these regulatory hurdles, Bitcoin Suisse is not slowing down its strategic expansion. The company plans to leverage its existing five-year-old Liechtenstein Crypto-Asset Service Provider (CASP) registration under the TV2 law to seek a full MiCA license. This move underscores the importance of a harmonized EU framework for firms seeking broader market access, despite its current complexities.

Beyond Europe, Bitcoin Suisse is eyeing significant international growth. The company received in-principle approval from the Abu Dhabi Global Market (ADGM) in May, signaling a strong pivot towards the Middle East. With CEO Andrej Majcen relocating to Abu Dhabi, Märkl noted a “tremendous attraction” to the region, which is rapidly positioning itself as a crypto hub. This highlights a broader trend: as regulatory clarity emerges in certain jurisdictions, capital and innovation tend to follow.

The firm is also exploring opportunities in the United Kingdom and the United States, although final decisions hinge on the evolving regulatory landscapes in these key markets. This cautious yet ambitious approach demonstrates how global regulatory developments directly influence business strategy in the crypto space.

The Broader Landscape of Crypto Regulation EU and Beyond

The challenges highlighted by Bitcoin Suisse’s general counsel are not isolated incidents but rather reflections of a broader global struggle to effectively regulate a rapidly evolving asset class. The approach to crypto regulation EU has taken with MiCA is comprehensive, yet its implementation reveals practical difficulties, especially concerning the nuanced classification of assets and the implications for non-EU entities.

Other jurisdictions, like the UK and US, are still grappling with their own frameworks, often leading to what experts term ‘policy procrastination.’ This delay can leave regions trailing behind, missing out on investment and innovation. The push for a euro stablecoin by entities like DWS and Deutsche Bank, which recently received regulatory approval, signals the growing institutional interest and the urgent need for a clear, predictable regulatory environment for stablecoins to thrive.

The Path Forward for Effective Stablecoin Regulation

The core message from Bitcoin Suisse’s legal chief is clear: effective stablecoin regulation must strike a delicate balance. It needs to be comprehensive enough to mitigate risks and protect consumers, yet flexible enough to adapt to technological advancements and practical for issuers to implement. The current gaps in both the EU’s MiCA framework and Switzerland’s DLT Act, particularly concerning dynamic classification and burdensome KYC requirements, create unnecessary friction and hinder the growth of a vital component of the crypto ecosystem.

For the crypto industry to fully realize its potential, regulators must prioritize creating a global, harmonized, and forward-looking framework for stablecoins. This includes:

- Clear Classification: Developing adaptable guidelines for classifying crypto assets that account for their evolving nature and use cases.

- Proportional KYC: Implementing KYC/AML requirements that are practical for stablecoin issuers and proportionate to the risks involved, perhaps exploring innovative on-chain solutions.

- Global Coordination: Fostering international cooperation to avoid regulatory arbitrage and create a more predictable environment for cross-border operations.

As Bitcoin Suisse strategically expands its footprint, its experiences underscore the critical need for regulatory frameworks that are not only robust but also pragmatic and conducive to innovation. The future of stablecoins, and indeed the broader crypto market, depends heavily on whether regulators can bridge these existing gaps with thoughtful, industry-friendly solutions.