TRUMP Token Unleashes Stunning 128% Price Surge Amidst Rising Altcoin Season Hopes

The cryptocurrency world is buzzing, and all eyes are on the TRUMP token. This meme coin, linked to former U.S. President Donald Trump, has unexpectedly exploded in activity, registering a colossal $1.6 billion in 24-hour trading volume. What’s even more remarkable? This surge occurred without the typical social media hype, making it a truly intriguing development in the volatile crypto landscape. Could this be the start of something big for TRUMP, potentially outperforming established rivals like BONK and PEPE in the upcoming market cycle?

TRUMP Token’s Astounding Volume Surge and Market Signals

The recent performance of the TRUMP token has left many analysts and investors intrigued. Its 24-hour trading volume, hitting $1.6 billion, marks the highest level since a significant holder event back in May. This surge, notably absent of major social media frenzy, suggests a deeper, perhaps more organic, accumulation of interest. Data from CoinGlass further illuminates this heightened activity:

- Open Interest: A staggering $555 million in open interest has been observed, a level last seen before the highly anticipated Trump presidential gala dinner. This indicates a substantial increase in speculative positions on the token.

- Binance Long/Short Ratio: On Binance, the long/short ratio stands at an impressive 3.81. This means that for every short position, there are nearly four long positions, with approximately 80% of traders betting on continued price appreciation. This underscores robust retail participation and a strong bullish sentiment.

The sheer volume and lopsided long-to-short ratio paint a clear picture of conviction among traders regarding the TRUMP token‘s immediate future.

Is Altcoin Season Gaining Momentum?

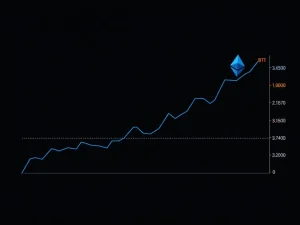

Beyond the individual performance of the TRUMP token, the broader crypto market is showing encouraging signs, particularly for non-Bitcoin assets. The altcoin season index, a key indicator of market enthusiasm for alternative cryptocurrencies, has seen a notable climb. Since the beginning of June, this index has risen from a low of 20 to 53.

While this is a significant improvement, it’s important to note that the index remains below the 75 threshold typically associated with a full-blown altseason. This suggests a growing appetite for altcoins but also indicates that further catalysts are needed to sustain and accelerate this momentum. The rising index, however, provides a favorable backdrop for tokens like TRUMP, indicating that capital is beginning to flow into the broader altcoin market, potentially benefiting those with strong narratives or technical setups.

Decoding the Crypto Market’s Technical Signals

Technical analysis offers crucial insights into the crypto market‘s potential trajectory. The TRUMP token has recently broken out of a symmetrical triangle pattern that had been forming since mid-April. This breakout is a bullish signal, projecting a substantial 128% price increase, potentially pushing the token to $24.50 if the trend holds. However, traders are keenly watching key levels:

- Immediate Resistance: $11.65

- Immediate Support: $10.60

The interaction with these levels will be critical in determining the validity of the breakout. Momentum indicators present a mixed bag: the Relative Strength Index (RSI) has stabilized near neutral territory, suggesting neither extreme overbought nor oversold conditions. Conversely, the Moving Average Convergence Divergence (MACD) line continues to widen below its signal line, hinting at lingering bearish pressure in the short term. This divergence calls for caution, as it could indicate a potential for consolidation or even a pullback before a sustained upward move.

Should the breakout prove genuine, the TRUMP token‘s market capitalization could soar to $4.8 billion. This would allow it to surpass BONK’s current $3.2 billion market cap, though it would still trail behind PEPE’s $5.7 billion. The race among meme coins remains fierce, with market cap benchmarks serving as crucial indicators of dominance.

What Drives Meme Coin Mania?

The surge in the meme coin sector, exemplified by TRUMP’s recent performance, highlights the unique dynamics of this corner of the crypto world. Unlike traditional cryptocurrencies driven by technological innovation or utility, meme coins often thrive on community sentiment, cultural relevance, and speculative interest. For the TRUMP token, potential catalysts could further ignite its price action:

- Regulatory Developments: The anticipated CLARITY Act in October could provide a clearer regulatory framework for digital assets, potentially attracting more institutional capital and legitimizing the space further.

- Public Endorsement: A public endorsement from Donald Trump himself would undoubtedly provide a massive spark, leveraging his immense public profile to attract a new wave of investors.

Meanwhile, retail investors are increasingly turning to self-custody solutions to manage their digital assets. Wallets like MetaMask remain popular, but new players like Best Wallet ($BEST) are gaining traction. Best Wallet’s features, such as an “Upcoming Tokens” screener and real-world spending tools like the Best Card, are particularly appealing for their utility in early-stage token discovery and practical application of crypto assets.

Navigating TRUMP Token Price Prediction and Risks

While the projected 128% price increase for the TRUMP token to $24.50 is exciting, investors must approach the situation with a balanced perspective. The current price action near the $11.65 resistance level, combined with the MACD divergence, underscores inherent risks. The market remains cautious, and the possibility of consolidation or even a pullback cannot be dismissed. The token’s trajectory hinges significantly on whether the current high trading volume can be sustained to validate the bullish thesis.

Furthermore, external factors such as broader macroeconomic shifts, unexpected regulatory news, or even shifts in political sentiment could significantly influence the next phase of the TRUMP token price prediction. Prudent investors will monitor these variables closely, understanding that while meme coins offer high reward potential, they also carry elevated risks.

Conclusion

The TRUMP token‘s recent surge, fueled by impressive trading volume and growing open interest, has certainly captured the crypto world’s attention. With the altcoin season index on the rise and a technical breakout suggesting significant upside, optimism abounds. However, the mixed signals from momentum indicators and crucial resistance levels remind us that the path forward may not be linear. As the market watches for key catalysts and assesses the sustainability of this momentum, the TRUMP token stands as a compelling case study in the volatile yet captivating realm of meme coins.

Frequently Asked Questions (FAQs)

Q1: What is fueling the recent surge in TRUMP token’s trading volume?

The TRUMP token’s recent surge is driven by a significant increase in trading activity, reaching $1.6 billion in 24-hour volume. This is supported by high open interest ($555 million) and a strong long/short ratio (3.81 on Binance), indicating heightened speculative interest and bullish sentiment among traders, even without major social media hype.

Q2: What does the Altcoin Season Index rising to 53 mean for the crypto market?

The Altcoin Season Index rising from 20 to 53 indicates a growing appetite for alternative cryptocurrencies (altcoins) among investors. While it suggests increasing capital flow into non-Bitcoin assets, it’s still below the 75 threshold typically signaling a full altcoin season, meaning more catalysts are needed for sustained, widespread altcoin rallies.

Q3: What are the price targets and resistance levels for the TRUMP token?

Based on a symmetrical triangle breakout, analysts project a 128% price increase for the TRUMP token, potentially reaching $24.50. Immediate resistance is identified at $11.65, while support is found at $10.60. These levels are crucial for confirming the validity of the breakout.

Q4: What are the main risks associated with investing in the TRUMP token?

Despite the bullish outlook, risks include mixed signals from momentum indicators (like the MACD widening below its signal line), potential for consolidation or pullback near resistance levels, and the inherent volatility of meme coins. Its trajectory also depends on sustained volume and external factors like macroeconomic shifts or regulatory news.

Q5: How might regulatory developments or a public endorsement affect the TRUMP token?

Regulatory developments, such as the anticipated CLARITY Act in October, could provide a clearer framework, potentially attracting more capital. A public endorsement from Donald Trump himself would likely act as a significant catalyst, drawing substantial attention and investment to the token.