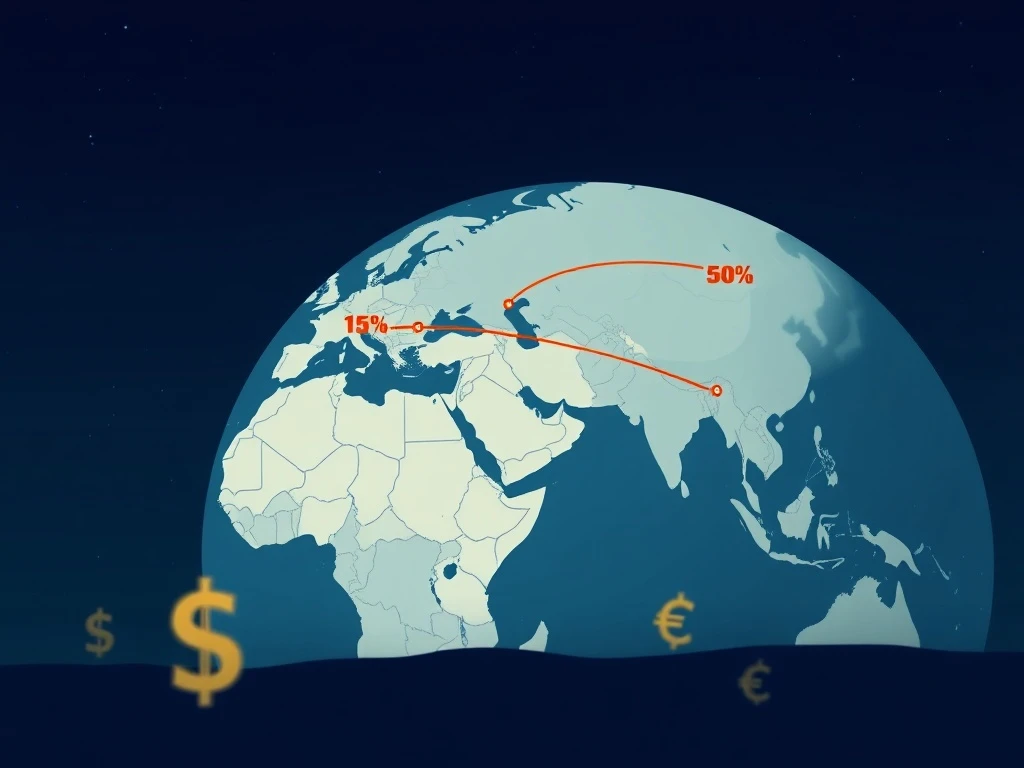

Trump Tariffs: Unprecedented Uncertainty as 15-50% Plan Reshapes Global Trade Deals

In an era defined by rapid technological advancements and interconnected financial systems, traditional economic shifts can send powerful ripples across unexpected markets. U.S. President Donald Trump’s recently unveiled 15-50% tariff plan is one such seismic event, poised to reshape global trade relationships and potentially influence the burgeoning Cryptocurrency Market. While seemingly a world apart, the intricate dance of protectionism, bilateral negotiations, and economic uncertainty could have profound implications for digital assets, making it crucial for crypto enthusiasts and investors to understand this evolving landscape.

Trump Tariffs: A Bold Shift Towards Protectionism

U.S. President Donald Trump’s administration has outlined a sweeping tariff policy, targeting over 150 countries with proposed rates ranging from 15% to 50% on imports. Announced in late July 2025, this framework signals a significant shift toward protectionism, marking a pivotal moment in reshaping U.S. trade relationships. The policy emphasizes simplicity, with most countries receiving baseline tariff notifications of “probably 10 or 15%.” However, Trump has reserved the right to adjust these rates up to 50% in specific cases, showcasing a blend of punitive threats and strategic flexibility.

This approach highlights a core tenet of Trump’s trade philosophy: using tariffs as a potent tool of leverage. The aim is to compel trading partners to renegotiate terms that are perceived to be more favorable to American interests, prioritizing domestic manufacturing and a balanced trade sheet. This stance aligns with his historical trade policies, emphasizing a transactional rather than multilateral approach to international commerce.

Navigating Global Trade Deals: Japan, EU, and Beyond

The proposed Trump Tariffs have already spurred significant diplomatic activity, leading to a series of crucial Global Trade Deals. A key development was the U.S.-Japan trade agreement, which settled on a 15% tariff for Japanese goods. This rate was notably lower than the initially threatened 30%, demonstrating the administration’s willingness to negotiate for favorable terms.

Here’s a snapshot of the emerging tariff landscape:

- Japan: Agreed to a 15% tariff, down from an initial threat of 30%. This agreement serves as a template for future bilateral deals.

- European Union (EU): Negotiations are reportedly nearing a 15% tariff agreement. However, European officials remain cautious, signaling potential retaliatory measures if terms are not mutually beneficial.

- North America (Mexico & Canada): Higher tariffs of 30% and 35% are set to take effect on August 1 for Mexico and Canada, respectively. This signals heightened scrutiny and a more stringent approach to cross-border trade within the continent.

These varying rates underscore the administrative complexities inherent in a multi-tiered system, despite the stated emphasis on simplicity. Each negotiation is a unique chess match, with the U.S. seeking to maximize its advantage.

The US Trade Policy Shift: Bilateralism Over Multilateralism

At the heart of these developments is a fundamental reorientation of US Trade Policy. The Trump administration explicitly prioritizes bilateral negotiations over broader multilateral agreements. This strategy aims to secure specific concessions from individual nations, believing that direct talks yield more advantageous outcomes for the U.S. economy and domestic industries.

The initial 10-15% baseline tariff, as outlined in July, serves as a strong opening bid, with subsequent deals like the Japan agreement (settling at 15%) suggesting a strategic elevation of minimum rates. This approach, while potentially securing immediate wins, risks straining relationships with traditional partners if negotiations stall or if perceived non-compliance arises. The emphasis is firmly on “America First,” with trade balance and domestic manufacturing at the forefront of policy decisions.

Understanding the Economic Impact: Inflation, Costs, and Market Reactions

The proposed tariffs have triggered considerable global economic uncertainty. Analysts widely highlight potential inflationary pressures as U.S. consumers and businesses face higher costs for imported goods. This could translate to increased prices across various sectors, impacting household budgets and corporate profit margins.

However, negotiated deals, such as the agreement with Japan, offer a glimmer of mitigation. By allowing trading partners to avoid the upper tariff limits, these agreements may prevent the most severe broader impacts. Global markets have responded with caution, though major indices have not yet shown significant volatility. Still, analysts warn that prolonged trade tensions could disrupt financial stability, forcing countries to prioritize cost-efficient sourcing strategies over supply chain diversification.

The direct Economic Impact on various sectors will depend heavily on the final agreed-upon rates and the elasticity of demand for imported goods. Industries reliant on global supply chains will need to adapt quickly, potentially re-evaluating their sourcing strategies or passing increased costs onto consumers.

How Might Trump’s Tariffs Influence the Cryptocurrency Market?

While trade tariffs primarily affect traditional economies, their ripple effects can significantly influence the Cryptocurrency Market. Here’s how:

- Inflation Hedge Narrative: If tariffs lead to increased import costs and domestic inflation, assets like Bitcoin, often touted as a hedge against inflation and currency debasement, could see renewed interest. Investors seeking to preserve purchasing power might look to decentralized alternatives outside the traditional financial system.

- Safe-Haven Appeal: During periods of global economic uncertainty and geopolitical tension, some investors view Bitcoin and other major cryptocurrencies as digital safe havens. As trade wars escalate and traditional markets face headwinds, a flight to quality could indirectly benefit the crypto space.

- Dollar Strength/Weakness: Trade policies can influence the strength of the U.S. dollar. A stronger dollar might make dollar-denominated crypto more expensive for international buyers, while a weaker dollar could have the opposite effect. The interplay between traditional currency markets and crypto is always dynamic.

- Increased Volatility: Overall economic instability often correlates with increased volatility in risk assets, including cryptocurrencies. While this presents opportunities for traders, it also underscores the need for caution and robust risk management strategies.

- Demand for Decentralized Alternatives: The very nature of tariffs is centralized control over trade. This contrasts sharply with the decentralized ethos of blockchain and cryptocurrencies. A world increasingly fragmented by protectionist policies might inadvertently strengthen the narrative for open, borderless, and censorship-resistant financial systems.

The precise impact remains speculative, but the general trend suggests that economic shifts, especially those introducing uncertainty, often push investors to explore alternative asset classes.

Challenges and the Road Ahead for Global Trade

Despite the administration’s emphasis on simplicity, significant enforcement complexities remain. The varying rates for specific nations—such as Japan, Mexico, and Canada—highlight the administrative challenges of managing a multi-tiered system. Furthermore, the lack of detailed timelines for tariffs beyond August 1 adds considerable uncertainty for businesses and governments attempting to navigate this new framework.

Global markets continue to respond with caution. While major indices have not yet shown extreme volatility, analysts warn that prolonged trade tensions could significantly disrupt financial stability. Countries may be compelled to re-evaluate their sourcing strategies, potentially leading to a fragmentation of global supply chains. The U.S. approach positions tariffs as a potent tool of leverage, compelling trading partners to renegotiate terms on American conditions. This strategy, while aligning with Trump’s historical trade policies, risks straining relationships with traditional partners if negotiations stall or perceived non-compliance arises, creating a delicate geopolitical balance.

Conclusion: A New Chapter in Global Economics

U.S. President Donald Trump’s 15-50% tariff plan marks a definitive new chapter in global trade. It’s a strategy rooted in protectionism and bilateral negotiation, designed to rebalance trade relationships and prioritize domestic interests. While already yielding specific Global Trade Deals with nations like Japan and nearing agreements with the EU, the policy introduces significant economic uncertainty, particularly concerning inflationary pressures and supply chain disruptions. For the Cryptocurrency Market, these macro-economic shifts could reinforce narratives around inflation hedging and safe-haven assets, drawing new attention to digital currencies as alternatives to traditional financial instruments. As the world adapts to this evolving US Trade Policy, the long-term Economic Impact will continue to unfold, shaping not only national economies but also the broader landscape of global finance and technology.

Frequently Asked Questions (FAQs)

1. What are the core proposed tariff rates under Trump’s plan?

U.S. President Donald Trump has outlined a sweeping tariff policy proposing rates ranging from 15% to 50% on imports from over 150 countries. While a baseline of 10-15% is often mentioned, specific cases could see tariffs rise significantly.

2. How have key trading partners like Japan and the EU reacted to these tariffs?

Japan has successfully negotiated a 15% tariff rate, lower than the initially threatened 30%, demonstrating the U.S. strategy of using tariffs as leverage for deals. The European Union is reportedly nearing a similar 15% agreement, though European officials remain cautious about potential retaliatory measures.

3. What potential economic impacts could these tariffs have?

Analysts highlight potential inflationary pressures as U.S. consumers and businesses face higher costs for imported goods. Prolonged trade tensions could also disrupt financial stability, forcing countries to re-evaluate sourcing strategies and potentially fragmenting global supply chains. However, negotiated deals may mitigate some broader negative impacts.

4. How might Trump’s tariff policy influence the Cryptocurrency Market?

The tariff policy could indirectly impact the Cryptocurrency Market by reinforcing the narrative of digital assets as inflation hedges or safe havens during economic uncertainty. Increased volatility in traditional markets due to trade tensions might also lead some investors to explore decentralized alternatives, potentially driving interest and capital into the crypto space.

5. What are the main challenges in implementing this tariff framework?

Challenges include the administrative complexities of managing varying tariff rates for different nations, the lack of detailed timelines for future tariffs, and the risk of straining relationships with traditional trading partners if negotiations falter. Businesses also face uncertainty in navigating the new framework and adapting supply chains.