XRP Price Warning: Classic Bearish Pattern Signals Potential Plunge to $2

For many cryptocurrency traders and investors, tracking the latest movements in XRP price is a priority. Currently, XRP is flashing significant warning signs, suggesting that further downside could be on the horizon. Technical patterns and key market indicators are aligning to paint a cautious picture for the popular altcoin.

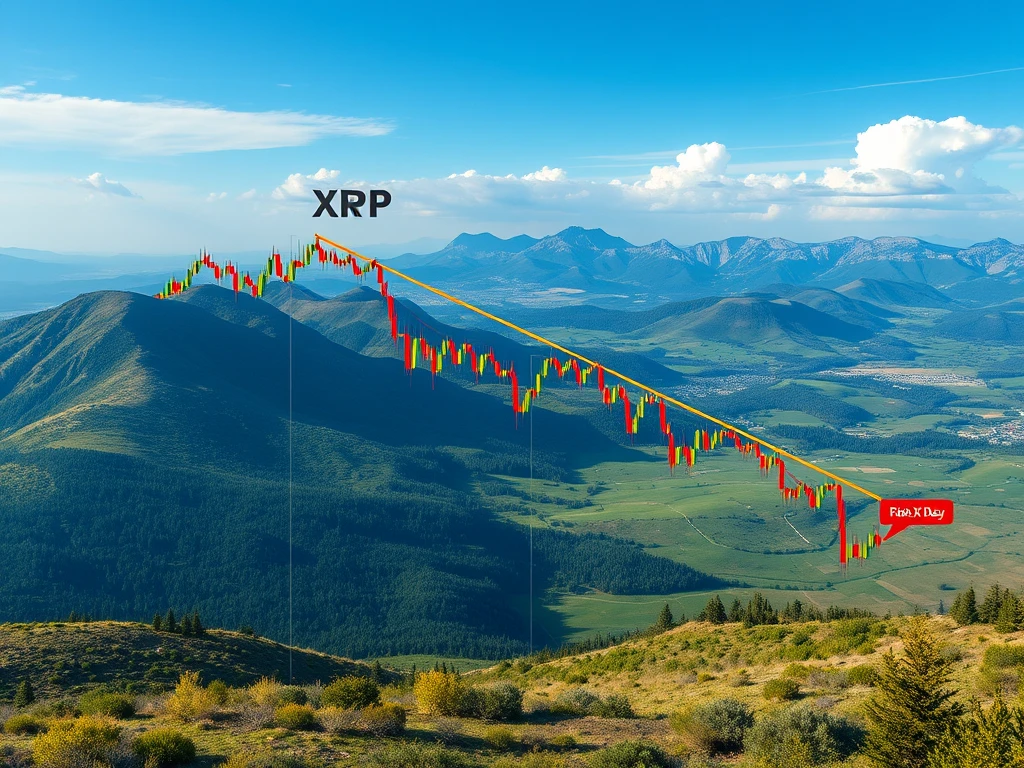

Head and Shoulders Pattern Confirms Downside Risk for XRP Price

One of the most concerning signals for XRP price comes from its four-hour chart, where a classic head and shoulders pattern has formed since early May. This pattern is widely recognized as a bearish reversal indicator, typically signaling that an upward trend is losing momentum and a downward move is likely.

The pattern consists of three peaks, with the middle peak (the ‘head’) being the highest, flanked by two lower peaks (the ‘shoulders’). The crucial element is the ‘neckline,’ a support line connecting the lows between the peaks. A confirmed breakdown occurs when the price closes decisively below this neckline.

In XRP’s case, the neckline was situated around $2.33. During early Asian trading on May 19, XRP price broke and closed below this level, validating the bearish head and shoulders pattern. Technical analysis suggests that the potential price target after a confirmed H&S breakdown is calculated by measuring the height of the head from the neckline and projecting that distance downwards.

For XRP, this projection points towards a target of $2.00. If the price continues to trade below the $2.33 neckline, initial support might be found near the 200-day simple moving average, currently sitting around $2.25, before potentially heading towards the pattern target of $2.00. Reaching this level would represent a decline of approximately 14% from recent levels.

Market analysts are watching this level closely. According to popular analyst Egrag Crypto, holding the $2.30 level (which aligns closely with the H&S neckline) is critical to prevent a more significant sell-off. Failure to hold this support could potentially trigger drops towards $2.15 and possibly even as low as $1.60, according to his analysis.

Declining XRP Futures Open Interest Adds Bearish Pressure

Adding to the technical concerns, data from the derivatives market shows weakening sentiment. Over the past five days, the total open interest (OI) in XRP futures has seen a sharp decline, dropping by 18% to $4.49 billion. Open interest represents the total number of outstanding derivatives contracts that have not been settled.

A significant drop in open interest, especially coinciding with a price decline, often signals reduced trader confidence and decreased liquidity in the futures market. This can indicate that traders are closing positions, potentially taking profits on shorts or being forced out of longs, which can further exacerbate selling pressure and drive prices lower.

Massive Long Liquidations Highlight Selling Momentum

The recent dip in XRP price has also triggered substantial liquidations. Over the last 24 hours, long positions (bets on price increasing) valued at $12 million were forcibly closed across exchanges. In contrast, only $1.4 million in short positions (bets on price decreasing) were liquidated during the same period.

This imbalance highlights the dominance of selling pressure as bullish traders are stopped out of their positions, adding to the supply on the market and pushing prices down. Interestingly, this 3% price drop over the last day occurred alongside a 70% surge in daily trading volume, reaching $4.1 billion. Increased volume during a price decline can be interpreted in a crypto market analysis as strong bearish momentum or significant repositioning by traders anticipating further moves.

What Does This Mean for XRP Price Going Forward?

The confluence of these factors – a confirmed bearish head and shoulders pattern, declining XRP futures open interest, and significant long liquidations – presents a challenging outlook for XRP price in the short term. The technical target from the H&S pattern points directly to the $2.00 level, a price not seen since early May.

While technical patterns are not guaranteed to play out perfectly, the alignment with derivatives data adds weight to the bearish case. Traders will be closely watching the $2.30-$2.33 level as critical resistance and the $2.25 (SMA) and $2.00 levels as potential support targets.

Conclusion

Current crypto market analysis indicates that XRP price is under significant pressure. The confirmation of a classic head and shoulders pattern on the chart, combined with a sharp drop in XRP futures open interest and heavy long liquidations, suggests that the path of least resistance is currently downwards. While market dynamics can change rapidly, the technical and on-chain signals point to a potential retest of the important $2 level if current support fails to hold. Readers should remember that this information is for analysis purposes only and does not constitute investment advice.