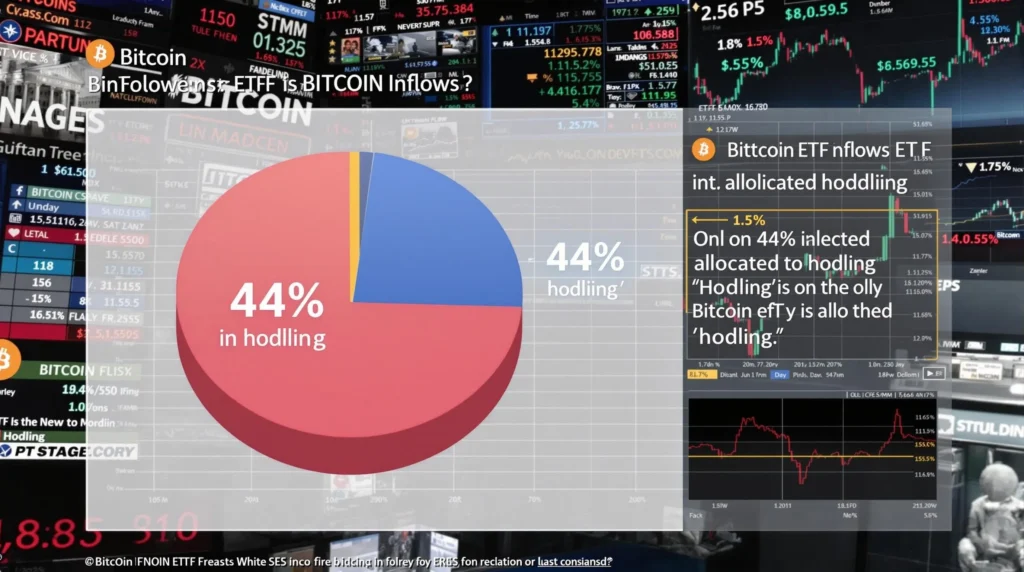

Revealing Report: Only 44% of US Bitcoin ETF Buying Driven by Hodling Mania

Are you riding the Bitcoin ETF wave, envisioning a future where institutional demand fuels a relentless bull run? Think again! A recent eye-opening report from 10x Research has thrown a curveball into the narrative, suggesting that the fervor for Bitcoin ETFs might not be entirely driven by long-term conviction, or what we affectionately call ‘hodling’. The data reveals a potentially surprising truth: only 44% of US Bitcoin ETF purchases are actually intended for long-term storage. Let’s dive into this fascinating revelation and unpack what it means for the future of Bitcoin and the crypto market.

The Shocking Truth About Bitcoin ETF Buying and Hodling

Markus Thielen of 10x Research has stirred up the crypto pot with his analysis, claiming that the demand for Bitcoin as a durable, long-term asset might be considerably overstated by mainstream media. This isn’t just market noise; it’s a critical perspective that challenges the widely held belief that institutional investors are primarily flocking to Bitcoin ETFs for long-term accumulation. According to Thielen’s research, a significant portion of the Bitcoin ETF inflow is likely driven by short-term trading strategies rather than steadfast hodling.

What Does ‘Only 44% for Hodling’ Actually Mean?

To understand the implications, let’s break down what this 44% figure suggests:

- Less Long-Term Commitment: If only 44% of Bitcoin ETF buying is for hodling, it implies that a substantial 56% is motivated by other factors. This could include short-term speculation, arbitrage opportunities, or tactical asset allocation shifts.

- Volatility Implications: A higher proportion of short-term holders can inject more volatility into the Bitcoin market. These investors are more likely to react to price swings and market sentiment, potentially leading to sharper price corrections and rallies.

- Challenging the Narrative: The dominant narrative has been that institutional money flowing into Bitcoin ETFs represents a bedrock of long-term demand. This report suggests we need to recalibrate our expectations and acknowledge a more nuanced picture.

- Market Maturity: While some might view this as concerning, it could also be a sign of market maturation. A healthy market includes a mix of long-term investors and active traders, contributing to liquidity and price discovery.

Decoding the Motivations Behind Bitcoin Buying

If hodling isn’t the primary driver for a majority of Bitcoin ETF buyers, what is? Let’s explore some potential motivations:

Short-Term Trading and Speculation

The allure of quick profits in the volatile crypto market is undeniable. Bitcoin ETFs provide a regulated and accessible avenue for traditional investors to engage in short-term Bitcoin trading. These traders aim to capitalize on price fluctuations, regardless of the long-term fundamentals. This segment of Bitcoin buying could be substantial, contributing significantly to the 56% not earmarked for hodling.

Arbitrage Opportunities

Bitcoin ETFs, especially in their early stages, can present arbitrage opportunities. Discrepancies between the ETF price and the underlying Bitcoin price in spot markets can be exploited by sophisticated traders. Such arbitrage activities contribute to ETF trading volume but don’t necessarily reflect genuine long-term investment in Bitcoin itself.

Tactical Asset Allocation

Institutional investors often employ tactical asset allocation strategies, adjusting their portfolios based on macroeconomic outlooks and market trends. Bitcoin ETFs can be used as a tool for tactical exposure to the crypto market, increasing or decreasing allocations based on short-to-medium term market views, rather than a deep conviction in long-term hodling.

The Role of 10x Research and Markus Thielen

10x Research, spearheaded by Markus Thielen, is known for its in-depth market analysis and often contrarian perspectives within the crypto space. Thielen’s analysis on Bitcoin ETF flows is a prime example of their approach – challenging conventional wisdom and prompting a deeper look at the underlying data. His insights are valuable for investors seeking a more realistic understanding of market dynamics beyond the hype.

Is the Hodling Dream Fading?

Does this report mean the dream of Bitcoin as a widely held, long-term store of value is diminishing? Not necessarily. It simply suggests a more nuanced reality. While the ‘hodl’ mentality remains strong within the core crypto community, the influx of traditional finance into Bitcoin ETFs brings a different set of players with diverse motivations.

Here’s a balanced perspective:

| Perspective | Implications |

|---|---|

| Hodling is still significant (44%) | A substantial portion of ETF demand is still driven by long-term conviction, providing a solid base for Bitcoin’s price. |

| Short-term trading adds liquidity | Active trading, even if not for hodling, enhances market liquidity and price discovery, which are crucial for a healthy market. |

| Realistic Expectations | We need to be realistic about institutional adoption. Not all ETF inflows represent unwavering long-term belief. |

| Opportunity for Growth | As the market matures, the balance between hodling and trading could shift, potentially leading to increased long-term holding in the future. |

Actionable Insights for Crypto Investors

So, what should crypto investors take away from this 10x Research report?

- Temper Expectations: Don’t solely rely on the narrative of unstoppable institutional hodling to drive Bitcoin’s price. Market dynamics are more complex.

- Monitor ETF Flows Closely: Pay attention to ETF inflow and outflow data, but interpret it with a critical eye, understanding the potential mix of short-term and long-term motivations.

- Focus on Fundamentals: Continue to assess Bitcoin’s long-term fundamentals – its technology, adoption, and network effects – rather than solely relying on ETF hype.

- Prepare for Volatility: Be prepared for potential volatility spikes driven by short-term trading activity within Bitcoin ETFs.

- Diversify Your Strategy: Consider a diversified investment strategy that balances long-term hodling with tactical trading approaches, based on your risk tolerance and market outlook.

Conclusion: Navigating the Evolving Bitcoin ETF Landscape

The 10x Research report serves as a valuable reminder that the Bitcoin ETF story is still unfolding, and the motivations behind Bitcoin ETF buying are multifaceted. While the dream of mass institutional hodling is certainly part of the picture, it’s not the complete picture. Understanding the nuances of market participation, including the significant role of short-term trading, is crucial for navigating the evolving crypto landscape. By staying informed, critically analyzing data, and maintaining a balanced perspective, investors can make more informed decisions in this exciting yet dynamic market. The revelation that only 44% is for hodling is not necessarily a negative signal, but rather a call for a more realistic and strategic approach to Bitcoin investment in the ETF era.