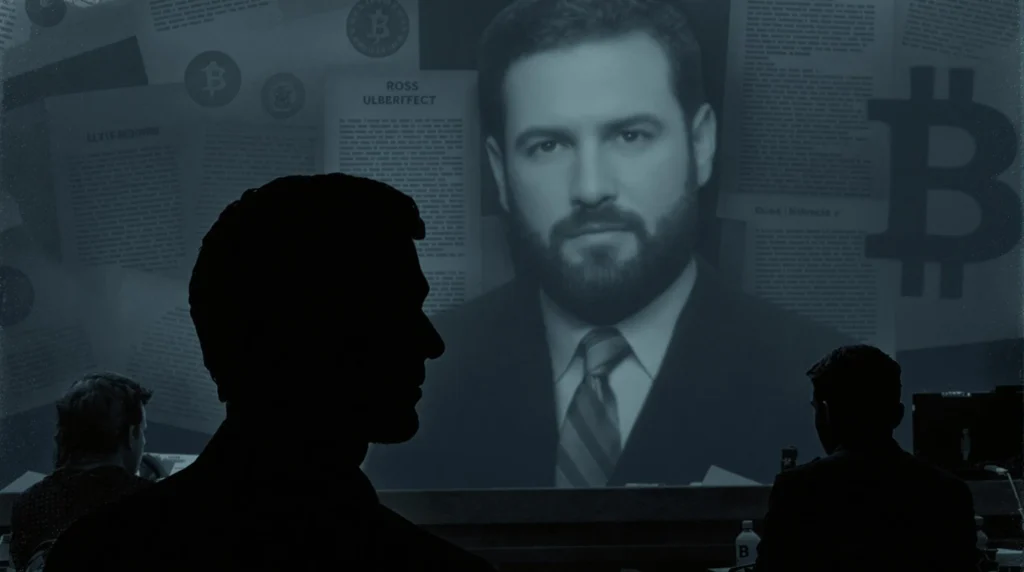

Grim Reality: SBF’s ‘Slim’ Crypto Pardon Chance Echoes Ulbricht’s Plight

The crypto world is no stranger to legal battles, but the recent conviction of Sam Bankman-Fried (SBF) has cast a long shadow. As SBF navigates the complex legal landscape, comparisons to other high-profile cases, particularly that of Ross Ulbricht, are inevitable. However, unlike Ulbricht’s supporters who tirelessly advocate for his release, SBF’s path to SBF conviction relief appears significantly steeper, facing what many legal experts are calling a ‘slim’ chance. This article delves into the stark realities of SBF’s situation, exploring why his hopes for a crypto pardon might be a distant dream, and how the Ulbricht case serves as both a point of comparison and a cautionary tale.

Why is SBF’s Path to Conviction Relief So Challenging?

The initial content snippet highlights a critical factor: the sheer volume of pardon petitions. The Office of the Pardon Attorney is reportedly swamped with around 10,000 requests. This backlog alone creates a formidable hurdle. But beyond the numbers, several factors contribute to the perceived ‘slim’ chance of slim chance clemency for SBF:

- Lack of Political Connections: The snippet subtly points to the importance of political influence in securing clemency. While details on SBF’s political connections are nuanced, the implication is that without strong ties, navigating the pardon process becomes exponentially harder. This contrasts with cases where influential figures or movements have rallied behind a convict.

- Severity of the Crimes: SBF’s conviction on multiple fraud and conspiracy charges related to the collapse of FTX paints a picture of significant financial wrongdoing. The scale of the alleged fraud and the number of victims involved can weigh heavily against any plea for leniency. Pardons are often considered for cases where there are mitigating circumstances or questions of proportionality in sentencing.

- Public Sentiment: The crypto community and the wider public have been deeply impacted by the FTX saga. The collapse not only resulted in substantial financial losses for many but also eroded trust in the crypto space. This negative public sentiment could further complicate SBF’s chances of garnering support for a pardon.

- Comparison to Ulbricht: While both cases involve individuals facing severe legal consequences within the crypto realm, the nature of their crimes and the public perception differ. Ross Ulbricht, the creator of Silk Road, is viewed by some as a victim of overzealous prosecution for creating a platform, while SBF’s case is centered around financial fraud and misappropriation of funds. This distinction, though debatable, impacts public discourse and potentially the perception of clemency eligibility.

The Ulbricht Case: A Beacon of Hope or a False Dawn for SBF?

The mention of Ulbricht in the title is deliberate and insightful. Ross Ulbricht, serving a double life sentence plus forty years for his role in the Silk Road marketplace, has become a symbol for many in the crypto and libertarian communities. His case has fueled ongoing debates about sentencing reform, government overreach, and the balance between innovation and regulation. Understanding the nuances of the Ulbricht case is crucial to grasping the context of SBF’s predicament.

Here’s a brief comparison:

| Feature | Ross Ulbricht | Sam Bankman-Fried |

|---|---|---|

| Primary Crime | Operating Silk Road, a dark web marketplace | Fraud and conspiracy related to FTX collapse |

| Sentence | Double life sentence plus forty years | Awaiting sentencing |

| Public Perception (in certain circles) | Viewed by some as a political prisoner, advocating for freedom and decentralization | Largely viewed negatively due to financial harm caused |

| Advocacy for Clemency | Strong and vocal movement for pardon and release | Less visible public advocacy for pardon |

| Political Connections | Limited direct political connections, but strong grassroots support | Potentially more initial political engagement, but current status uncertain |

While Ulbricht’s case has garnered significant public and even some political support for clemency, it’s important to note that he remains incarcerated. His ongoing legal battles and the persistent advocacy efforts highlight the immense challenge of securing a presidential pardon, even with substantial public backing. For SBF, who currently lacks a similar level of public sympathy and faces charges rooted in financial harm, the path to crypto legal challenges resolution through pardon appears even more arduous.

Navigating the Complexities of Crypto Pardons: What are SBF’s Options?

Given the ‘slim’ chances and the precedent set by cases like Ulbricht’s, what realistic options remain for SBF to seek SBF conviction relief?

- Appeals Process: The immediate legal avenue is the appeals process. SBF’s legal team will likely focus on challenging the conviction itself, arguing legal errors or insufficient evidence. This is a standard legal procedure and doesn’t rely on executive clemency. Success in appeals is statistically challenging but remains a crucial step.

- Sentencing Mitigation: Ahead of sentencing, SBF’s defense will likely present arguments for a lighter sentence. This could involve highlighting mitigating factors, demonstrating remorse (though this might be difficult given his public statements), and emphasizing his contributions to the crypto space before the FTX collapse. A reduced sentence, even if not full crypto pardon, could be a more attainable goal.

- Long-Term Clemency Petition: While the immediate chances of a pardon might be slim, the legal landscape and political climate can shift over time. Filing a petition with the Office of the Pardon Attorney is still a formal option. However, as the initial snippet indicates, this is a long and often uncertain process, especially given the backlog.

- Public Opinion Shift (Unlikely but Possible): Public sentiment can be fickle. While currently negative, it’s theoretically possible for public opinion to evolve, particularly if new information emerges or if there’s a broader shift in the perception of crypto regulations and enforcement. However, relying on a significant shift in public opinion is a highly speculative strategy.

Actionable Insights and Takeaways for the Crypto Community

The SBF case and the comparison to Ulbricht’s situation offer several crucial takeaways for the crypto community:

- Regulatory Compliance is Paramount: The FTX collapse underscores the critical importance of regulatory compliance in the crypto industry. Operating outside legal frameworks, even with innovative intentions, carries immense risks. Robust compliance measures are not just about avoiding legal trouble but also about building trust and long-term sustainability.

- Transparency and Accountability are Non-Negotiable: The lack of transparency and accountability within FTX was a major contributing factor to its downfall. Crypto businesses must prioritize transparency in their operations and maintain clear lines of accountability to build confidence among users and investors.

- Understand the Legal Landscape: Navigating the legal and regulatory landscape in the crypto space is complex and evolving. Crypto entrepreneurs and investors must invest in understanding these complexities and seek expert legal counsel to ensure compliance and mitigate risks.

- Public Perception Matters: The crypto industry’s reputation is constantly being shaped by events like the FTX collapse. Building a positive public image through ethical practices, consumer protection, and responsible innovation is crucial for the long-term growth and acceptance of cryptocurrencies.

- Clemency is a Long Shot, Focus on Prevention: While the idea of slim chance clemency and pardons might capture headlines, the reality is that legal battles in the crypto space are often protracted and outcomes uncertain. The focus should be on preventative measures – building robust legal and ethical frameworks within crypto businesses to avoid legal entanglements in the first place.

Conclusion: A Grim Outlook, But Lessons to Learn

Sam Bankman-Fried’s quest for SBF conviction relief faces significant headwinds. The comparison to the Ulbricht case highlights the uphill battle, and the sheer volume of pardon petitions further diminishes the already slim chance clemency prospects. While the legal process will unfold, the crypto community must absorb the hard lessons from the FTX saga and prioritize responsible innovation, regulatory compliance, and ethical conduct. The grim reality of SBF’s situation serves as a stark reminder of the high stakes involved in the crypto world and the critical need for robust legal and ethical foundations. Navigating crypto legal challenges requires proactive measures, transparency, and a commitment to building a sustainable and trustworthy ecosystem.