Crucial Crypto News Today: Bitcoin Debate Ignites Market Buzz

Navigating the volatile world of cryptocurrency can feel like a rollercoaster. To keep you ahead of the curve, we’ve compiled the most crucial crypto news today. From heated debates within the Bitcoin community to significant shifts in the movements of crypto leaders and venture capital, let’s dive into the key events shaping the crypto landscape right now.

Why is the Bitcoin Community Buzzing About a ‘Better Bitcoin’?

A bold statement from angel investor Jason Calacanis has ignited a firestorm in the Bitcoin community. Calacanis, known for his early investment in Uber, suggested that Bitcoin, despite its success, is ripe for disruption. He tweeted about the opportunity to “build a better Bitcoin,” implying that the current cryptocurrency king might be overtaken by something new. This remark sparked immediate reactions from Bitcoin proponents, who staunchly defended Bitcoin’s position and its foundational strength.

Here’s a breakdown of the debate:

- Calacanis’s Claim: He believes Bitcoin’s market dominance by a few major players opens the door for innovation and a superior cryptocurrency to emerge.

- Bitcoin Community’s Response: Figures like Brady Swenson from Swan Bitcoin argue that winning protocols like Bitcoin aren’t replaced but built upon. They emphasize Bitcoin’s established network effect and security.

- Layer-2 Solutions: The discussion also touched on the potential for a dominant layer-2 protocol to enhance Bitcoin’s functionality without replacing the core Bitcoin network itself.

This debate underscores the ongoing evolution and innovation within the crypto space. While some see room for a ‘better Bitcoin’, many in the community remain steadfast in their belief in Bitcoin’s enduring value and potential for growth through layer-2 solutions.

Telegram Founder Pavel Durov’s Strategic Move: What Does it Mean for Crypto?

In other significant news, Pavel Durov, the founder of the messaging giant Telegram, has relocated from France to Dubai. This move, approved by a French court, is seen as strategic due to Dubai’s business-friendly environment and its lack of extradition treaties with many countries. Durov’s departure from France raises questions about the regulatory landscape and its impact on tech entrepreneurs in the crypto space. Given Telegram’s deep integration with blockchain technology and its active crypto community, Durov’s location is closely watched by industry experts.

Key takeaways from Durov’s relocation:

- Dubai’s Crypto Hub Status: Dubai is increasingly becoming a hub for crypto businesses due to its favorable regulations and economic policies.

- Reduced Regulatory Scrutiny: Moving to a jurisdiction with fewer extradition agreements could offer Durov and Telegram greater operational flexibility.

- Implications for Telegram’s Crypto Projects: Durov’s move could signal further development and focus on Telegram’s blockchain and cryptocurrency initiatives, given Dubai’s welcoming stance towards digital assets.

Massive Crypto Sell-Off Before White House Role: Ethical or Just Good Timing?

David Sacks, now serving in a White House role focused on AI and crypto, made headlines for divesting over $200 million in crypto and crypto-related stocks before assuming his position. This preemptive action, detailed in a White House memorandum, involved Sacks and his venture capital firm, Craft Ventures, selling off substantial holdings in Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), among others. This move was aimed at mitigating potential conflicts of interest as Sacks steps into a role that will significantly influence crypto regulation in the United States.

Here’s what we know about the sell-off:

| Details | Impact |

|---|---|

| Over $200 million in crypto and related stocks divested. | Demonstrates a commitment to avoiding conflicts of interest in his White House role. |

| $85 million directly attributable to Sacks. | Highlights the significant personal financial stake Sacks had in the crypto market. |

| Divestment included Bitcoin, Ethereum, and Solana. | Impacted a broad spectrum of the crypto market, though the overall market impact is likely minimal given the market size. |

| Occurred before commencing White House role. | Shows proactive measures to ensure ethical standards are maintained in his public service. |

This event underscores the increasing intersection of cryptocurrency and government policy, and the stringent ethical considerations that come into play when individuals with significant crypto holdings transition into public service roles.

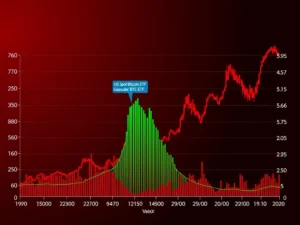

Bitcoin Price: Poised for a $90,000 Reclaim?

Amidst these developments, the Bitcoin price remains a central point of interest for investors. Derivatives metrics suggest a potential surge, with some analysts predicting a reclaim of the $90,000 mark. While market predictions should always be taken with caution, various factors, including institutional adoption and macroeconomic conditions, could contribute to upward momentum for Bitcoin.

Factors influencing Bitcoin’s price:

- Institutional Interest: Continued and growing institutional investment in Bitcoin.

- Derivatives Market Signals: Positive signals from Bitcoin derivatives markets suggesting bullish sentiment.

- Macroeconomic Factors: Global economic conditions and inflation concerns often drive investors towards assets like Bitcoin.

DeFi Regulation: Can Congress Truly Regulate Decentralized Finance?

In regulatory news, while Congress recently repealed the IRS broker rule, the question of effectively regulating DeFi (Decentralized Finance) remains complex. The decentralized nature of DeFi protocols presents unique challenges for traditional regulatory frameworks. As DeFi continues to grow, finding a balance between fostering innovation and protecting consumers will be a critical task for lawmakers and regulators.

Challenges in DeFi regulation:

- Decentralization: DeFi protocols operate without central intermediaries, making traditional regulatory approaches difficult to apply.

- Global Nature: DeFi is inherently global, transcending national borders, which complicates jurisdictional issues.

- Rapid Innovation: The fast pace of innovation in DeFi requires regulations to be adaptable and forward-thinking to avoid stifling growth.

In Summary: Crypto Market Dynamics in Motion

Today’s crypto news highlights a market in constant motion. From debates about the future of Bitcoin to strategic moves by crypto leaders and evolving regulatory landscapes, the crypto world is anything but static. Staying informed and understanding these dynamics is essential for anyone involved or interested in cryptocurrencies. Keep checking back for more updates as these stories unfold and new developments emerge in the ever-exciting world of crypto.