Is Altseason a Relic? Shocking Rise of BTC Dominance in 2024

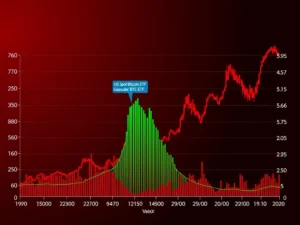

Is the crypto market undergoing a fundamental shift? For years, crypto enthusiasts have anticipated the famed ‘altseason’ – a period where altcoins surge, often eclipsing even Bitcoin’s gains. But recent market trends are raising a crucial question: Is altseason now a relic of the past? The data points to a significant trend: Bitcoin’s dominance is not just holding steady, it’s been steadily climbing since 2023. Let’s dive into what this means for the future of crypto investments.

Decoding the Dominance: Why is BTC Dominance Surging?

BTC dominance, a key metric reflecting Bitcoin’s share of the total cryptocurrency market capitalization, has been on a noticeable uptrend. Currently hovering around 61.6%, after peaking at 64.3% in early February, this figure signifies more than just market fluctuation. It suggests a potential power shift. But what’s driving this resurgence of Bitcoin’s stronghold?

- Macroeconomic Uncertainty: When global economies face turbulence, investors often flock to perceived safe havens. In the crypto world, Bitcoin, despite its volatility, is still viewed as the most established and liquid asset. Recent fears of prolonged trade wars have amplified this flight to safety, impacting altcoins more severely due to their inherent higher risk.

- Bitcoin ETFs: A Liquidity Magnet: The introduction of Bitcoin exchange-traded funds (ETFs) has undeniably altered the landscape. These ETFs act as powerful magnets, drawing in substantial liquidity from traditional financial markets. This capital, which might have previously flowed into altcoins during previous market cycles, is now largely siloed within these BTC-centric investment vehicles.

- Proliferation of Tokens: Market Saturation: The sheer number of new cryptocurrencies entering the market is staggering. As of March 15th, CoinMarketCap listed over 12.7 million digital assets, a dramatic increase from under 11 million just a month prior. This explosion of new tokens, many being memecoins or low-cap altcoins, dilutes investor attention and capital, making it harder for individual altcoins to gain traction and spark an altseason.

| Metric | February 8th | March 15th |

|---|---|---|

| Unique Digital Assets Listed on CoinMarketCap | Below 11 Million | Over 12.7 Million |

Source: Dune

The Altseason Dream: Fading or Evolving?

Historically, crypto market cycles have featured a predictable pattern: Bitcoin leads the charge, followed by a rotation of profits into altcoins. Investors, emboldened by Bitcoin’s gains, would venture into higher-risk, higher-reward altcoins, starting with large-cap projects and eventually trickling down to smaller cap tokens. This ‘altseason‘ was a period of explosive growth and opportunity for altcoin investors.

However, the current market dynamics are challenging this established pattern. The combination of liquidity being locked in Bitcoin ETFs and the overwhelming number of new tokens vying for attention has led some analysts to question if the traditional altseason is becoming a thing of the past.

Too Many Tokens: A Double-Edged Sword for Altcoins

The data is stark. Over 600,000 tokens were launched in January 2024 alone. While innovation and accessibility are positive aspects of the crypto space, this massive influx of new assets creates significant challenges for altcoins:

- Capital Trapped in Illiquidity: Market analyst Jesse Myers highlights a critical issue: when many of these new, often low-quality coins fail, they don’t vanish. Instead, they linger with market caps of $10,000 to $100,000, effectively trapping capital in illiquid pools. This fragmented liquidity makes it harder for genuine, promising altcoin projects to attract investment.

- Attention Deficit: With millions of tokens available, investors are faced with an overwhelming choice. This ‘attention deficit’ makes it harder for even solid altcoin projects to stand out and capture investor interest needed to fuel a significant price surge characteristic of an altseason.

- Coinbase Re-evaluation: Even major exchanges like Coinbase are feeling the pressure. CEO Brian Armstrong’s recent statement about reevaluating token listing processes underscores the need to adapt to this new reality of market saturation.

Is This the End of Altseason? Not Necessarily ‘The End’, But a New Era

While the traditional, explosive altseason might be less predictable in the current market, it’s premature to declare it completely dead. Instead, we might be witnessing an evolution. The market is maturing, becoming more discerning, and potentially favoring quality and utility over hype and novelty.

Key Takeaways:

- BTC Dominance is a Powerful Signal: Monitor Bitcoin dominance as a key indicator of market sentiment and potential shifts in capital flow.

- Selective Altcoin Investing: In a saturated market, due diligence and careful selection are more critical than ever for altcoin investments. Focus on projects with strong fundamentals, real-world use cases, and active development.

- Adapt to the New Normal: The crypto market is constantly evolving. Be prepared to adapt your investment strategies to the changing dynamics, recognizing that the ‘old rules’ of altseason might be less reliable in the future.

The crypto market is entering a fascinating new phase. While the days of indiscriminate altcoin pumps might be waning, opportunities for strategic and informed altcoin investments likely remain. The key is to understand the evolving landscape and adapt to thrive in this new era of crypto.

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Crypto investments are highly risky; conduct thorough research before making any decisions.