Bitcoin’s Shocking 30% Retracement: Will Institutional Demand Trigger Price Stability?

Bitcoin recently experienced a dramatic 30% retracement, sending ripples of concern through the crypto market. After hitting an all-time high, the flagship cryptocurrency faced intense selling pressure, leading to its second-largest correction in this bull run. Is this a temporary dip, or a sign of deeper market shifts? Let’s delve into the insights from Bitfinex analysts to understand what triggered this price movement and what could happen next for Bitcoin.

Why Did Bitcoin See a 30% Retracement?

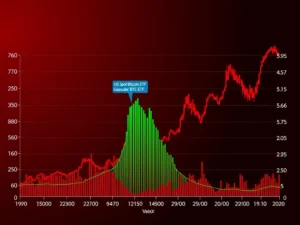

According to analysts at Bitfinex, this significant retracement can be attributed to increased selling pressure, primarily from short-term holders. These holders, defined as those who purchased Bitcoin within the last 7 to 30 days, often react more sensitively to market fluctuations. When Bitcoin’s price corrected from its peak of $109,590 to a low of $77,041, these short-term investors experienced unrealized losses, prompting many to sell. This cascade of selling exacerbated the price drop, resulting in the 30% retracement.

Bitfinex highlights a crucial factor: outflows from Bitcoin ETFs. During the week of March 9-15, these outflows totaled around $920 million, indicating a lack of strong institutional demand to counteract the selling pressure. This absence of robust institutional buying power allowed the selling pressure from short-term holders to dominate the market and drive prices down.

| Factor | Impact on Bitcoin Price |

|---|---|

| Short-term Holder Selling | Increased downward pressure |

| ETF Outflows | Reduced institutional buying |

| Macroeconomic Uncertainty | Contributes to market caution |

Can Institutional Demand Bring Price Stability to Bitcoin?

The crucial question now is whether institutional demand will return to the Bitcoin market. Bitfinex analysts believe that the resurgence of institutional buying power is key to achieving price stability and absorbing the current supply overhang. If institutions step in at these lower price levels, their significant capital could counteract the selling pressure and pave the way for price stability.

Currently trading around $84,357 after a 9.5% rebound from its low, Bitcoin’s immediate future hinges on this factor. Bitfinex suggests that a historical perspective offers some hope. “While institutional flows and the macro situation is pivotal for market direction in the mid-term, statistically, a 30 percent drawdown has often marked the low before continuation higher,” they stated. This historical pattern suggests that if Bitcoin can stabilize around the current levels, a strong recovery could indeed follow.

Macroeconomic Headwinds and Bitcoin’s Safe-Haven Status

Beyond market-specific factors, the broader macroeconomic climate is also playing a role. Weekly outflows from crypto exchange-traded products (ETPs) have reached a five-week streak, totaling a substantial $6.4 billion, with Bitcoin ETPs accounting for $5.4 billion of these losses. This trend reflects a wider risk-off sentiment in the market, possibly driven by macroeconomic uncertainties.

US consumer confidence has declined to a two-year low, and concerns about higher inflation and economic uncertainty are mounting. Adding to the unease, a Federal Reserve model has predicted a potential 2.8% contraction of the US economy in the first quarter of 2025. Furthermore, ongoing discussions of trade wars cast doubt on Bitcoin’s perceived status as a safe-haven asset. These macroeconomic headwinds contribute to the overall market caution and can impact investor sentiment towards even digital assets like Bitcoin.

Looking Ahead: Will History Repeat Itself for Bitcoin?

Despite the current challenges, Bitfinex analysts offer a glimmer of optimism based on historical data. The 30% retracement, while significant, is not unprecedented in Bitcoin’s volatile history. Past instances of similar drawdowns have often been followed by strong recoveries. The critical factor for this recovery, as emphasized by Bitfinex, remains the return of robust institutional demand.

If institutional demand picks up at these levels, it could signal a turning point. Increased buying pressure from institutions would not only absorb the existing supply but also instill confidence in the market, potentially leading to renewed upward momentum and price stability. However, the macroeconomic landscape and the evolution of ETF flows will be crucial indicators to watch in the coming weeks. Will Bitcoin defy the current headwinds and stage another powerful recovery? The answer likely lies in the hands of institutional investors and the broader economic outlook.

In conclusion, Bitcoin’s recent 30% retracement is a stark reminder of the market’s inherent volatility and the influence of selling pressure from short-term holders. The absence of strong institutional demand has exacerbated this correction. However, history suggests that such drawdowns can be followed by significant recoveries. The key to Bitcoin’s next move lies in whether institutional demand returns to provide the necessary buying power for price stability and a potential resurgence. Keep a close watch on institutional flows and macroeconomic indicators to gauge the future trajectory of Bitcoin.