Urgent Bitcoin Price Prediction: Is the Bull Cycle Really Over Based on Onchain Metrics?

Is the party over for Bitcoin bulls? CryptoQuant CEO Ki Young Ju has issued a stark warning, suggesting the Bitcoin bull cycle might be finished. Citing critical onchain metrics, Ju predicts a potentially lengthy period of bearish or sideways price action for the leading cryptocurrency. But is this cause for panic, or just another twist in the volatile world of crypto? Let’s dive into the details and see what other analysts are saying about the future of the crypto market.

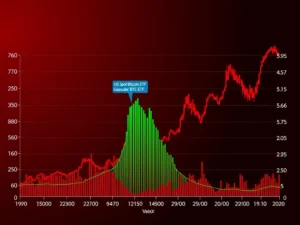

Is the Bitcoin Bull Cycle Truly Over? Examining Onchain Metrics

CryptoQuant’s Ki Young Ju is making headlines with his revised outlook on Bitcoin. Just weeks after stating the bull cycle was intact, he now believes the peak might be behind us. His analysis hinges on key onchain metrics, which he claims are flashing bearish signals. According to Ju, fresh liquidity is drying up, and even new whales are starting to sell Bitcoin at lower prices. This shift in sentiment, based on data directly from the blockchain, paints a potentially concerning picture for short-term Bitcoin price movements.

- Bearish Signals: Ju points to onchain data indicating a decrease in new liquidity entering the Bitcoin market.

- Whale Behavior: He notes that new, large Bitcoin holders (whales) are now selling, adding downward pressure.

- Timeframe: Ju anticipates a bearish or sideways Bitcoin price prediction for the next 6 to 12 months.

Contrasting Bitcoin Price Predictions: Not Everyone Agrees

While CryptoQuant’s CEO is sounding the alarm, it’s crucial to remember that market analysis is rarely unanimous. Several other analysts offer contrasting Bitcoin price predictions, suggesting that the bull run might not be over yet. Swyftx lead analyst Pav Hundal, for example, believes there’s “no reason to panic.” He attributes recent market jitters to external factors like potential tariffs but emphasizes the underlying strength of the global economy. Hundal suggests that once market uncertainty subsides, investors will likely return to risk-on assets like Bitcoin.

Other bullish arguments include:

- Global Money Supply: Crypto analyst Seth points to the global M2 money supply reaching new all-time highs, historically a positive indicator for Bitcoin.

- Historical Trends: CoinRoutes CEO Dave Weisberger believes that if Bitcoin’s correlation with money supply holds, we could see new all-time highs as early as late April.

- Undervaluation: Former Phunware CEO Alan Knitowski argues that Bitcoin is significantly undervalued based on historical cycles, suggesting a much higher price target in the long run.

Decoding Onchain Metrics: What Are They Telling Us About the Crypto Market?

Onchain metrics are data points derived directly from the blockchain. They offer a transparent view into the actual activity and health of a cryptocurrency network. Analyzing these metrics can provide valuable insights into market sentiment and potential price movements. Key onchain metrics include:

| Metric | What it Indicates |

|---|---|

| Active Addresses | Network usage and adoption trends. |

| Transaction Volume | Economic activity on the blockchain. |

| Miner Activity | Health and security of the network. |

| Exchange Flows | Investor sentiment (inflows to exchanges often indicate selling pressure, outflows indicate accumulation). |

| Funding Rates | Cost of holding long or short positions, reflecting market sentiment in derivatives markets. |

CryptoQuant’s CEO is using these tools to assess the current crypto market conditions and formulate his bearish outlook. However, the interpretation of these metrics can be subjective, and different analysts may draw different conclusions.

Navigating Bitcoin’s Volatility: What’s Next for Price Prediction?

The current situation highlights the inherent volatility and uncertainty in the Bitcoin price prediction landscape. While some analysts rely on onchain metrics to suggest a bearish phase, others point to macroeconomic factors and historical trends to maintain a bullish outlook. It’s important to remember that no single prediction is guaranteed, and the crypto market can be influenced by a multitude of unforeseen events.

For investors, this means:

- Do Your Own Research (DYOR): Don’t rely solely on any single analyst’s prediction. Explore different perspectives and data points.

- Manage Risk: Cryptocurrency investments are inherently risky. Only invest what you can afford to lose.

- Long-Term Perspective: Bitcoin has historically shown resilience and long-term growth despite short-term volatility.

Ultimately, the future of Bitcoin’s price remains uncertain. While onchain metrics might suggest a cooling-off period, other factors could still propel Bitcoin to new heights. The crypto market is dynamic, and staying informed and adaptable is key to navigating its ever-changing landscape.